CBS’ Best Ideas of 2025: The Russo 5x5x5 Fund’s Winning Stock Theses

5 investment ideas from CBS’ 5x5x5 Russo Fund. Deep dives on CNH Industrial, Light & Wonder, Avery Dennison, Cellebrite, and WESCO International.

Every year, a select group of Columbia Business School students manage the 5x5x5 Russo Student Investment Fund, a long-term, real-money portfolio backed by legendary investor Tom Russo. The rules are simple: pick five stocks, hold them for five years, and make a strong case rooted in deep fundamental research. The five ideas chosen in 2025 stood out for their compelling asymmetry, quality businesses, and long-term thinking. In this post, I summarize the five winning investment theses — from misunderstood industrials to niche software leaders.

But before we dive in… A few previous posts from CBS’ investment theses that you can’t miss

Ideas featured

CNH Industrial N.V. (NYSE: CNH)

Light & Wonder (NASDAQ: LNW)

Avery Dennison Corporation (NYSE: AVY)

CELLEBRITE (Nasdaq: CLBT)

WESCO International, Inc. (NYSE: WCC)

CNH Industrial N.V. (NYSE: CNH)

Recommendation: Long | Target Price (2028): $20.14 | IRR: 14.2%

Author: Mario Stefanidis

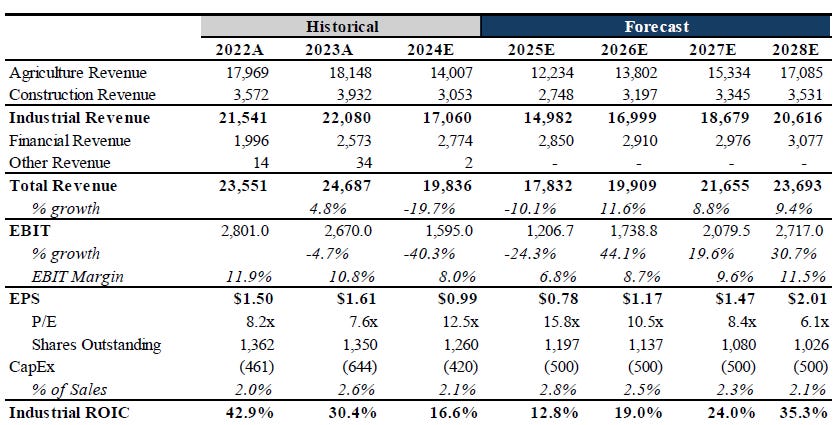

Mario presents CNH Industrial as a high-quality industrial business misunderstood by the market, offering investors a compelling entry point mid-downcycle. The author believes that despite near-term headwinds in agriculture, CNH is positioned to emerge stronger and more profitable — with significant upside from operating leverage, dealer destocking, and management-led margin improvements. CNH trades at depressed multiples (~6.1x 2028 P/E), distorted by cyclical pessimism, misunderstood leverage, and recent technical dislocations.

Following its 2022 spin-off of Iveco, CNH became a pure-play off-highway equipment manufacturer, focused on agriculture (~71% of FY24 revenues), construction equipment (~15%), and a financial services arm (~14%). Its agriculture business is the core earnings engine, boasting strong brands like Case IH and New Holland, and global diversification across North America, EMEA, South America, and APAC. CNH has long-standing customer loyalty, high barriers to entry, and significant exposure to precision and autonomous agriculture — bolstered by its 2021 acquisition of Raven Industries.

The central premise is that CNH is nearing the bottom of its ag downcycle — a cycle that historically lasts 3–5 years and is already ~2 years in. Interest rates are easing, farmer sentiment is improving, and farm capital investment indicators are rebounding. CNH is intentionally underselling to accelerate dealer inventory normalization — a proactive strategy that contrasts with the prolonged 2011–16 downturn. Titan Machinery (CNH’s largest North American dealer) has already reported significant inventory drawdowns, indicating the destocking is well underway.

Meanwhile, CEO Gerrit Marx — who took over in 2024 — is driving structural margin improvements. In FY24 alone, CNH achieved ~US$480M in COGS and SG&A savings through plant closures, warehouse streamlining, and smarter procurement using new software systems. EBIT margins held at 8% despite a 23% revenue decline, showcasing operating resilience and cost discipline. These efforts are expected to produce ~11.5% EBIT margins by FY28, translating into US$2.01 EPS — well above the Street’s US$1.11 consensus.

Finally, valuation is distorted by technical and accounting factors: CNH delisted from Euronext Milan in early 2024, triggering ~$2B of forced selling from European funds. U.S. fund ownership remains far below peers like Deere and AGCO, leaving room for passive inflows and rerating. Moreover, its financial services debt inflates GAAP EV/EBIT and P/E multiples — obscuring the healthy industrial balance sheet. David Einhorn’s Greenlight Capital disclosed a position in late 2024, citing this exact mispricing.

At ~US$12/share, the thesis sees 63.6% upside to $20.14/share by 2028, supported by improving fundamentals, growing EPS, and multiple rerating. CNH also returns capital through a 2% dividend and ~5% annual buybacks. The stock trades below earnings power value and well below strategic value, making it a classic misunderstood industrial turnaround with embedded optionality on ag recovery, precision tech, and operational execution.

What makes the company a compelling long, in my view, is its improving fundamentals driven by margin-enhancing cost cuts, precision ag investments, and disciplined supply chain control under new seasoned management led by Gerrit Marx.

Light & Wonder (NASDAQ: LNW)

Recommendation: Long | Target Price (2027): $151.93 | Upside: 86% | IRR: 23%

Author: Joe Ferguson

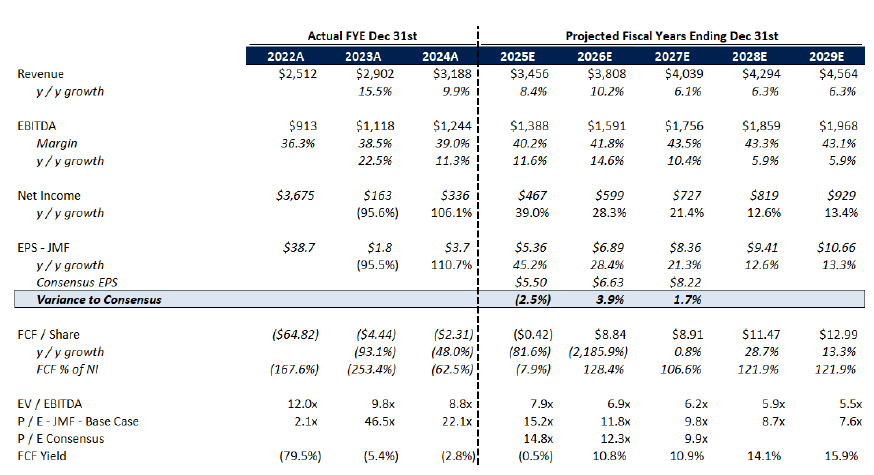

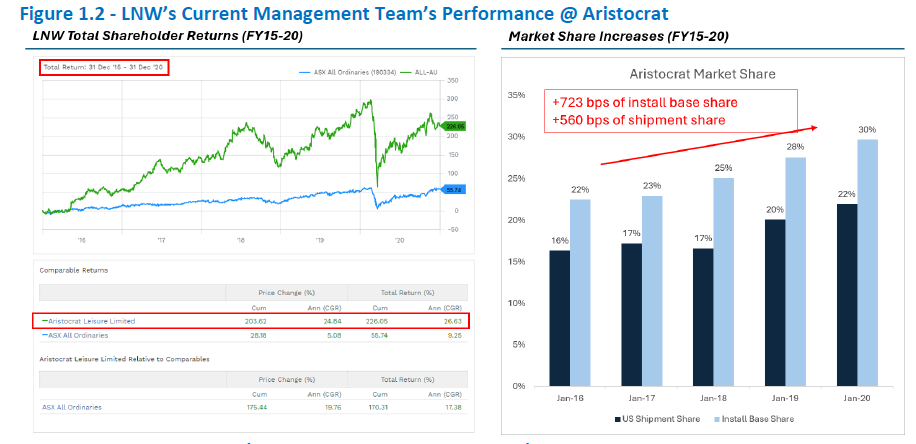

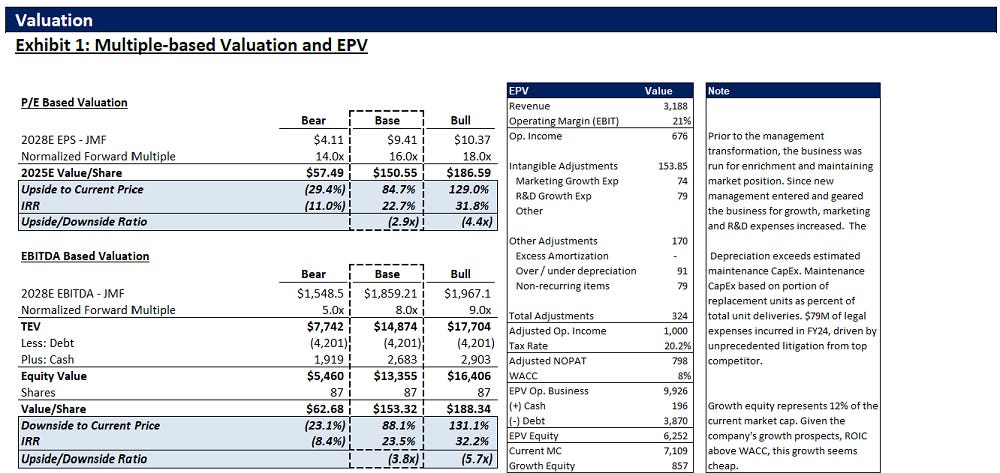

Joe Ferguson presents Light & Wonder (LNW) as a deeply misunderstood and undervalued business undergoing a strategic transformation. While the market continues to view LNW as a distant second to Aristocrat (ALL), the pitch argues that this perception is outdated. Since 2020, LNW has replaced its legacy leadership, deleveraged significantly, restructured its business lines, and now closely mirrors Aristocrat’s business model — but trades at a steep valuation discount (53% lower EV/EBITDA), representing a compelling opportunity for mean reversion as fundamentals continue to improve.

LNW is a leading global provider of gaming machines (especially slots), social casino games (via SciPlay), and iGaming products. Following the divestiture of its lottery and sports betting divisions in 2022, LNW now focuses solely on its gaming segments. Key changes under the new CEO Matt Wilson (formerly of Aristocrat) include a revamped C-suite and mid-level leadership team, improved capital allocation (with share buybacks and divestitures), and increased R&D efficiency. ROIC has risen from 6% in FY22 to 15% in FY24, yet the stock still trades at ~7.3x forward EV/EBITDA.

A major pillar of the thesis is LNW’s moat, which the market has misjudged. Morningstar gives the company “no moat,” but Ferguson provides evidence that LNW is gaining market share alongside Aristocrat and IGT, as the U.S. slot market consolidates. LNW’s broad IP library, cross-platform game ecosystem (land-based + social + real money gaming), and regulatory barriers give it scale and stickiness. The company develops ~130 games/year, and its premium leased titles command attractive recurring revenue. Eilers & Krejcik data now ranks several LNW titles in the top 10, with Dragon Train taking the #1 spot in 2025.

Critics point to litigation risks — particularly Aristocrat’s lawsuit over Dragon Train — but Ferguson argues these are overstated. Financial exposure is minimal, the games in question represent a small fraction of LNW’s pipeline, and 95% of affected machines were replaced within 30 days. In fact, the lawsuit reveals Aristocrat’s internal struggles to replicate past hit titles, while LNW continues to innovate and retain elite game developers.

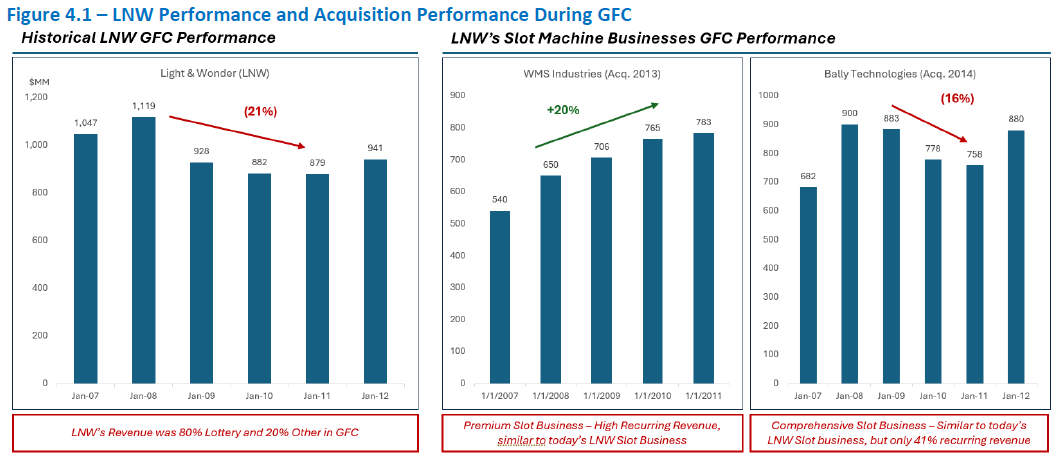

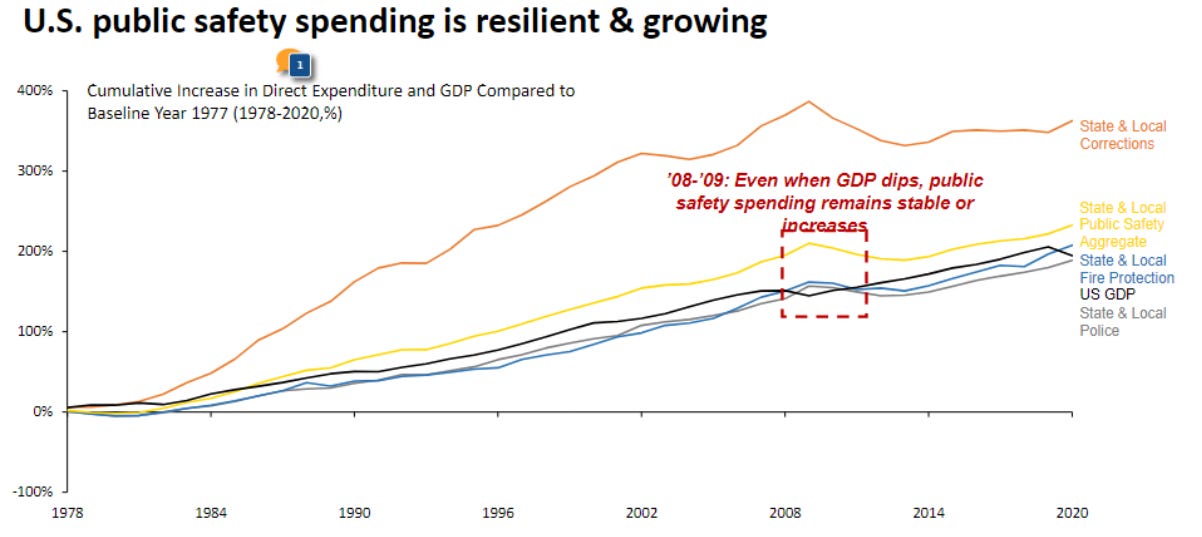

The thesis also dismantles fears about economic cyclicality. While legacy LNW businesses were exposed during the 2008 crisis, its current revenue mix is dominated by more resilient segments acquired from WMS and Bally. Slot demand is stable among retirees — a customer base that remains active even during downturns. Post-COVID data even show that premium slot floorspace allocation rose in tough times, benefiting performance-leading companies like LNW.

Finally, the market seems to ignore LNW’s online and social gaming segments, which have hidden value. Though daily active users (DAUs) in SciPlay have declined overall, that trend is mostly driven by non-core games. Core casino games are growing at a 6% CAGR and now make up 93% of users. A favorable court ruling in early 2025 (related to Apple’s App Store rules) will allow LNW to push more revenue through direct-to-consumer (DTC) channels — improving margins significantly. The iGaming division also shows little cannibalization of land-based slots, and instead attracts younger players, expanding the overall market.

At a base case price target of US$151.93 by FY27, the thesis forecasts an IRR of 23%, driven by EBITDA growth, multiple re-rating, and margin expansion. With strong momentum, leadership from Aristocrat veterans, and growing mindshare across platforms, LNW is pitched as a classic transformation story that the market hasn’t yet priced in.

Avery Dennison Corporation (NYSE: AVY)

Recommendation: Overweight | Target Price (2030): $294 | IRR: 16.5%

Author: Keshav Prasad

Keshav positions the company as a durable compounder with a long runway for growth, driven by the accelerating adoption of RFID-based intelligent labels. AVY is best known for its pressure-sensitive materials (PSM) used in packaging and labeling, but the core of the investment case lies in its Intelligent Labels division, where RFID adoption is still early and expanding into sectors like apparel, logistics, pharmaceuticals, and automotive.

AVY benefits from a strong moat: its vertically integrated model, economies of scale, and global reach make it a key supplier to Fortune 500 companies. Intelligent Labels already have ~40% penetration in the apparel industry, and the thesis argues that AVY will benefit as RFID expands across supply chains to improve inventory tracking, reduce shrink, and enable real-time logistics. While much of the market sees AVY as a mature industrial business, the analyst views it as an underappreciated tech-enabled infrastructure play.

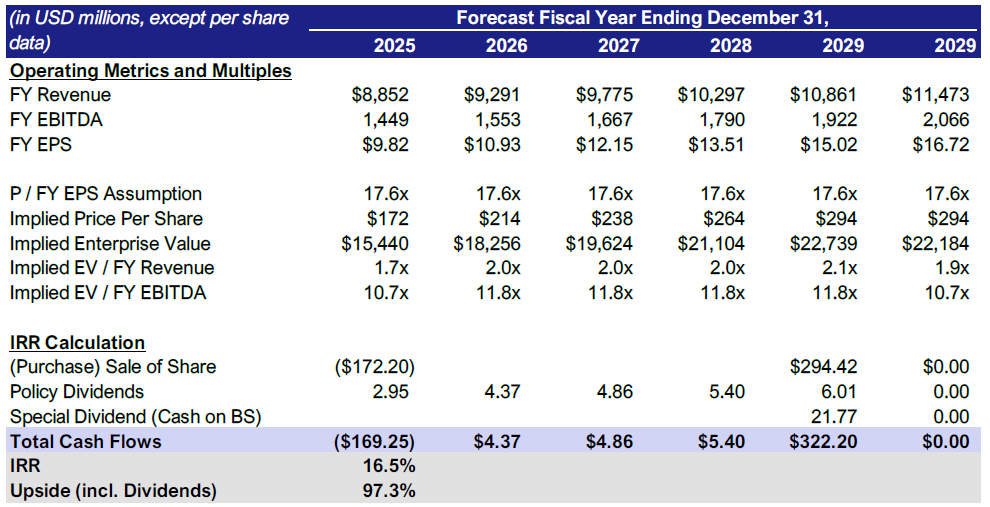

The company also scores high on capital discipline. Management targets 10% long-term EPS growth, driven by margin expansion, organic growth, and bolt-on M&A. AVY has returned nearly US$4B to shareholders since 2016 and follows an economic value-added (EVA) framework to guide acquisitions and capital allocation. Its balanced approach includes ~50–55% of capital allocated to buybacks and M&A, 25–30% to CapEx, and 20% to dividends.

Valuation is compelling: at US$172/share, the stock trades below its intrinsic value based on earnings power and discounted cash flows. The base case assumes AVY reaches US$16.72 EPS by 2030, and applying a conservative 17.6x multiple (in line with RFID-focused comps) yields a price target of US$294, or a 16.5% IRR. The analyst also sees upside from AVY’s premium positioning, pricing power, and expanding role in mission-critical supply chain solutions.

Risks include increased RFID competition, pricing pressure, and demand cyclicality — but these are mitigated by AVY’s strong brand, sticky customer relationships, and global diversification. Overall, Keshav sees AVY as a steady compounder with hidden tech exposure, offering attractive returns with low execution risk.

CELLEBRITE (Nasdaq: CLBT)

Recommendation: Long | Target Price (2027): $27.86 | Upside: 117% | IRR: 42%

Author: Roy Swisa

Roy Swisa presents Cellebrite as a capital-light, high-moat business in the digital forensics market with significant long-term growth potential. The company’s core offering is used by law enforcement agencies to extract, analyze, and present mobile device data in legally admissible formats. Cellebrite is not only the industry standard—often explicitly required in court orders—but also a category leader with a strong brand and high user retention.

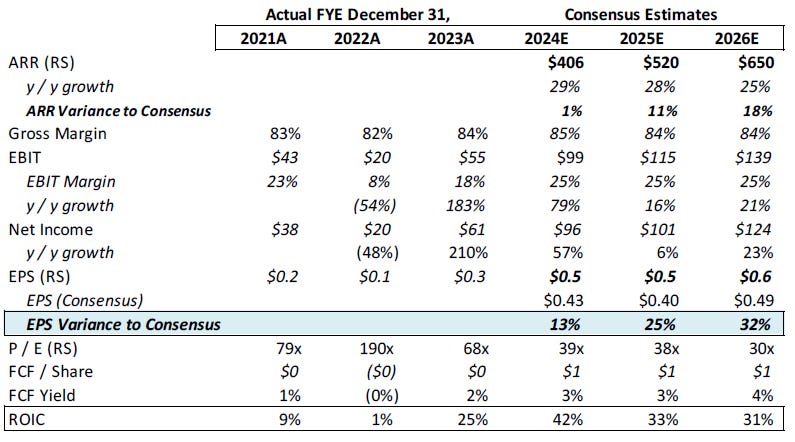

The thesis is built around several powerful growth vectors. First, Cellebrite is expanding beyond Digital Forensics Units (DFUs) into Investigative Units (IUs), opening a new avenue for license sales and reducing investigative backlogs. This transition could triple the company’s addressable recurring revenue opportunity. Second, the company is nearing FedRAMP certification, which would allow it to serve U.S. federal agencies at scale, unlocking US$50M in potential ARR. Third, Cellebrite is showing strong growth within its existing client base, generating US$80M in ARR from upselling and cross-selling.

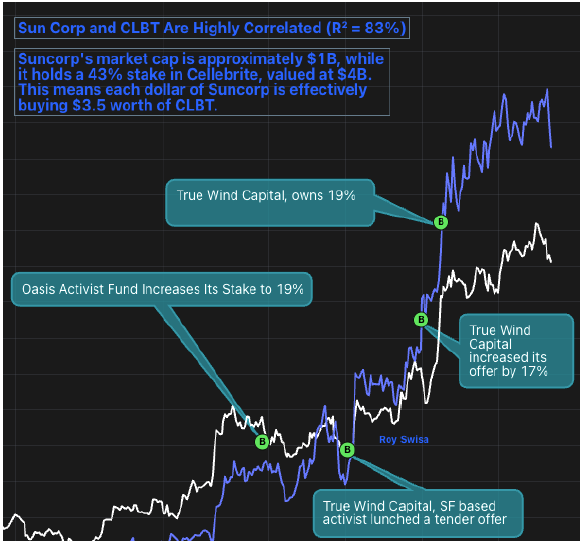

Swisa also highlights an overlooked deep value arbitrage opportunity: Japanese-listed Sun Corporation owns 44% of Cellebrite, yet trades at a 70% discount to the value of its stake. Activist investor True Wind has taken positions in both companies, adding pressure for value realization.

Cellebrite’s fundamentals are compelling. It operates at 85% gross margins, 92% retention, and is growing ARR at 25% per year. Its software is considered essential, with courts and law enforcement agencies showing strong willingness to absorb annual price increases. Concerns over technological obsolescence (e.g., Apple neutralizing Cellebrite’s software) are dismissed as unlikely, since Cellebrite exploits hardware-level vulnerabilities that cannot be patched via software alone.

On valuation, the company trades at 8x forward revenue—well below the 10x revenue multiple seen in the Thoma Bravo acquisition of competitor Magnet Forensics, despite similar growth profiles. The base case assumes modest penetration increases and continued expansion into IUs and federal accounts, delivering a 117% upside to $27.86 per share, and a 42% IRR over 2y. With a 25% EBIT margin and ROIC above 80%, Swisa argues that Cellebrite is an organic compounder with one of the strongest moats in software— a “Rule of 40” business with misunderstood optionality and multiple re-rating potential.

WESCO International, Inc. (NYSE: WCC)

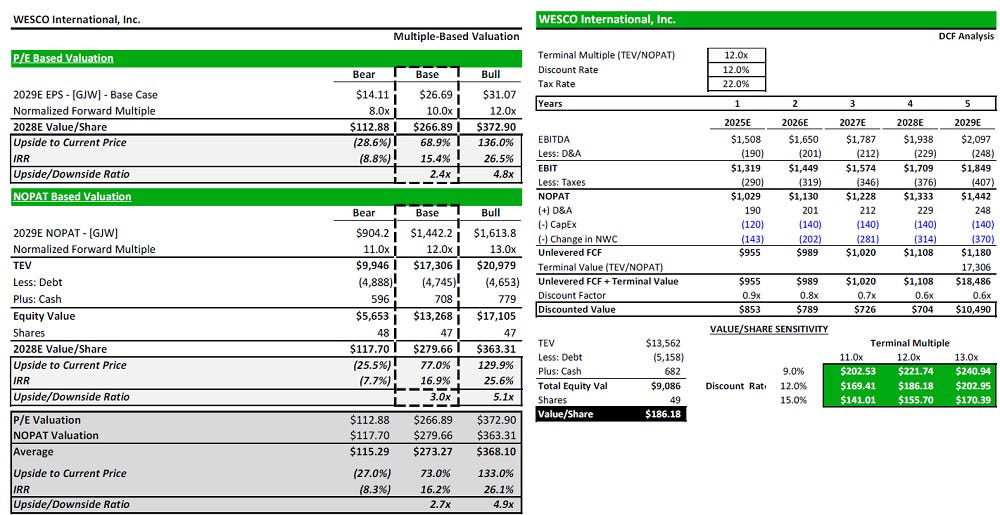

Recommendation: Long | Price Target (2027): $294 | Upside: 73% | IRR: 17%

Author: Garrett Wallis

The thesis on WESCO International (WCC) presents it as a misunderstood and undervalued distributor that is evolving into a tech-enabled infrastructure solutions provider. While the market continues to view WESCO as a cyclical, low-margin industrial business, Garrett argues that its transformation is real and accelerating — supported by secular tailwinds in electrification, data center buildout, grid modernization, manufacturing reshoring, and AI-powered automation.

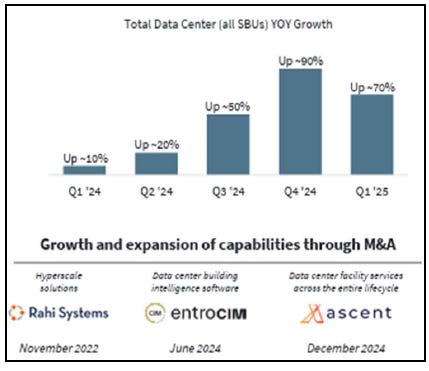

WESCO is one of the largest distributors of electrical, data communications, and industrial automation products in North America, with over 1.5 million SKUs and deep relationships across construction, utility, and OEM customers. The company underwent a pivotal transformation in 2020 with the acquisition of Anixter, doubling revenues and expanding into high-growth verticals. Since then, WESCO has actively reshaped its portfolio, adding businesses like Rahi Systems (data centers), Ascent (wireless connectivity), and entroCIM (smart building software) — all aimed at raising the company’s value-add and pushing margins higher.

The investment case rests on three main pillars:

Secular growth from multi-decade trends like EV infrastructure, cloud computing, and U.S. manufacturing reshoring.

Operating leverage and SG&A efficiency, as recent tech and IT investments taper off post-2025.

FCF optionality, allowing for debt reduction, preferred stock redemption, and share buybacks.

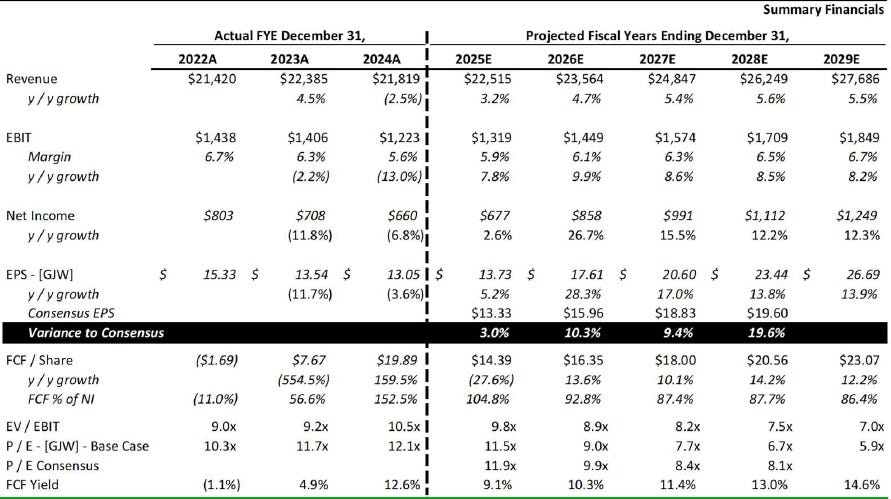

WESCO is guiding toward 10% EBITDA margins by 2028–2030, up from ~6.4% in 2024. This expansion is not just theoretical: management has shown execution by reducing debt by US$278M in 2024, buying back US$425M in shares, and planning to retire its preferred equity, which will eliminate a US$57M dividend drag. Despite this, the market still values WCC at just 8x forward EV/EBITDA and ~11x earnings, a multiple more appropriate for no-growth distributors.

A key part of the thesis is that the market is missing the shift in WESCO’s business mix. While P/E screens and historical comps still anchor investor perception, the company is moving aggressively into high-margin, recurring-service-based segments that command premium valuations — yet none of that re-rating has occurred. Meanwhile, WESCO’s diversified end-markets (utilities, renewables, automation, construction) provide a buffer against short-term cyclicality.

The base case estimates a 2027 share price of US$294, driven by margin expansion, moderate revenue growth, and a modest re-rating of the multiple. The IRR estimate is ~17%, with upside from stronger-than-expected margin gains or value-accretive M&A. The downside is estimated at –27% in a bearish scenario, giving the idea a favorable risk/reward ratio.

Risks include macroeconomic headwinds delaying infrastructure projects, execution risk in integrating acquisitions, and investor skepticism that WESCO can break out of its historical “distributor” identity. However, the analyst argues these are well mitigated by visible cost savings, strong cash flow, and secular demand. Garrett concludes that WESCO is a classic value-to-quality transition story — a capital-efficient compounder in the making, hiding in plain sight

Nice job collecting and sharing our work! I’m glad it’s reaching new audiences. If you have any questions, feel free to reach out.