90% ROIC, 23% Margins — This Microcap Trades at Just 9x EBIT

Alphapolis is a high-growth, asset-light IP platform compounding capital at 90%+ ROIC, with 23.6% EBIT margins and 14.6% FCF margins — yet trades well below peers at just 15.7x P/E ex-cash

Executive Summary

Alphapolis (TSE:9467) is a high-margin, asset-light IP platform disguised as a traditional Japanese publisher. The company sources and develops manga and light novels through a user-generated model that minimizes editorial risk and maximizes scalability. Despite exceptional fundamentals—23.6% EBIT margin, 14.6% FCF margin, and 90.6% ROIC ex-cash—the stock trades at just 15.7x P/E ex-cash and 9.2x EV/EBIT, far below peers. Based on conservative peer multiples, the intrinsic value is ¥1,426–¥4,024 per share, implying an upside of –4% to +170%.

Company overview

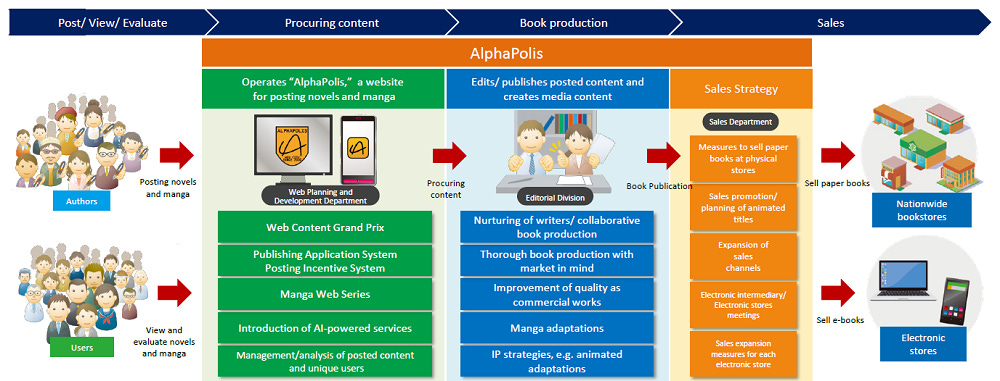

The company operates a unique hybrid model that combines digital publishing, crowdsourced content curation, and intellectual property (IP) development. While it may resemble a traditional publisher on the surface, the company is fundamentally a digital platform that sources and filters light novels and manga through user-generated submissions. Stories that gain traction among the platform’s active community are identified by a data-driven editorial team, developed professionally, and monetized across multiple media formats—books, e-books, and anime adaptations.

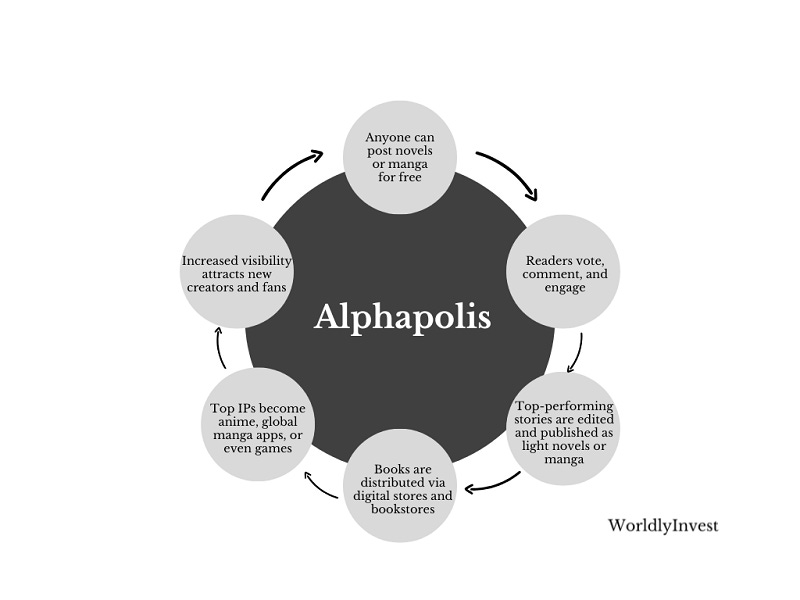

This structure gives Alphapolis several durable advantages over traditional publishers. It minimizes editorial risk by relying on real-time reader feedback to surface promising stories, enables higher-margin internal IP development, and creates a self-sustaining feedback loop between creators, readers, and the editorial team. By integrating the entire value chain—from discovery to adaptation—the company retains greater control over its IP and captures more economic value across formats.

Importantly, the platform includes basic social media features—users can vote, comment, and participate in contests to elevate their favorite content. This adds an element of community engagement and virality to what would otherwise be a static publishing pipeline. Creators are incentivized with visibility, recognition, and sometimes cash rewards, while readers gain influence over what stories get professionalized.

These features give Alphapolis the early seeds of network effects. As more writers contribute content, the diversity and quality of options available increases, which in turn attracts more readers. More reader activity generates better data, which helps surface the best content for editorial investment. While these dynamics are still in their infancy and not yet strong enough to create high switching costs or true user lock-in, they lay the foundation for scalable discovery and long-term defensibility. These are not mature network effects, but rather a “proto-platform” effect—a strategic direction that, if successfully cultivated, could deepen Alphapolis’s competitive moat over time.

Key Revenue Segments and Growth Drivers

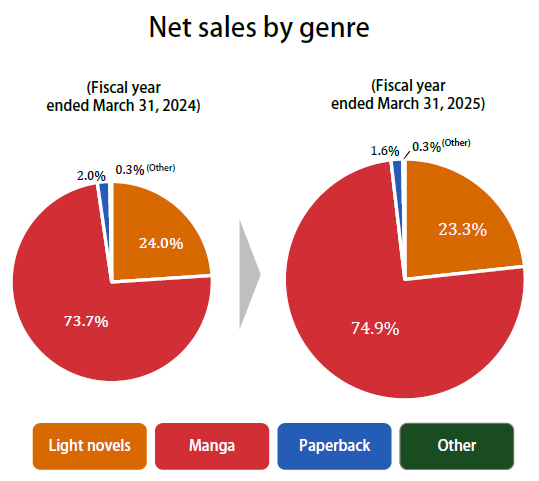

Alphapolis derives 98% of its revenue from just two product categories:

Manga (75% of revenue, +33.8% YoY): Largely digital, these titles are often successful spin-offs of light novels first discovered on the Alphapolis platform. Top-performing manga have the potential to become anime series, providing a significant flywheel effect on sales.

Light Novels (23% of revenue, +28% YoY): Sold in both print and digital formats. These are the primary source of original IP on the platform.

The remaining ~2% comes from:

General Novels (1.6% of sales, +4% YoY): Period dramas, horror, and other non-manga categories.

Children’s Books, Business, Self-Help (<0.5%, +20% YoY): Fast-growing but still immaterial to overall revenue.

Alphapolis further strengthens its model by offering monetary incentives and recognition to high-performing creators, attracting new talent and reinforcing user loyalty. This approach has helped fuel a healthy pipeline of new content with strong monetization potential.

Some financials

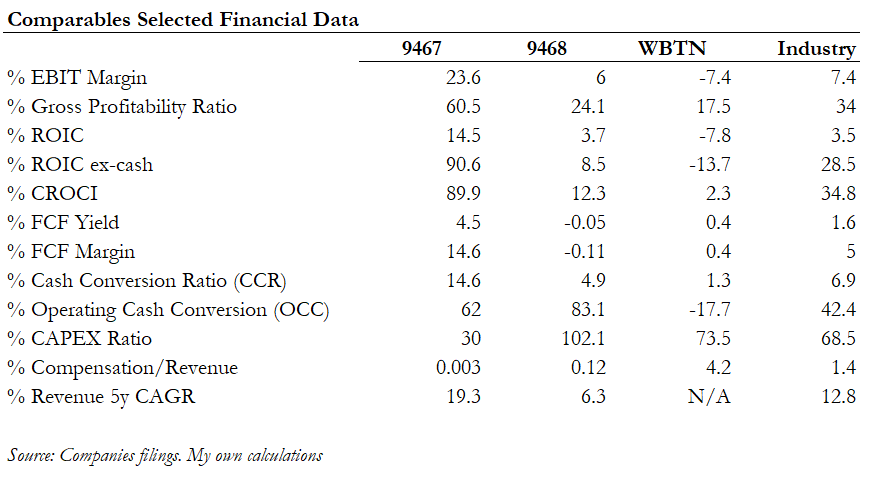

The company combines high growth with exceptional profitability and capital efficiency. Its EBIT margin of 23.6% and 5y revenue CAGR of 19.3% significantly outpace industry averages, reflecting the strength of its asset-light, platform-driven model. The company converts a large share of earnings into FCF, with a 14.6% FCF margin and 4.5% FCF yield, supported by minimal CapEx needs. Returns on capital are outstanding—ROIC ex-cash is 90.6% and CROCI is 89.9%—indicating highly productive reinvestment. Strong cash conversion metrics further confirm the quality and sustainability of Alphapolis’s earnings.

Overall, Alphapolis stands apart from its peers as a capital-efficient, cash-generating growth compounder in a traditionally low-margin industry.

Industry Overview

The global manga industry is experiencing a secular growth wave, with the market projected to grow from $15.6B in 2024 to $42.5B by 2030 at a 18.7% CAGR. This growth is overwhelmingly digital: in Japan, digital manga already accounts for over 70% of sales, and globally it represents 78% of market revenue. The shift is fueled by smartphone usage and the rise of platforms offering both subscription (e.g., Kindle Unlimited, LINE Manga) and freemium models (e.g., Piccoma). As publishers pivot toward digital-native formats and direct-to-consumer channels, companies like Alphapolis—with a fully online, user-driven publishing model—are structurally aligned with where the market is headed.

Manga’s international appeal has also surged, with the U.S., France, and Germany seeing rapid sales growth, driven by anime streaming and rising pop-culture visibility. Cross-media adaptations into anime, video games, and live-action series have become powerful monetization levers, often reigniting demand for the original manga or light novel. Meanwhile, emerging tools like AI-powered localization promise to unlock global demand more efficiently by accelerating high-quality translations. These trends favor IP owners who can originate content in-house and scale it across geographies and media—an area where Alphapolis is increasingly well positioned.

Management & Capital Allocation

Alphapolis is founder-led and tightly controlled, with the Kajimoto family holding 67.8% of the shares. The company’s president, Yusuke Kajimoto, is both the majority shareholder and the primary architect of its long-term strategy. Compensation is modest and conservative by industry standards: executive pay is capped at ¥50 million annually (~US$335K), with no stock options or performance-based bonuses. In FY2024, Kajimoto received ¥49.6 million in total compensation, equivalent to just 0.003% of revenue and 0.02% of net income. This alignment between ownership and operational leadership supports a culture of capital discipline and long-term thinking.

The company reinvests a significant portion of its internally generated cash flow into platform development, editorial hiring, and content promotion, while maintaining a stable dividend policy.

In FY2025, management is guiding for 17.5% sales growth, 14.6% profit growth, and a dividend increase of ¥10 per share, raising the payout ratio from 20.1% to 30.3%.

Importantly, Alphapolis has also articulated long-range targets for 2030 that reflect its ambition to evolve from a domestic light novel publisher into a vertically integrated media IP company. These include: increasing anime production investment from 5% to over 30% of content spend (with a long-term goal of 50%), aiming to grow anime profits by 20x; expanding international manga sales from 2.3% to 30% of digital manga revenue through localization efforts; and investing in AI tools like Novel AI Proofreading to support creators and improve content quality. Collectively, these plans reflect a management team that is capital-efficient, aligned with shareholders, and strategically focused on long-term IP monetization across multiple formats and markets.

Investment Thesis

Why Alphapolis is Undervalued

Alphapolis trades at a significant discount to its intrinsic value despite having superior fundamentals to many of its publicly listed peers. The company generates EBIT margins of 23.6%, FCF margins of 14.6%, and an ROIC ex-cash above 90%—figures that far exceed industry norms in traditional publishing. Yet the stock trades at just 15.7x P/E excash and 9.2x EV/EBIT, well below their peers.

This mispricing is largely due to investor misperception. Alphapolis is superficially categorized as a small, conventional Japanese publisher, masking its underlying identity as a scalable, digital-native IP platform. Its user-generated model creates a steady flow of low-cost, high-engagement content, and its integrated publishing and editorial process allows it to capture more value from successful titles. However, because of its limited float, lack of analyst coverage, and relatively low visibility outside Japan, the market has yet to fully recognize the platform’s monetization potential and capital efficiency.

Why This Opportunity Exists

The company is in the early stages of a long-term strategic transformation. The company is actively investing in anime production, expanding internationally through its Alpha Manga app and digital storefronts, and developing tools like AI-powered proofreading to enhance content quality at scale. These initiatives are designed to increase both the quantity and the lifetime value of its IP. Management has set a 2030 target to grow anime-related profits by 20x and increase the overseas share of digital manga sales from 2.3% to 30%.

These changes are timely. The global manga market is expanding at a ~19% CAGR, digital adoption continues to accelerate, and anime/IP adaptations are commanding premium valuations across media. Alphapolis is positioning itself to ride these secular trends with relatively low incremental capital, given its existing platform and in-house development capabilities. As the company delivers on its growth roadmap and begins to unlock value from its content pipeline across formats and geographies, there is a high likelihood of both earnings growth and multiple re-rating. This disconnect between market perception and business quality creates a compelling entry point for long-term investors.

Valuation

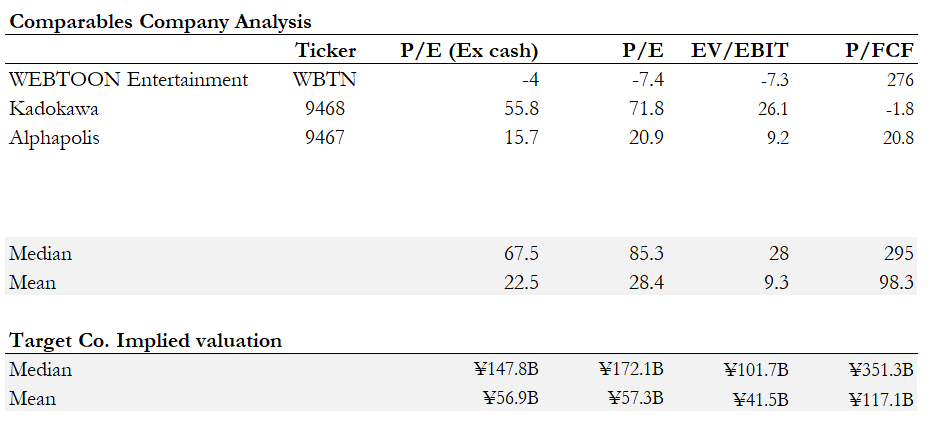

Alphapolis appears modestly to significantly undervalued based on a relative valuation using mean trading multiples from peers Kadokawa and WEBTOON Entertainment. While peer medians suggest extreme upside potential, a more conservative—and arguably more realistic—view emerges from the mean multiples across P/E, P/E ex-cash, EV/EBIT, and P/FCF.

On average, peers trade at 28.4x P/E, 22.5x P/E ex-cash, 9.3x EV/EBIT, and 98.3x P/FCF. In contrast, Alphapolis currently trades at 20.9x P/E, 15.7x P/E ex-cash, 9.2x EV/EBIT, and 20.8x P/FCF—well below the peer set on every dimension except EV/EBIT, where it's roughly in line. Applying these mean multiples to Alphapolis’s FY2024 results implies a fair equity value between ¥41.5 billion and ¥117.1 billion, corresponding to a share price range of ¥1,426 to ¥4,024. At a current share price of ¥1,491, this suggests upside of –4% to +170%.

The lower bound reflects the conservatism embedded in EV/EBIT multiples, while the upper range is supported by Alphapolis’s strong free cash flow generation and low reinvestment needs. Given its superior fundamentals—high ROIC, strong cash conversion, and an asset-light model—there is a credible case that the company deserves to trade toward the upper end of this more conservative range over time.

Risks

Distribution Concentration: Around 90% of Alphapolis’s revenue is routed through just three Japanese distributors, creating meaningful dependency and counterparty risk.

Mitigation: The company is actively developing alternative channels, including its own Alpha Manga app, overseas digital platforms, and direct rental models to reduce reliance on intermediaries.

Product Dependence on Manga and Light Novels: 98% of sales stem from this two content categories, making the company vulnerable to shifts in genre popularity or saturation.

Mitigation: Management is expanding into adjacent genres (e.g., horror, romance, slice-of-life) using the same UGC model, supported by monetary incentives and awards to attract diverse creators.

Execution Risk in Anime and Overseas Expansion: Plans to grow anime production and scale international manga sales require new capabilities in localization, licensing, and content development.

Mitigation: The company is reinvesting in internal tools (like AI-powered proofreading) and gradually increasing anime spend to build capabilities over time. Overseas efforts are focused on digital channels where the cost of entry and experimentation is lower.

Catalysts

Expansion into Anime and Media Formats: Alphapolis is increasing investment in anime adaptations, with a goal to grow anime-related profits 20x by 2030. Success in this vertical could amplify IP monetization, expand global reach, and increase optionality through merchandising, mobile apps, and potential videogames.

Growth in Direct and International Channels: The company is actively building out its own digital distribution via the Alpha Manga app and rental models, especially for overseas markets. A rise in international digital manga sales—targeted to grow from 2.3% to 30% by 2030—could meaningfully diversify revenue and reduce dependence on Japanese distributors.

Multiples Expansion: Alphapolis trades at a material discount to peers despite superior margins and returns on capital. As it scales, diversifies, and improves investor communications, there is room for valuation multiples to converge with those of more prominent IP platforms and media publishers.

Great deep dive. The market’s tendency to misclassify companies like Alphapolis creates an opportunity. The UGC-driven model plus early-stage network effects really stand out as a moat in the making.

Your content is gold! Keep it coming!