Electromed: An Expensive High-Quality Microcap

ELMD is a high-quality microcap company with strong gross margins, improving profitability, and a unique position in the growing respiratory care market.

Investment Thesis

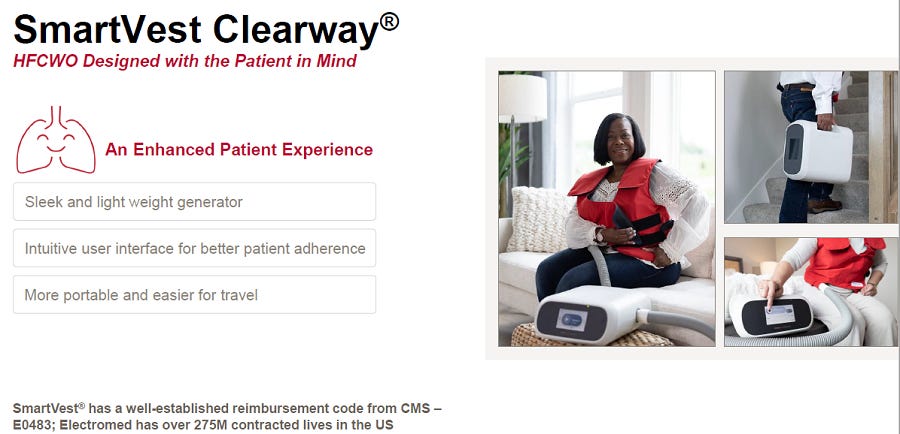

ELMD represents an intriguing opportunity in the niche medical devices market, offering a high-quality product in the form of its SmartVest® Airway Clearance System. The company’s focus on treating chronic respiratory conditions positions it within an expanding market supported by favorable demographic trends and growing awareness of respiratory health. However, despite its strong market fundamentals and operational efficiency, the current valuation significantly overprices its intrinsic value, limiting the attractiveness of an investment at this time.

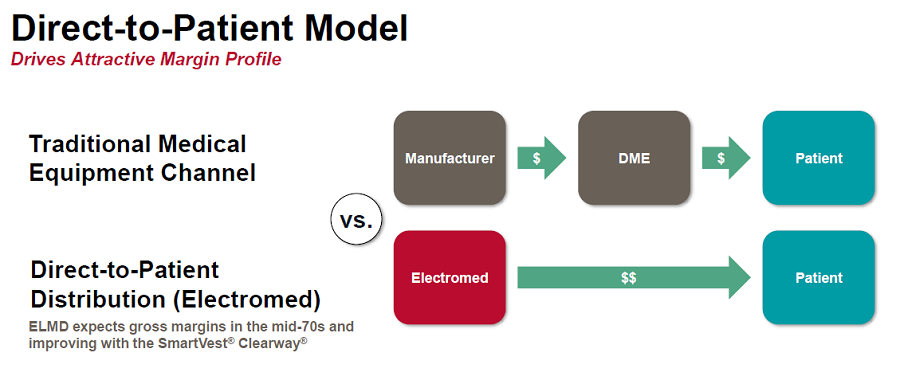

The company benefits from a direct-to-patient (DTP) business model, which creates a streamlined sales process and high gross margins while fostering strong customer relationships. This approach, combined with Medicare and private insurance reimbursements, underpins a recurring revenue model that contributes to financial stability. Furthermore, its targeted market of bronchiectasis remains underpenetrated, with ~15% of diagnosed patients currently using airway clearance devices. This highlights a substantial growth runway, especially as diagnostic rates improve and awareness increases.

Also, it has demonstrated operational excellence, achieving consistent improvements in profitability and capital efficiency. Over the past 5y, operating margins have nearly doubled, and returns on invested capital have significantly improved, reflecting prudent capital allocation and scaling efficiencies. Electromed’s clean balance sheet, with no debt and growing FCF, further underscores its financial health and resilience.

Nevertheless, a closer examination reveals limitations in the strength of the company’s competitive positioning. While the company benefits from barriers to entry and high switching costs, its moats are not impervious. High-Frequency Chest Wall Oscillation (HFCWO) vests, including the SmartVest, are viewed as part of a broader therapeutic strategy rather than a standalone solution, reducing customer dependence on specific brands. Additionally, competition from larger players, such as Baxter International, and the potential for commoditization in the airway clearance device market could erode Electromed’s pricing power and market share over time.

Valuation remains a critical concern. Based on multiple valuation methods, the company’s fair value is estimated at approximately $16/share, significantly below the current stock price of $31.05. This overvaluation suggests limited margin of safety, making the stock less appealing under a value investing framework.

In summary, ELMD offers a compelling story of growth, profitability, and market opportunity within a niche segment of the medical devices industry. However, the mismatch between its intrinsic value and current valuation, coupled with potential risks from competition and limited differentiation, tempers the investment case. While the company warrants monitoring for future opportunities, the current price presents more downside risk than upside potential.

Company Overview

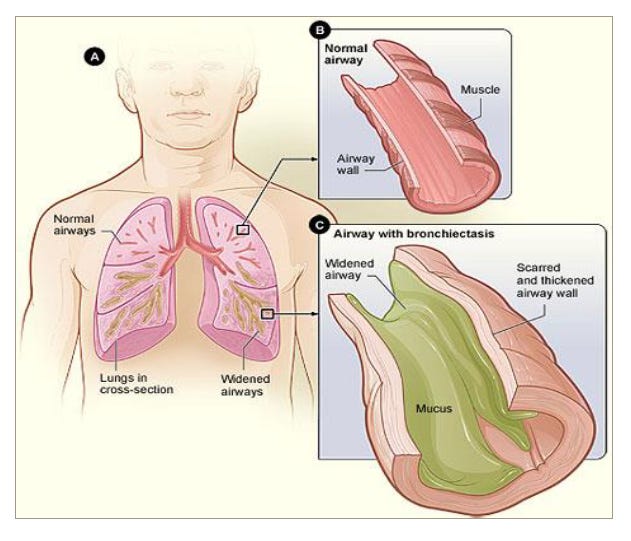

ELMD is a U.S.-based micro-cap medical device company that designs, manufactures, and markets the SmartVest® Airway Clearance System, a device used to help patients with chronic respiratory conditions manage their symptoms by loosening and clearing mucus from the lungs. The company focuses on treating bronchiectasis, cystic fibrosis, and neuromuscular disorders, conditions that require ongoing therapy to prevent infections and hospitalizations.

Founded in 1992 and headquartered in New Prague, Minnesota, the company operates primarily in the homecare market, selling directly to patients through a direct-to-patient (DTP) business model. Electromed manages the entire process from physician prescription to patient education and insurance reimbursement support. This vertical integration allows the company to achieve high gross margins and build a predictable recurring revenue stream from the sale of replacement parts and accessories.

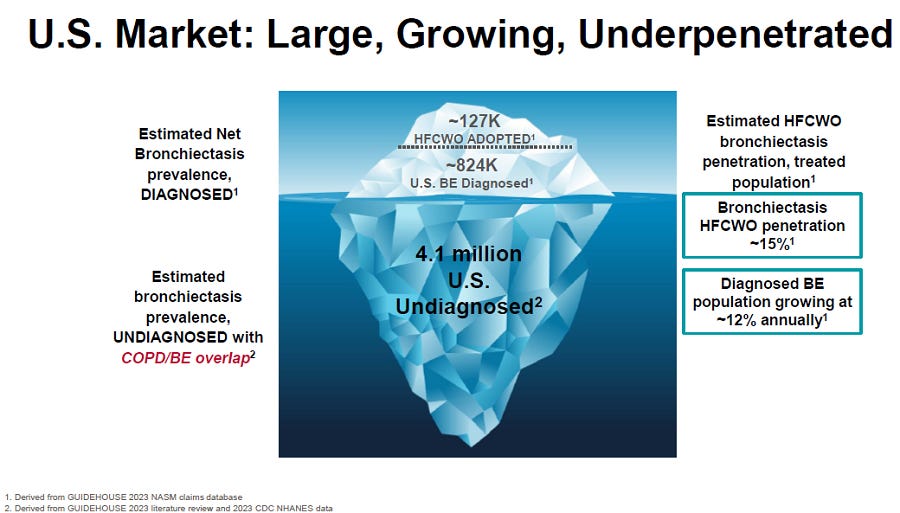

Electromed’s revenue is heavily insurance-backed, with Medicare, Medicaid, and private insurers covering a significant portion of its product sales. The company’s core market is bronchiectasis, a growing and underdiagnosed condition in the U.S., creating a large runway for growth. Diagnostic rates are improving at ~12% annually, but only ~15% of diagnosed patients currently use airway clearance devices, highlighting a significant market opportunity.

What is HFCWO Therapy?

HFCWO therapy is a non-invasive treatment designed to help clear mucus from the lungs of patients with respiratory conditions such as cystic fibrosis, Chronic obstructive pulmonary disease (COPD), bronchiectasis, and neuromuscular disorders

It involves the use of a vest connected to an air-pulse generator that creates vibrations across the chest wall, loosening mucus and making it easier to expel. Sessions typically last 20–30 minutes and can be performed at home, offering convenience and consistency.

Some of the benefits of using vests:

Improves lung function by clearing mucus obstructions.

Reduces the risk of respiratory infections and hospitalizations.

Enhances breathing efficiency and quality of life.

Provides a standardized therapy compared to manual techniques.

However, there are some disadvantages for the patients as well:

Discomfort or inconvenience may lead to inconsistent use.

Excessive use can cause fatigue or mechanical stress on the chest wall.

Devices are expensive, potentially limiting access for some patients.

Studies show mixed results in terms of superiority over manual chest physiotherapy.

Side effects like skin irritation or increased coughing may occur.

Not suitable for patients with severe osteoporosis, rib fractures, or certain cardiac conditions.

Over-reliance on devices may neglect other aspects of respiratory care.

Variability in treatment protocols can lead to suboptimal outcomes.

In fact, I researched several comments on specialized forums from patients with these types of diseases to learn more about their opinions on the use of vests: and what I discovered was that indeed, these vests help certain patients, but that they should be considered as a tool within a broader strategy of clearing the airways, rather than being the ONLY solution to these respiratory problems.[1]

Industry

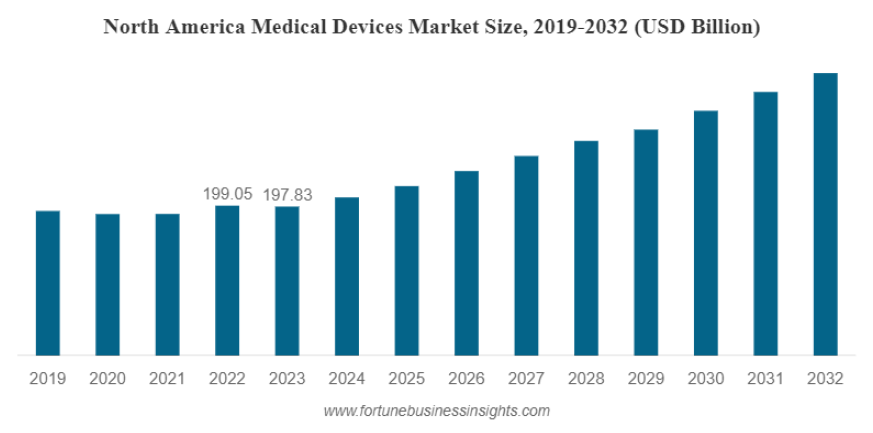

Electromed operates in the medical devices industry, specifically within the respiratory care devices segment. This sector addresses chronic respiratory conditions such as the previously mentioned bronchiectasis, COPD, and asthma, which require long-term, often home-based airway clearance solutions. The respiratory care market is projected to grow at a CAGR of approximately 9.8% from 2024 to 2031, driven by the rising prevalence of respiratory diseases, aging populations, and increasing patient preference for home healthcare solutions.[2]

The broader medical devices industry is undergoing rapid transformation with advances in connected healthcare technologies and regulatory frameworks. In the U.S., the home medical equipment (HME) market is a key driver, supported by reimbursement policies from Medicare and private insurers. However, regulatory pressures and pricing dynamics from group purchasing organizations pose challenges.

The shift towards cost-effective, home-based therapies reflects broader trends in healthcare cost containment and patient-centered care. As healthcare providers increasingly focus on reducing hospital admissions and managing chronic conditions outside of acute care settings, companies like Electromed are well-positioned to benefit from this transition.

Moats

Electromed, Inc. possesses certain competitive advantages in the HFCWO market, primarily through its SmartVest® Airway Clearance System. However, a closer analysis reveals that these advantages, while meaningful, may not be as unassailable as they initially appear. The company's competitive positioning is shaped by its focus on high switching costs and barriers to entry, but these moats are not without vulnerabilities.

High switching costs form a core component of Electromed’s strategy. The company’s direct-to-patient model, coupled with personalized training and strong insurance reimbursement support, creates a streamlined process that fosters customer loyalty. Additionally, the lifetime warranty on its products provides long-term value, incentivizing patients to remain within the Electromed ecosystem. Yet, real-world patient feedback suggests that HFCWO vests, while helpful, are typically viewed as one tool within a broader airway clearance strategy rather than a standalone solution. This dilutes the perceived necessity of brand-specific features and support, weakening the durability of these switching costs. Patients and clinicians may prioritize results over brand loyalty, making the perceived moat less robust in practice.

Barriers to entry are another key advantage for Electromed. The medical device industry is highly regulated, and the company has already navigated the complex pathways to secure FDA clearance and establish reimbursement codes for the SmartVest. Additionally, its extensive patent portfolio and proprietary features, such as the single-hose design and intuitive touchscreens, offer protection against direct replication by competitors. However, these barriers are not insurmountable. Larger competitors, such as Baxter International, have the resources, regulatory expertise, and economies of scale to challenge Electromed’s position if they decide to aggressively target the HFCWO market. Furthermore, the commoditization risk—where patients and clinicians focus on cost and availability rather than brand differentiation—reduces the long-term effectiveness of these barriers.

Ultimately, the company’s moats are tangible but may be narrower than they initially appear. While Electromed’s direct engagement with patients and proprietary technology give it a solid foothold in its niche, the broader context of airway clearance therapy—as part of a multi-modal treatment strategy—limits the extent to which any single brand can dominate the market. To maintain its position, Electromed must continually innovate and address the shifting dynamics of patient and provider preferences. Without sustained differentiation, its competitive advantages risk erosion over time, particularly as larger players and alternative therapies gain traction.

Financials

In the last 5y, you can see a consistent upward trend in Days Sales Outstanding (DSO) and Cash Conversion Cycle (CCC). In the first case, I believe that the slower collections from customers it's because of they take a long time to pay them or extend payment terms to generate more sales (Remember that it is not the end customer who is going to buy these vests directly, but rather they do so through their insurers, and these, in turn, take a long time to pay). In the second case (CCC), the inventory is accumulating.

Let’s talk about inventory. Electromed's inventory management shows signs of inventory build-up in finished goods, which has contributed to the upward trend in the CCC. This indicates that sales are not keeping pace with production, slower sales conversion rates and potential risks of inventory obsolescence.

In general, the company shows positive progress in inventory management and payables management, both of which contribute to better cash flow efficiency. However, the slight decline in receivables turnover warrants monitoring, as slower collections could strain working capital if it persists.

One of management's long-term objectives is to increase Electromed's market share. To do so, they have been investing heavily in expanding their sales force and in marketing to increase brand awareness. This is reflected in the growth of SG&A expenses over the last 5 years. Taking into account the Revenue/SG&A ratio, in FY 2024 we have a result of 1.59, which indicates that for every $1 that Electromed invests, it generates $1.59 in revenue. I think this is an adequate ratio for a microcap in the growth phase.

Strong balance sheet (net cash)

Quality Ratios

Is ELMD a quality company? Yes, it is.

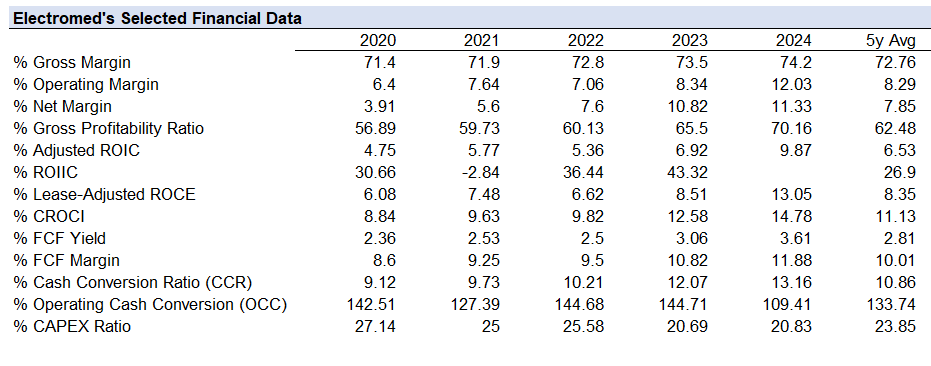

Company’s financial quality ratios over the past 5y reveal a business that is steadily improving its profitability, cash flow generation, and returns on capital, reflecting a company that is successfully transitioning from a growth-focused phase to a more mature, cash-generative business.

Gross margin has consistently increased from 71.4% in 2020 to 74.2% in 2024, indicating strong pricing power and efficient cost management despite rising operating expenses related to salesforce expansion.

More importantly, operating margins have nearly doubled over this period, from 6.4% to 12.03%, driven by a combination of revenue growth and operating leverage. This improvement highlights management’s ability to control fixed costs as sales scale, a critical factor in long-term margin expansion for a company of Electromed’s size.

Similarly, net margins have expanded significantly from 3.91% in 2020 to 11.33% in 2024, a direct result of the company’s ability to convert top-line growth into bottom-line profitability without sacrificing long-term investments.

Returns on capital metrics further reinforce the quality of ELMD’s financial performance:

Adjusted ROIC improved from 4.75% in 2020 to 9.87% in 2024, signaling that the company is allocating capital more efficiently and generating better returns on incremental investments (ROIIC). This is especially notable given that Electromed operates in a niche medical devices market where scaling requires heavy upfront investments in sales and marketing. The upward trend in ROIC suggests that the company is achieving better returns on its expanding capital base and that its recent investments in direct-to-patient sales and marketing are paying off.

Additionally, the Lease-Adjusted ROCE increased from 6.08% to 13.05%, further indicating that the business is becoming more capital-efficient as it scales.

This improvement in returns is complemented by a rising Cash Return On Capital Invested (CROCI), which reached 14.78% in 2024, underscoring Electromed’s ability to translate its accounting earnings into actual cash flows, a critical component of earnings quality.

FCF metrics paint a picture of a company that is becoming increasingly cash generative:

FCF yield grew from 2.36% in 2020 to 3.61% in 2024, while its FCF margin rose from 8.6% to 11.88%. This improvement highlights Electromed’s ability to generate meaningful FCF, which is essential for a microcap company that must fund its own growth internally without significant reliance on external capital markets. Importantly, the improving FCF profile suggests that the company has reached a point of financial flexibility where it can reinvest in the business, reduce debt, or return capital to shareholders without jeopardizing growth.

Electromed’s cash conversion metrics, including the Cash Conversion Ratio (CCR) and Operating Cash Conversion (OCC), also point to high earnings quality:

CCR increased steadily from 9.12% in 2020 to 13.16% in 2024, indicating that the company is converting more of its net income into cash flow from operations, which reduces the risk of earnings manipulation or aggressive accounting practices.

OCC remains above 100%, signaling that Electromed’s operating cash flow consistently exceeds its reported EBIT, further reinforcing the credibility of its earnings. This high cash conversion rate is a key indicator of a high-quality business with sustainable cash flow generation.

Finally, the CAPEX ratio decreased from 27.14% in 2020 to 20.83% in 2024, indicating that the company is becoming less capital-intensive while continuing to grow. This improvement in capital efficiency suggests that the company’s growth is now being driven more by operational leverage than by heavy capital expenditures.

Taken together, these quality ratios suggest that Electromed is maturing into a business that can generate consistent FCF and achieve strong returns on capital, positioning it well for long-term shareholder value creation. For a microcap company in a niche market, the improvements in both profitability and capital efficiency are indicative of a business that is becoming more durable and scalable, capable of compounding shareholder value over time without significant reinvestment risk. The combination of margin expansion, cash flow growth, and improving returns on capital highlights a high-quality business that, while still in its growth phase, is showing the early signs of transitioning into a mature, cash-generative company.

Growth

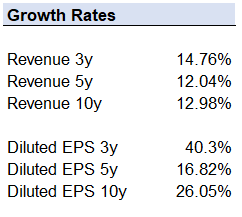

Electromed has demonstrated strong and consistent growth across both revenue and EPS over the past 3, 5, and 10 years, reflecting its ability to scale operations effectively while improving profitability:

Revenue has grown at a CAGR of 14.76% over the past 3y, driven by investments in its direct salesforce and marketing efforts to expand market share within the airway clearance therapy space.

More notably, diluted EPS has grown at an even faster rate, with a 3-year CAGR of 40.3%, highlighting significant margin expansion, operating leverage, and disciplined cost management. The faster growth in EPS relative to revenue indicates that the company is becoming increasingly efficient as it scales, benefiting from improved fixed-cost absorption and potential reductions in share dilution.

Management & Compensation

The numbers clearly indicate that the management team is performing well:

With 14% insider ownership, management has significant "skin in the game."

They avoid raising debt or issuing additional shares to fund operations, as the company generates substantial cash flow.

While there is some common stock issuance due to stock option compensation, management offsets this shareholder dilution by executing share repurchases, effectively neutralizing dilution risks.

Management’s Compensation

The proxy states that management is compensated based on long-term value creation. However, I disagree. The compensation structure is currently heavily tied to short-term performance metrics, particularly revenue growth and EBIT targets. Incentivizing management solely based on top-line performance can encourage short-term decision-making, such as pursuing low-margin sales or implementing aggressive promotions to meet targets.

For instance, in fiscal year 2024, management’s cash incentives were tied to the following metrics:

Revenue Growth: A minimum of 9% (target of 15%).

EBIT Growth: A minimum of 10% (target of 35%).

Meeting these short-term objectives allowed the CEO and CFO to earn their performance-based compensation.

One interesting metric for evaluating management’s compensation—though not a commonly used one in the industry—is the ratio of total compensation to net income. A good benchmark is for management compensation to remain below 10% of reported net income. However, Electromed’s management compensation was 69% of net income in FY24 ($3,555,510/$5,150,000). This means only $1.59 million was left for reinvestment into the company.

Is this a good or bad thing? It’s hard to say. On one hand, management has been effective in driving growth and making sound capital allocation decisions. Given that they are meeting their short-term performance goals, perhaps their compensation is justifiable.

Final Thoughts

Considering that Electromed is a microcap company in a niche medical devices market, its focus on revenue growth is both understandable and reasonable at its current stage. For a small company, scaling top-line revenue is critical to gaining market penetration and achieving operating leverage.

Valuation

As we saw before, ELMD is a high-quality microcap with industry tailwinds, no debt, and the ability to generate cash with high returns on capital. However, despite these strengths, my analysis shows that the current stock price of $31.05 (as of 01/14/2025) significantly exceeds its fair value, making the company overvalued.

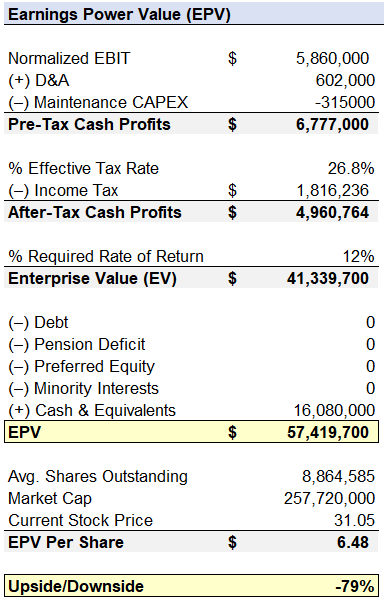

I applied different valuation methods, including Earnings Power Value (EPV), Buffett’s Owner Earnings, Comparable Analysis, and a DCF analysis, and the conclusions were the same: the market is pricing in aggressive growth assumptions for the company.

EPV

ELMD's EVP/share is $6.48. That's a 79% downside from the current market cap of the company. The market is too optimistic about Electromed's growth expectations.

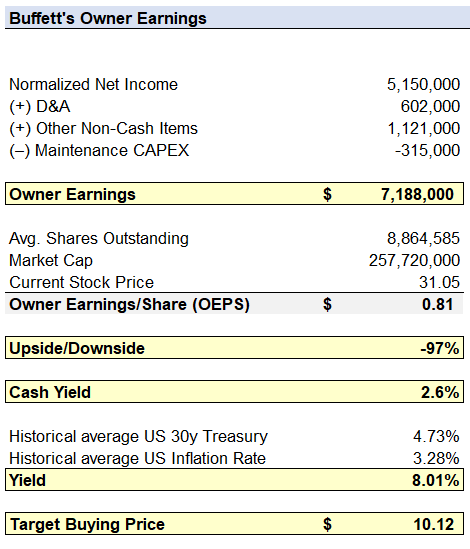

Owner Earnings

I estimate Electromed’s Owner Earnings at $0.81 per share, which represents a 97% downside when compared to the current stock price of $31.05. With a required yield of at least 8% when evaluating investments, the company would only be attractive at a price around $10.12 per share, reflecting its intrinsic value based on sustainable cash-generating ability.

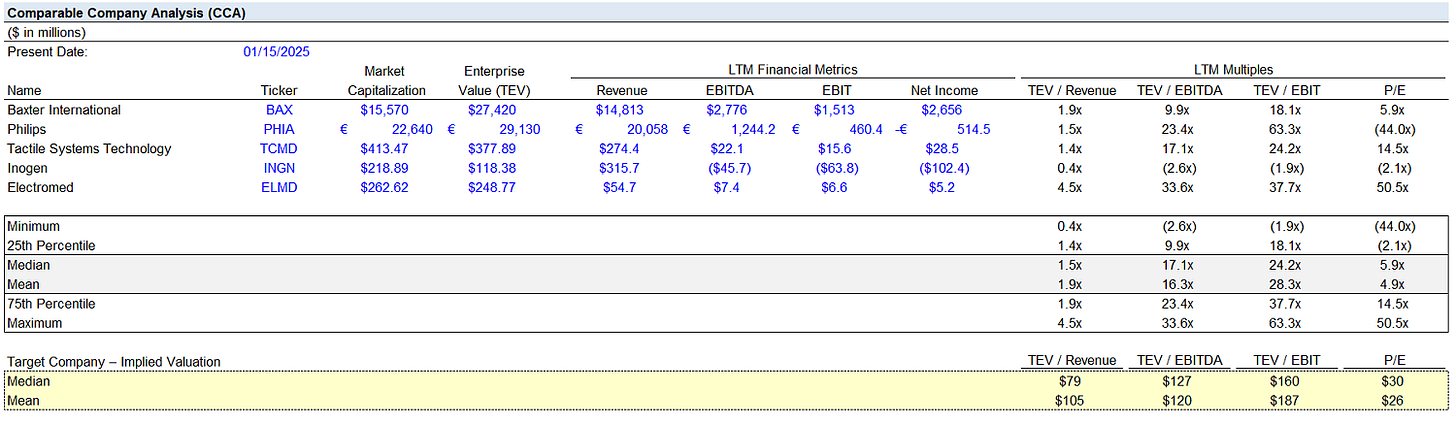

Comparables

CCA reinforces the view that ELMD is significantly overvalued relative to its peers. Across all valuation metrics, the company's multiples are materially higher than the median and mean of its peer group, suggesting that the current stock price reflects overly optimistic growth assumptions.

The company trades at a TEV/Revenue multiple of 4.5x, compared to a median of 1.5x, and its TEV/EBITDA multiple of 33.6x far exceeds the median of 17.1x. Additionally, its P/E ratio of 50.5x is dramatically higher than the peer median of 5.9x. These elevated multiples highlight the market's reliance on aggressive growth expectations, which may not be sustainable given the company's size and market dynamics.

Using the median multiples for valuation, Electromed's implied enterprise value (TEV) ranges between $79 million (TEV/Revenue) and $160 million (TEV/EBIT), significantly below its current TEV of $248.77 million. This translates to a substantial downside of 55-68% when compared to its current valuation, indicating that the stock is trading at a steep premium to its intrinsic value relative to peers.

DCF

Using Electromed's Owner Earnings as the basis, I did a DCF with a 12% discount rate (consistent with the EPV analysis), a 2.75% terminal growth rate (aligned with the current inflation rate), and a 12% growth rate for the next 5y. The analysis estimates Electromed’s intrinsic value at $14.42/ share, highlighting that the stock remains significantly overvalued.

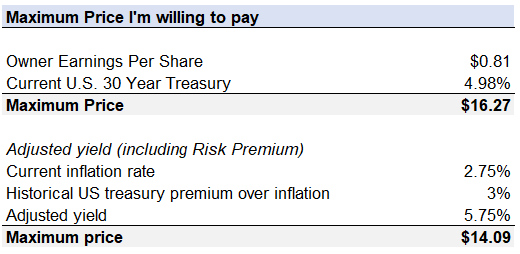

How much I’m willing to pay for Electromed?

Based on the different valuation methods, I’m willing to pay maximum price of $16.27/share.

Risks

The company faces several risks that could impact its growth trajectory and financial performance:

1. Product Concentration

Electromed’s revenue is heavily reliant on a single product, the SmartVest® Airway Clearance System. Any technological advancements, product recalls, or substitute therapies could significantly impact its business.

2. Reimbursement Dependency

A large portion of sales is funded by insurance reimbursements from Medicare, Medicaid, and private insurers. Policy changes or increased scrutiny could disrupt revenue predictability.

3. Competition

Electromed competes in a niche medical device market, with Hillrom (Baxter) as the dominant player. Larger competitors may introduce new products or engage in pricing competition to protect market share. Also, slower-than-expected sales growth due to entrenched competition.

4. Geographic Concentration

Revenue is almost entirely derived from the U.S. market, exposing the company to domestic regulatory and reimbursement risks.

5. Sales Force Execution

The company growth strategy depends on expanding its sales force to drive physician referrals and increase market penetration. Execution risks include turnover, rising customer acquisition costs and failure to convert physician outreach into patient prescriptions.

Catalysts

1. Market Penetration in Bronchiectasis

The underpenetrated bronchiectasis market presents a significant growth opportunity. With only ~15% of diagnosed patients using HFCWO devices, ongoing sales force expansion and physician outreach should drive higher adoption rates.

2. Product Innovation

The launch of SmartVest Clearway®, featuring lighter design and improved usability, could enhance patient adherence and support new sales. Continued R&D investment will be essential for maintaining pricing power and market share.

3. Reimbursement Stability

Continued insurance coverage by Medicare, Medicaid, and private insurers is crucial. Any policy changes that broaden eligibility criteria for HFCWO devices would further expand the addressable market.

4. Post-COVID Respiratory Awareness

The COVID-19 pandemic increased focus on respiratory health. Patients with post-COVID complications may require ongoing airway clearance therapy, creating a new patient segment for Electromed.

5. M&A

Electromed’s clean balance sheet and predictable cash flow make it an attractive acquisition target for larger medical device companies. Alternatively, Electromed could pursue strategic acquisitions to accelerate growth.

Things I don’t like

Related Party Transactions

Electromed has an ongoing relationship with a supplier founded by a former director who is a beneficial owner of more than 5% of the company’s shares. Payments to this supplier increased from $1.86 million in FY 2023 to $2.05 million in FY 2024, with outstanding balances owed of $18,000 and $247,000 as of FY 2024 and FY 2023, respectively.

While the Audit Committee reviews and approves such transactions to ensure they are conducted on market terms, this arrangement poses potential conflicts of interest, particularly given the supplier's ties to a major shareholder.

Accounting shenanigans

While Electromed’s financial statements do not indicate any fraudulent activity, certain aggressive accounting practices raise concerns about the quality and sustainability of its reported earnings. Some of these practices have already been mentioned in the financials section.

Revenue Recognition Policies

Installment Sales: Revenue is recognized upon shipment or delivery, even when payments are deferred over several months. This could artificially inflate short-term revenue, particularly if collections are delayed or therapy compliance is low.

Variable Consideration Estimates: Revenue relies on historical reimbursement rates from third-party payers, which introduces subjectivity. This poses a medium risk of revenue reversals if actual collections fall short of expectations.

Accounts Receivable Growth

Over the past few years, accounts receivable has grown faster than revenue, raising concerns about potential collection issues or premature revenue recognition. If this trend continues, it could lead to write-offs or earnings revisions, negatively impacting earnings quality.

Inventory Build-Up

Significant increases in finished goods inventory without corresponding sales growth suggest the risk of overproduction or slow-moving products. This could result in future inventory write-downs, impacting profitability. Enhanced inventory reserves are recommended to account for potential obsolescence.

Conclusion

ELMD is a high-quality microcap company with strong gross margins, improving profitability, and a unique position in the growing respiratory care market. Its focus on the underpenetrated bronchiectasis segment and direct-to-patient business model provides significant growth potential. However, despite these strengths, the current stock price of $31.05 significantly exceeds the company’s intrinsic value, as calculated using multiple valuation methodologies. This overvaluation leaves little margin of safety for investors.

While the company’s financials highlight operational improvements and strong cash generation, risks such as reliance on a single product, reimbursement dependencies, and growing accounts receivable could impact its long-term performance. Additionally, aggressive growth assumptions appear baked into the current valuation, making the stock vulnerable to potential underperformance.

At its current price, Electromed does not present an attractive investment opportunity. Investors should monitor the stock for a more favorable entry point, ideally below $16.27 per share, where the valuation would align with its intrinsic value and offer a more compelling risk-reward profile. For now, patience is key when considering Electromed as an investment.

[1] Several users on these forums suggest trying more affordable and practical alternatives like a PEP device (Aerobika), saline nebulization, and postural drainage, before investing in a costly vest. https://www.inspire.com/groups/american-lung-association-lung-disease/discussion/mac-lung-and-bronchiectasis/ | https://connect.mayoclinic.org/discussion/hey-all-starting-smartvest-anyone-w-positive-experience/?pg=3 | https://www.reddit.com/r/CysticFibrosis/comments/bwbrvu/pros_and_cons_of_vest_vs_other_airway_clearance/ | https://www.reddit.com/r/CysticFibrosis/comments/17pbqc8/good_vest_brands/ | https://www.reddit.com/r/CysticFibrosis/comments/v7azcd/hfcwo_alternatives_for_pt/ | https://patient.info/forums/discuss/smart-vest--727839

[2] https://www.biospace.com/press-releases/respiratory-care-market-size-to-reach-usd-49-84-billion-by-2031

BTW

I’ve launched 6 ebooks to support this newsletter and align with the principles and objectives of WorldlyInvest. These ebooks serve as guides to learning and applying various value investing strategies.

As a special launch offer, you can get each ebook for just $10.99 USD.

By purchasing, you’ll not only gain valuable insights but also support this newsletter’s growth.

Got a burning question or a topic you're curious about? I'd love to hear from you! Please drop a comment 💬 below or shoot me an email 📧 at worldlyinvest@gmail.com