Cathie Wood’s ARK ETFs: The Cost of Chasing the Hype

Explore the highs and lows of Cathie Wood’s ARK ETFs, uncovering the risks of trend investing and the impact of investor biases.

A MESSAGE FROM GRAHAM-QUALITY INVESTOR

Hello, friends! 👋

I’m thrilled to share that this week’s post comes from a special guest and dear friend: Gaspar Fierro.

You might not have heard of him yet, but as I like to say, Gaspar is the "Jason Zweig" of the Spanish-speaking world.

With decades of experience in both passive and active investing, Gaspar is one of the few people I know who truly understands passive investing. If you want to learn more about him, you can do so here: Learn more about Gaspar.

Gaspar is starting his newsletter in English here on Substack: The Passive Value Investor. I convinced him to publish his first post on Graham-Quality Investor so you, dear readers, can judge his work for yourselves. If you enjoy it, I highly encourage you to subscribe.

I hope you enjoy this excellent post by Gaspar on Cathie Wood’s ARK ETFs.

In the world of investing, narratives are powerful, and dangerous. They can draw in even the most seasoned investors with the promise of untapped potential and future riches. A compelling story can often overshadow hard data, leading to decisions that might not always align with long-term financial success.

When you arrive late to the party, the best opportunities are likely gone, and what's left might not live up to the hype. In fact, the thrill of a good story often masks the underlying risks, setting the stage for disappointment. This article explores how trendy ETFs often emerge after the prime window for high returns has closed and how some cognitive biases like FOMO (Fear of Missing Out) and the disposition effect push investors into making poor investing decisions.

TL; DR

Narrative Risks: Compelling stories, like those of ARK ETFs, can overshadow data, leading to poor investment decisions.

Timing Matters: Latecomers to trendy ETFs often miss out on the best returns as the market has already priced in expected growth.

Cognitive Biases: FOMO and other biases drive investors to chase trends and hold onto underperforming assets.

Cathie Wood's ARK ETFs: Initially successful during the pandemic, ARK ETFs faced significant losses as market conditions changed.

Over-Expectations: Unrealistic expectations, fueled by media and marketing, can lead to financial disappointments.

Invest Cautiously: Focus on fundamentals and long-term strategies rather than chasing trends.

The Lure of a Good Story

Narratives in the financial world often revolve around innovative technologies, disruptive business models, or emerging market trends. These stories are not inherently false or misleading; many are based on legitimate economic shifts. However, the timing can be critical. By the time an investment theme has gained widespread recognition and the related ETFs have been launched, the market has usually already priced in much of the expected growth. As a result, latecomers find themselves buying into a story that has already been fully valued, leaving little room for further upside. We have seen this over and over.

The Reality of Arriving Late

When a new trend or theme finally hits the ETF market, it's often a sign that the best of the upside has already been realized. But remember, this is about probabilities, not certainties. The launch of new ETFs frequently coincides with the peak of the trend they’re based on, leaving little room for investors to reap significant rewards. The SUBZ ETF, which offered exposure to the streaming industry, is a prime example. Despite the industry's strong fundamentals, the ETF's launch came after the market had already absorbed the most significant gains, resulting in underwhelming performance for those who jumped in late.

Wall Street sell side is filled with examples of financial products that capitalize on the tail end of a trend. For instance, during the late 1990s, technology-focused mutual funds proliferated as the dot-com boom captured investor imagination. However, many of these funds were launched just as the bubble was about to burst, leading to significant losses for those who invested at the peak. Similarly, the real estate bubble of the mid-2000s saw the launch of numerous real estate investment trusts (REITs) and housing-focused ETFs, many of which suffered severe declines when the housing market crashed in 2008.

These patterns are not coincidental. ETF issuers are keenly aware of market trends and investor demand, and they often launch products that cater to the prevailing market sentiment. However, by the time an ETF is created to capture a specific trend, the underlying assets have often already experienced substantial price appreciation. This timing issue makes it challenging for these ETFs to deliver the same level of returns as early investments in the trend.

The problem isn't just with the timing of these launches but with the psychology driving investors to chase them. Cognitive biases play a significant role here. FOMO compels investors to jump on the bandwagon, fearing they'll miss out on potential gains. Meanwhile, the disposition effect—the tendency to sell winners too early and hold onto losers for too long—ensures that many investors stay stuck in underperforming assets, hoping for a turnaround that may never come.

Another crucial aspect to consider is the role of media and marketing in shaping investor behavior. Financial news outlets, blogs, and social media platforms often amplify the excitement around new trends, creating a sense of urgency among investors. Headlines touting "the next big thing" or highlighting the meteoric rise of certain stocks can lead to irrational exuberance, where investors rush to buy in without fully understanding the risks. This media-driven frenzy can cause a feedback loop, where rising prices attract more media attention, which in turn draws in more investors, further inflating the bubble.

This isn't just a phenomenon limited to niche markets. Even widely recognized ETFs like those managed by Cathie Wood's ARK Invest have seen similar patterns. Initially lauded for their innovative approach and eye-catching returns during the recent tech boom, these ETFs have struggled as the market has shifted. Investors who joined the party late have found themselves holding the bag, with expectations crashing hard against the reality of market cycles.

Case Study: Cathie Wood's ARK ETFs

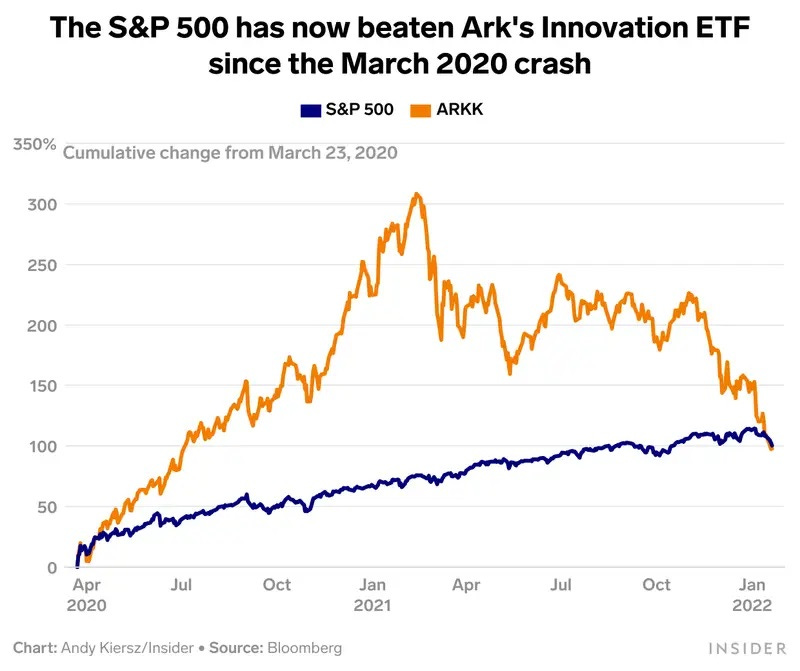

Cathie Wood and her ARK ETFs are perfect examples of how a compelling story can captivate investors, sometimes to their detriment. During the peak of the pandemic, Wood became a household name, with her bold predictions about disruptive technologies drawing in billions of dollars in assets. The ARK Innovation ETF (ARKK) and others in the ARK family delivered jaw-dropping returns during 2020 and 2021, driven by massive gains in companies like Tesla, Zoom, and Roku.

However, the story began to unravel as the broader market environment changed. Rising interest rates and a shift in investor sentiment led to massive outflows from ARK's ETFs and staggering losses running into billions. Despite the fund's poor performance, many investors remained loyal, drawn in by the narrative of long-term disruptive growth, even as the returns failed to materialize. This scenario underscores a critical point: a good story, and a good pinch of biases, can sustain investor interest, but it doesn't guarantee financial success.

Let's delve deeper into the dynamics of ARK's meteoric rise and subsequent fall. ARK Invest's success during the early days of the COVID-19 pandemic was driven by its heavy exposure to high-growth tech stocks, many of which benefited from the shift to remote work, e-commerce, and digital entertainment. Tesla, for example, became one of the flagship holdings of the ARK Innovation ETF, and its explosive growth helped propel the fund to unprecedented heights. Investors were drawn to Wood's visionary approach, which seemed to identify the most promising companies at the forefront of technological innovation.

However, the very factors that contributed to ARK's success also sowed the seeds of its later struggles. The concentration in high-growth, high-volatility stocks made the fund exceptionally sensitive to changes in market sentiment. As interest rates began to rise in 2022, the valuations of these growth stocks came under pressure. Investors who had flocked to ARK during its heyday suddenly found themselves facing significant losses.

Moreover, Wood's strategy of "buying the dip" in her favorite stocks, such as Tesla, while selling more stable holdings like Nvidia, raised eyebrows among analysts and investors alike. While this approach demonstrated her unwavering conviction in her investment thesis, it also increased the risk profile of her funds. Wood's reluctance to chase Nvidia—a move that some viewed as prudent—cost her fund dearly as Nvidia's stock went on to rally, leaving ARK's investors wondering if they had been too hasty in trusting the narrative.

The lesson here is that even the most compelling stories can falter when they collide with market realities. ARK's story resonated with investors because it tapped into the broader narrative of technological disruption, but when expectations became too high, and the market environment changed, the story was no longer enough to sustain the fund's performance.

The Danger of Over-Expectations

Beyond the risk of arriving late, there's another danger that can be equally damaging: having expectations that are too high. When expectations are not met, the disappointment can be severe, leading to poor decision-making and significant financial losses. This is particularly true in the world of trendy investments, where the hype can inflate expectations to unrealistic levels.

The Fintech Industry

The fintech industry offers a clear example of this. Wood's ARK Fintech Innovation ETF (ARKF) was a top performer in 2023, largely driven by the resurgence of interest in cryptocurrencies. However, by 2024, the ETF was flat, and its assets under management had plummeted from nearly US$5 billion to under US$1 billion. The fintech sector, once hailed as the next big thing, struggled to meet the high expectations set by its previous success. Investors who expected continued outsized returns were left disappointed, illustrating the danger of letting past performance dictate future expectations.

Renewable energy

Over-expectation is not just limited to ETFs; it can affect entire sectors or asset classes. For example, the renewable energy sector experienced a surge in investor interest in the early 2020s, fueled by growing awareness of climate change and the transition to a low-carbon economy. Companies involved in solar power, wind energy, and electric vehicles saw their stock prices skyrocket as investors piled in, hoping to capitalize on the "green revolution." However, as with any rapidly growing sector, the initial exuberance led to inflated valuations and unrealistic expectations for future growth.

When the sector experienced a slowdown in 2023, many investors were caught off guard. The stocks that had once been darlings of the market saw their prices plummet as earnings failed to meet sky-high expectations. Investors who had bought in at the peak were left nursing significant losses, a stark reminder of the dangers of over-expectation.

The disappointment that follows unmet expectations can lead to a vicious cycle of poor decision-making. Investors who suffer losses may become reluctant to sell their holdings, hoping that the market will eventually "come around" and validate their initial thesis. This behavior, driven by the disposition effect, can result in prolonged periods of underperformance and missed opportunities elsewhere in the market.

Cognitive Biases: The Invisible Hand Guiding Your Poor Decisions

Several cognitive biases play a significant role in why investors continue to chase trends and hold onto unrealistic expectations. Understanding these biases can help investors make more rational decisions and avoid the pitfalls of trend-chasing.

FOMO (Fear of Missing Out): This bias drives investors to join in on a trend simply because others are doing it. The fear of being left behind can cloud judgment, leading to impulsive decisions that often result in buying high and selling low. The FOMO effect was particularly evident during the GameStop saga in early 2021, where retail investors, fueled by social media hype, drove the stock price to astronomical levels. Many latecomers to the trade were left with significant losses as the stock eventually crashed back to earth.

Disposition Effect: This bias causes investors to sell their winners too early and hold onto their losers for too long. When combined with the narrative of a compelling story, it can lead to poor investment outcomes as investors cling to underperforming assets, hoping for a turnaround. The disposition effect can be particularly damaging in volatile markets, where the temptation to lock in gains quickly can result in missing out on further upside, while holding onto losers can exacerbate losses.

Base Rate Neglect: Investors often ignore the statistical base rate of success in favor of anecdotal evidence. For example, hearing about a single success story in a particular ETF might lead an investor to ignore the broader trend of underperformance in that sector. Base rate neglect is a common pitfall in the world of venture capital, where stories of "unicorns" like Facebook or Uber dominate the headlines, while the vast majority of startups fail to achieve meaningful returns.

Loss Aversion: Investors tend to feel the pain of losses more acutely than the pleasure of gains. This can lead to a reluctance to sell underperforming assets, exacerbating the financial impact of bad decisions. Loss aversion is closely linked to the endowment effect, where investors overvalue assets they already own, leading them to hold onto losing investments longer than they should.

Confirmation Bias: This bias leads investors to seek out information that confirms their existing beliefs while ignoring evidence that contradicts them. Confirmation bias can be particularly insidious in the context of trend-following, where investors may only pay attention to positive news about a particular sector or ETF while disregarding warning signs. This selective attention can reinforce unrealistic expectations and lead to poor investment outcomes.

The ETF Industry: Feeding the Narrative

The ETF industry is highly adept at capitalizing on these biases. Wall Street is a master at giving investors what they ask for, regardless of whether it's in their best interest. The proliferation of niche ETFs targeting specific trends is often more about marketing than it is about providing sound investment opportunities. The industry's focus on launching new products that capitalize on recent trends ensures that these ETFs are often overpriced, highly volatile, and prone to underperformance.

In the competition for investor attention, ETFs with catchy themes and compelling narratives often outshine more traditional, broad-based funds, despite offering poorer long-term returns. The industry's ability to package and sell these narratives plays directly into the cognitive biases that drive poor investment decisions.

For example, the rise of thematic ETFs has been a notable trend over the past decade. These ETFs target specific sectors or investment themes, such as artificial intelligence, cybersecurity, or cannabis. While the themes themselves may have long-term growth potential, the timing of the ETF launches often coincides with peak investor enthusiasm, leading to suboptimal entry points.

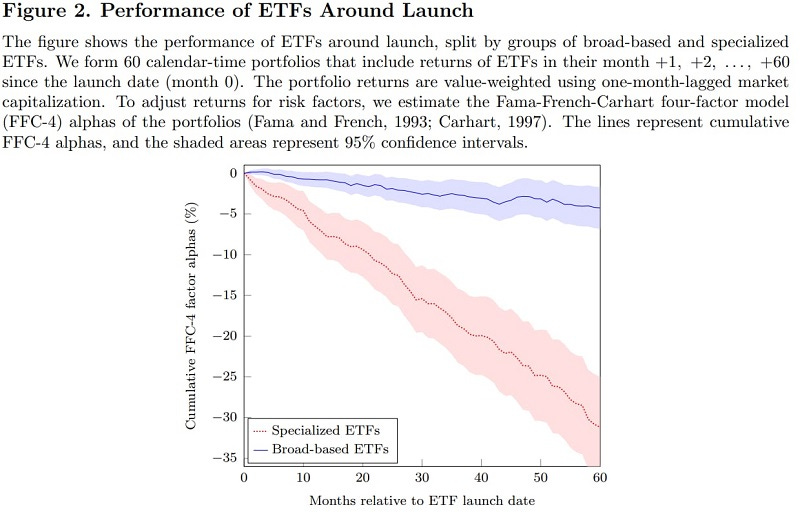

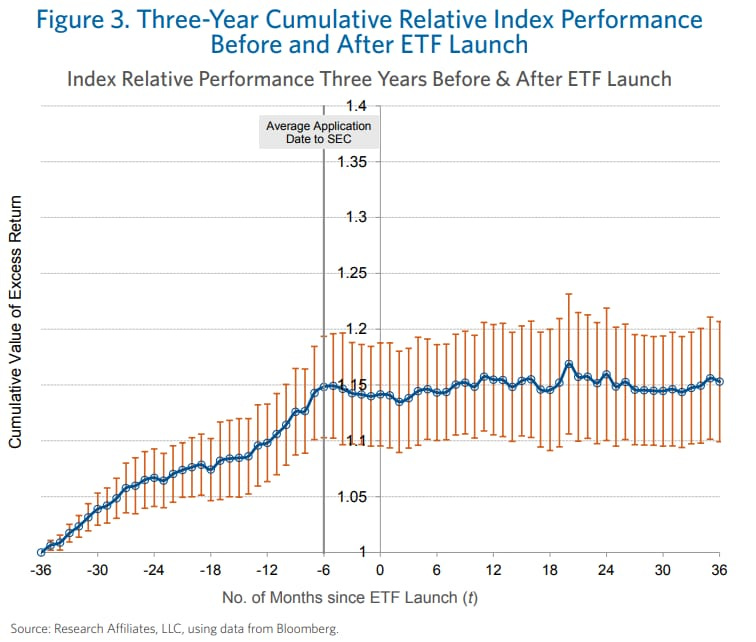

A study by Research Affiliates demonstrates how the returns of an index often decline after the launch of an ETF that tracks it. This pattern suggests that ETF issuers are more focused on capturing investor dollars than on providing sustainable investment opportunities. The study's findings are consistent with the observation that ETFs are often launched to capitalize on past performance, rather than future potential.

Moreover, the marketing tactics used by ETF issuers can exacerbate cognitive biases. By emphasizing the potential upside and downplaying the risks, issuers create a narrative that appeals to investors' desire for quick gains. The use of back-tested data, which shows how an ETF would have performed in the past, is a common tactic that can give investors a false sense of security. However, as the saying goes, "past performance is not indicative of future results," and investors who rely too heavily on these projections may find themselves disappointed.

Conclusion: Investing with Caution and Realism

Investing should be a rational, data-driven process, but all too often, it’s driven by emotion and narrative. The allure of a good story, the fear of missing out, and the desire for quick gains can lead even the most prudent investors into making poor decisions. Understanding the risks of arriving late to a trend and tempering expectations are critical to avoiding the pitfalls of trend-chasing.

Investors need to be aware of the cognitive biases that influence their decisions and approach trendy investments with a healthy dose of skepticism. The best opportunities often come when everyone else has moved on, not when a trend is making headlines. By focusing on solid fundamentals and long-term strategies, investors can avoid the disappointments that come with chasing trends and unrealistic expectations.

In the end, the key to successful investing lies in maintaining a balanced perspective. While it's natural to be drawn to the excitement of a new trend, it's essential to evaluate the risks and rewards objectively. By doing so, investors can make more informed decisions that align with their financial goals and avoid the pitfalls of being late to the party with overly high expectations.

Download this post 👇

Got a burning question or a topic you're curious about? I'd love to hear from you! Please drop a comment 💬 below or shoot me an email 📧 at grahamqualityinvestor@gmail.com