The Best Ideas I Found in Q3 2025 Investor Letters (Part II)

Investment thesis on Golar LNG by LVS Advisory letter.

Golar LNG ( GLNG 0.00%↑ )

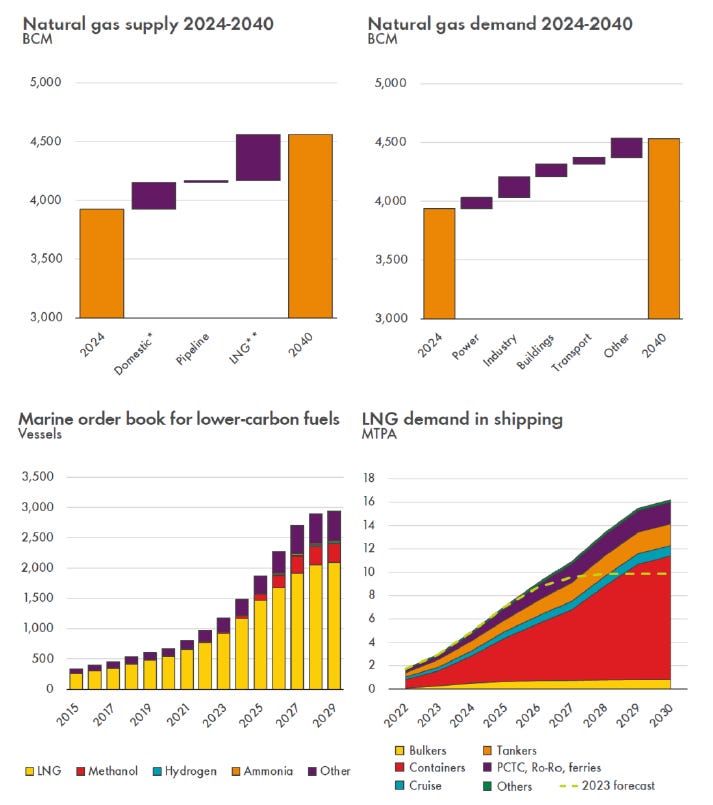

In his latest letter, Luis V. Sanchez, CFA, of LVS Advisory presents one of the most compelling energy theses of the year — a case for Golar LNG (GLNG) as the ultimate beneficiary of a looming global power shortage. Sanchez believes the world is entering a decade-long electricity deficit driven by AI, electrification, and industrial reshoring. As these forces collide, natural gas will emerge as the most flexible bridge fuel, and floating LNG infrastructure will be the most profitable way to deliver it.

For context, Luis estimates that U.S. electricity demand will exceed baseload capacity by more than 50 gigawatts over the next five years. Even more striking, OpenAI’s own projections imply that data centers could require 250 gigawatts of new capacity by 2033 — roughly one gigawatt per week, far beyond what utilities can realistically build. In this environment, the firm’s “power generation basket” — including Talen Energy, Curtiss-Wright, and Golar LNG — forms a thematic bet on the only resources capable of meeting that demand.

Rather than constructing billion-dollar onshore terminals, Golar converts existing LNG carriers into floating liquefaction plants (FLNGs) that can be deployed directly above gas fields. Each vessel can generate hundreds of millions in annual EBITDA under long-term, dollar-denominated contracts — and can sail away if political or regulatory risks arise.

Golar currently operates or is developing three key FLNG assets:

Hilli (Cameroon → Argentina): Moving from Perenco to a 20-year contract in Argentina that triples its tolling revenue to $285M/year, with EBITDA expected near $355M.

Gimi (Mauritania/Senegal): Now online with BP, earning $151M/year through 2045.

Fuji (Under construction): Scheduled to deploy alongside Hilli in Argentina by 2027, generating an estimated $470M in annual EBITDA once fully operational.

These projects are governed by English law, dollar contracts, and Argentina’s new RIGI framework, which locks in tax and regulatory terms for 30 years. In Sanchez’s words, “If the politics turn, the ships sail.”

From a valuation standpoint, Luis sees massive asymmetry. He projects roughly $800 million in fixed-fee EBITDA by 2029, worth about $79/share, plus commodity-linked upside and minority stakes adding another $20/share. Its base-case estimate: $95/share by 2030, with each additional FLNG project adding roughly $50/share.

The risks — commodity volatility and geopolitical uncertainty — are real but manageable. Even if energy prices fall, the long-term contracts provide cash flow stability. If prices rise or Argentina becomes a major LNG exporter, the upside multiplies. As Sanchez puts it:“Even if oil falls to $50, Golar doubles; if it rises, it triples.”