Bonhoeffer Fund on Fairfax Financial

From the Q3 2025 letter of Bonhoeffer Fund.

Fairfax Financial (TSE: FFH)

The core idea is simple but often misunderstood: FFH is not just an insurance company. It is a leveraged investment vehicle funded by insurance float, very much in the tradition of Berkshire Hathaway. Over the past decade, Fairfax’s average cost of float has been negative, meaning policyholders effectively pay the company to hold capital. That float finances investment assets equal to roughly 160% of equity, creating structural leverage without relying on traditional debt.

Underwriting First, Always

Keith Smith stresses that float only becomes an advantage if underwriting is disciplined. Fairfax’s decentralized model allows its insurance subsidiaries to expand when pricing is attractive and pull back when it isn’t. Growth is not forced. As a result, underwriting profitability has steadily improved over time.

A key insight from the letter is how successful Fairfax has been as an insurance operator, not just an investor. Roughly two-thirds of current premiums come from insurers acquired since 2009, and those businesses have seen dramatic improvements in combined ratios after being brought into the Fairfax ecosystem. Keith highlights US$2B of reserve redundancies accumulated over many years — evidence that underwriting has been conservative rather than aggressive.

This underwriting discipline forms the foundation of the entire model. Without it, float becomes dangerous leverage. With it, float becomes a durable competitive advantage.

Capital Allocation as a Flywheel

The second engine of Fairfax’s compounding is capital allocation. Since 2009, the company has acquired multiple insurers, often through negotiated transactions at attractive prices. Bonhoeffer notes that Fairfax paid an average of 1.7× premium written for these acquisitions — a figure that looks even cheaper once underwriting improvements are factored in.

Crucially, FFH does not rely on continuous acquisitions to grow. When opportunities are scarce, management reallocates capital toward investments or share repurchases. This flexibility — shifting between underwriting growth, acquisitions, investing, and buybacks — mirrors the Berkshire playbook and prevents capital from being wasted at the wrong point in the cycle.

The Investment Portfolio and the Role of Leverage

Fairfax’s investment portfolio is intentionally conservative. The majority is invested in short-duration, high-quality fixed income, which reduces both interest-rate and credit risk. Equities and operating businesses provide upside, but the portfolio is not dependent on heroic assumptions.

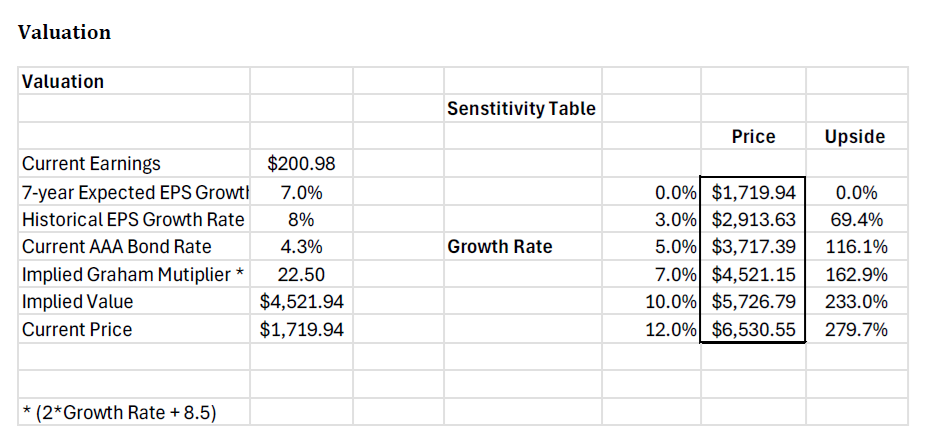

When combined with float-based leverage, this structure produces attractive economics. Keith estimates that Fairfax’s current setup supports a normalized mid-teens ROE, driven by a combination of underwriting profits, modest investment returns, and disciplined leverage. Importantly, this outcome does not require exceptional market conditions — only patience and consistency.

Why Bonhoeffer Owns Fairfax

Bonhoeffer’s conclusion is that the market continues to misprice Fairfax by treating it as a cyclical financial stock rather than a long-duration compounder. At current valuations, the market appears to assume little to no long-term growth, despite Fairfax’s demonstrated ability to grow book value and earnings over full cycles.

The broader lesson goes beyond Fairfax itself. Insurance companies like Fairfax are best understood not through quarterly results, but through structure: the cost of float, the discipline of underwriting, and the quality of capital allocation. When all three align, float becomes an enduring source of value rather than a hidden risk.

Love how this breaks down the float-as-leverage model that most people miss when evaluating insurers. The fact that Fairfax's float has a negatve cost while financing 160% of equity is wild becuz it turns the traditional capital structure on its head. I've worked with a few insurance-linked securities and seeing disciplined underwriting paired with patient capital allocation is rare. The real test is whether management can stay disciplined when pricing softens and resist the temptation to chase premium growth.

Thanks for sharing this, also really like their quarterly investor presentation videos, always very informative