Global Insurance Outlook 2025

Explore the 2025 insurance outlook: growth trends, digital innovation, climate risks, and key opportunities in life, P&C, health, and auto insurance.

Executive Summary

The global insurance industry is poised for a period of significant transformation as it approaches 2025. This report highlights the key drivers shaping the sector, including demographic shifts, climate change, technological advancements, and evolving consumer behaviors. While challenges such as rising costs, regulatory pressures, and climate-related risks persist, the industry is demonstrating resilience and innovation, presenting opportunities for growth and long-term success.

Key insights:

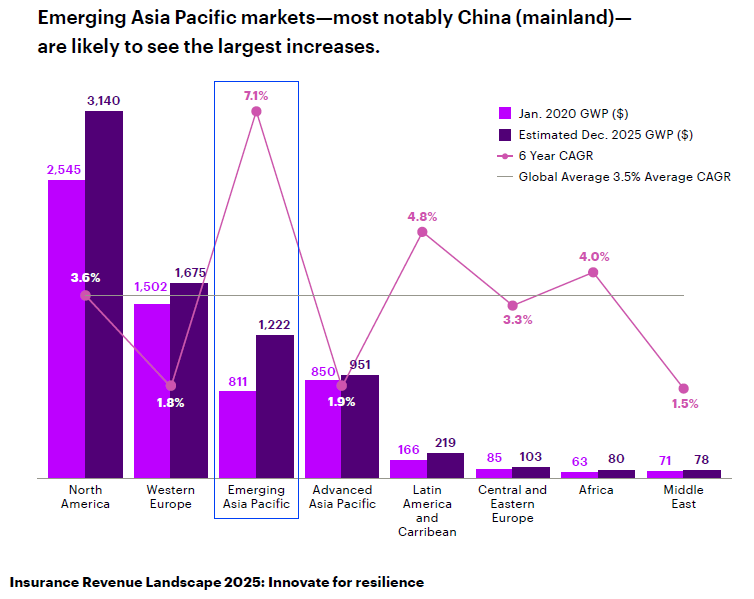

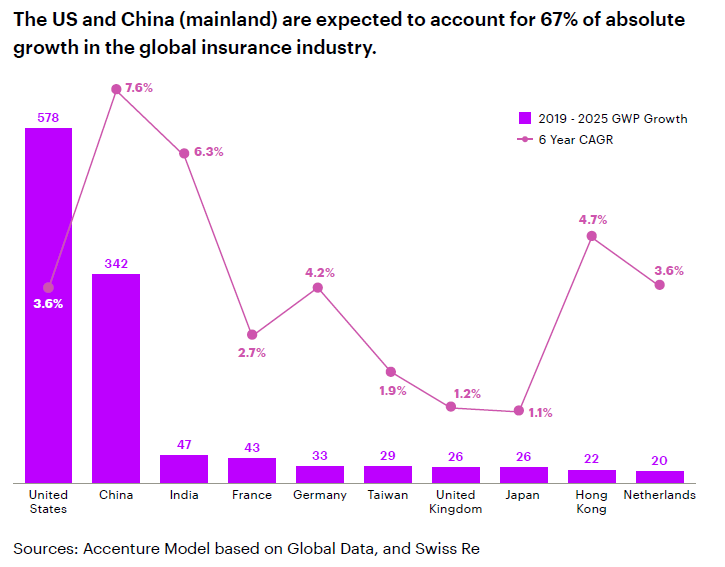

Market Growth: The industry is projected to grow from $6.1 trillion in gross written premium (GWP) in 2020 to US$7.5 trillion by the end of 2025, reflecting a compound annual growth rate (CAGR) of 3.5%. Emerging markets, particularly in Asia Pacific, are driving this growth, with China and India leading premium expansion.

Technological Transformation: Digital platforms, artificial intelligence, and telematics are revolutionizing the insurance landscape, enabling insurers to offer personalized, usage-based products while enhancing operational efficiency. However, the rise of cyber risks and technological dependencies presents new challenges.

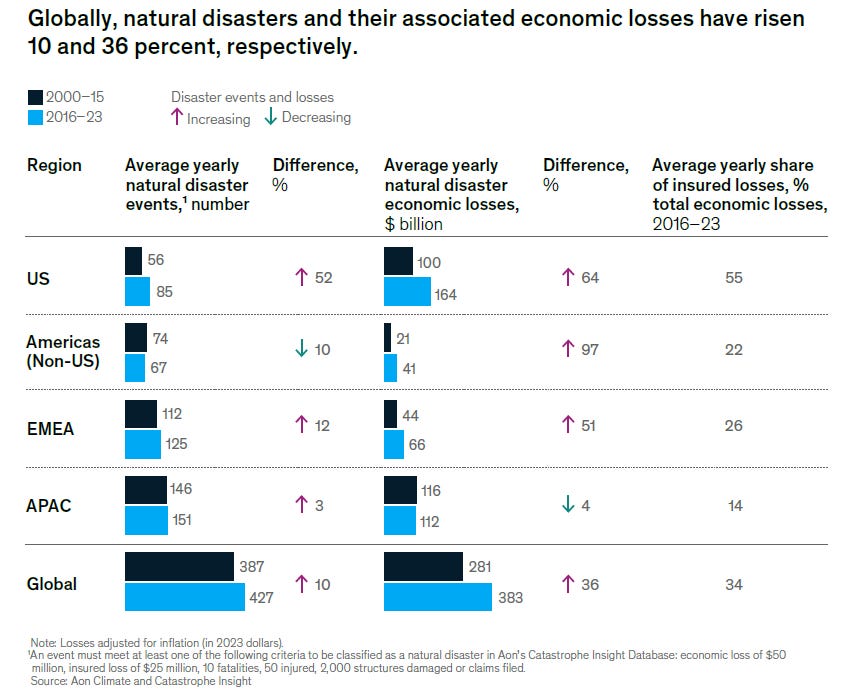

Climate and Sustainability: Climate change continues to increase the frequency and severity of natural disasters, leading to rising insured losses. Innovative solutions, such as parametric insurance, are becoming essential, while the global push for decarbonization creates opportunities in green insurance.

Demographic Trends: Aging populations in advanced economies are driving demand for retirement and long-term care products, while younger, tech-savvy generations favor flexible, digital-first insurance solutions. Emerging markets also present significant opportunities for growth, fueled by urbanization and rising incomes.

Health and Auto Insurance: The health insurance sector is expanding due to rising healthcare costs and demand for wellness-focused coverage. Meanwhile, auto insurance is undergoing a shift as electric vehicles, autonomous cars, and telematics reshape traditional risk profiles.

Regulatory and ESG Pressures: Insurers are adapting to stricter regulations and the growing emphasis on environmental, social, and governance (ESG) principles. These pressures require robust compliance measures but also offer opportunities to align operations with societal expectations.

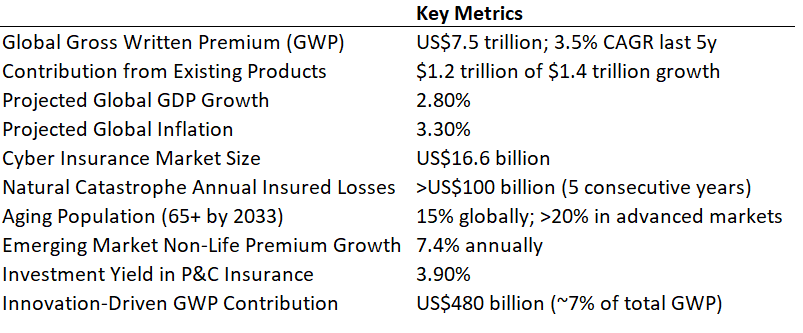

Key Data

As insurers seek answers about competing in a changed market, there are signs that the gloomy story of 2020 will brighten. The world is slowly emerging from the pandemic, and in the process, the insurance industry is proving its resilience. These metrics illuminate growth patterns, profitability trends, and emerging opportunities across different segments and regions.

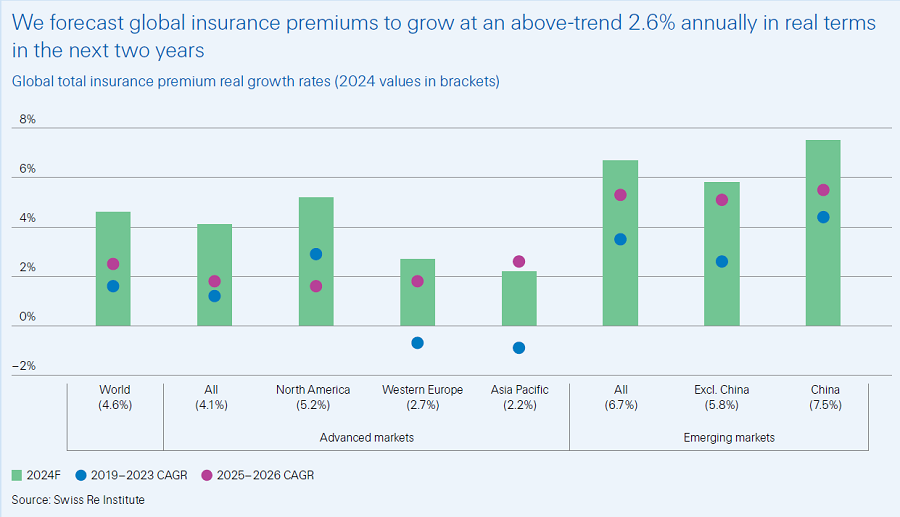

Global Premium Growth

The global insurance industry is forecasted to grow at an annual real rate of 2.6% in 2025–2026, above the historical five-year average of 1.6%. Life insurance premiums are set to lead this growth with a 3% real annual increase, driven by demand for savings and protection products. Non-life insurance is expected to grow more modestly at 2.3%, as rate moderation in advanced markets balances exposure-driven growth in emerging regions.

The insurance industry is expected to grow from US$6.1 trillion in GWP in 2020 to US$7.5 trillion by the end of 2025, representing a six-year CAGR of 3.5%. Emerging markets in Asia Pacific, most notably China, are driving this growth, reflecting the region’s outsized GDP performance and expanding insurance penetration. This US$1.4 trillion in projected growth aligns closely with global GDP forecasts and the rising demand for insurance driven by increasing asset ownership and usage.

Macroeconomic Indicators

Global GDP is projected to grow by 2.8% in 2025, accompanied by an average inflation rate of 3.3%, down from 5.1% in 2024. Central bank policies will remain cautious, with interest rates in advanced economies stabilizing at moderately elevated levels. These macroeconomic trends directly influence premium pricing, claims inflation, and investment returns.

Natural Catastrophe Losses

Insured losses from natural catastrophes are estimated to exceed US$100 billion annually for the fifth consecutive year. Climate-related risks are growing at an average real rate of 5–7% per year, driven by urbanization and wealth accumulation in hazard-prone areas.

Cyber Insurance

The cyber insurance market is projected to grow to US$16.6 billion by 2025, reflecting heightened demand for coverage against ransomware, data breaches, and systemic cyber risks. However, the protection gap remains significant, with more than 90% of cyber exposures currently uninsured.

Investment Returns

Higher reinvestment yields are bolstering profitability across the industry. In P&C insurance, investment yields are expected to rise from 3.6% in 2024 to 3.9% in 2025, driven by the replacement of pre-pandemic low-yielding assets. Life insurers also benefit from structurally higher bond yields, supporting both portfolio returns and product appeal.

Demographics and Aging Populations

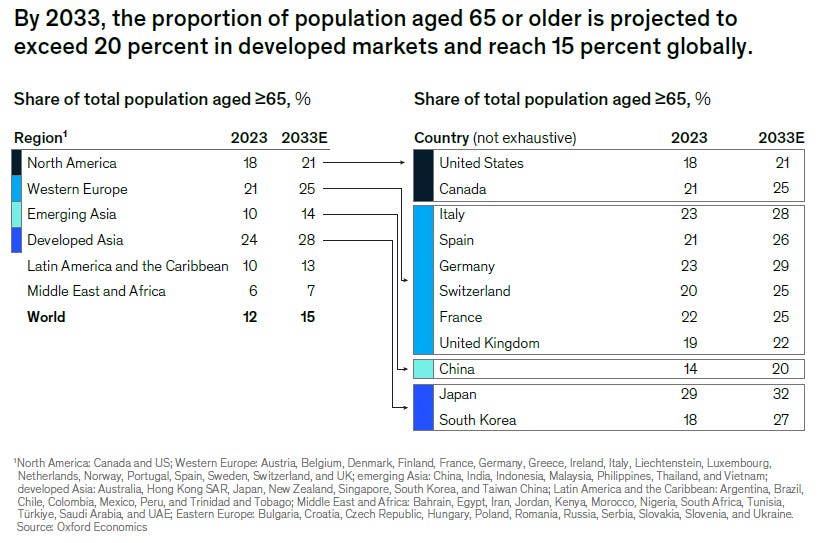

The share of the global population aged 65 or older will reach 15% by 2033, with advanced markets exceeding 20%. This demographic shift is driving demand for annuities, long-term care insurance, and other retirement-focused products. The aging population also presents challenges for underwriting and claims management, as healthcare costs and longevity risks rise.

Global Economic Context

The global economy in 2025 sets the stage for a mixed yet resilient outlook for the insurance industry. While growth remains steady, it is tempered by geopolitical uncertainties, inflationary pressures, and uneven regional performance. These factors are shaping the demand for insurance products and creating both challenges and opportunities for insurers worldwide.

Stable Growth Amid Divergences

Global GDP is expected to grow at a steady rate of approximately 2.8% in 2025, a pace consistent with recent years. However, this growth is marked by significant regional divergences. The United States continues to outperform other advanced economies, driven by resilient consumer spending and a robust labor market. In contrast, Europe grapples with structural challenges, slower disinflation, and geopolitical headwinds, while China faces the effects of trade tensions and a cooling property market.

For insurers, these dynamics mean varying growth prospects by region. In advanced markets, slower growth and modest inflation improvements may dampen demand for certain insurance products. Meanwhile, emerging markets, particularly in Asia and Latin America, present opportunities for expansion as economic growth fuels rising incomes and asset accumulation.

Inflation and Interest Rates: A Delicate Balance

Global inflation, while declining from its peak, remains a key factor influencing the insurance sector. Average global inflation is projected to decrease to 3.3% in 2025 from 5.1% in 2024, but the pace of disinflation varies significantly. In the U.S., fiscal policies and tighter labor markets could slow progress, while Europe and China are expected to see more substantial declines due to easing monetary policies.

Interest rate movements further complicate the landscape. Central banks in advanced economies are expected to lower rates cautiously, with the U.S. Federal Reserve likely to cut rates gradually while maintaining a restrictive stance to guard against inflationary risks. For insurers, this presents both opportunities and challenges. Higher interest rates have improved investment yields, particularly in fixed-income portfolios, yet rising claims costs and prolonged inflationary pressures could erode underwriting margins.

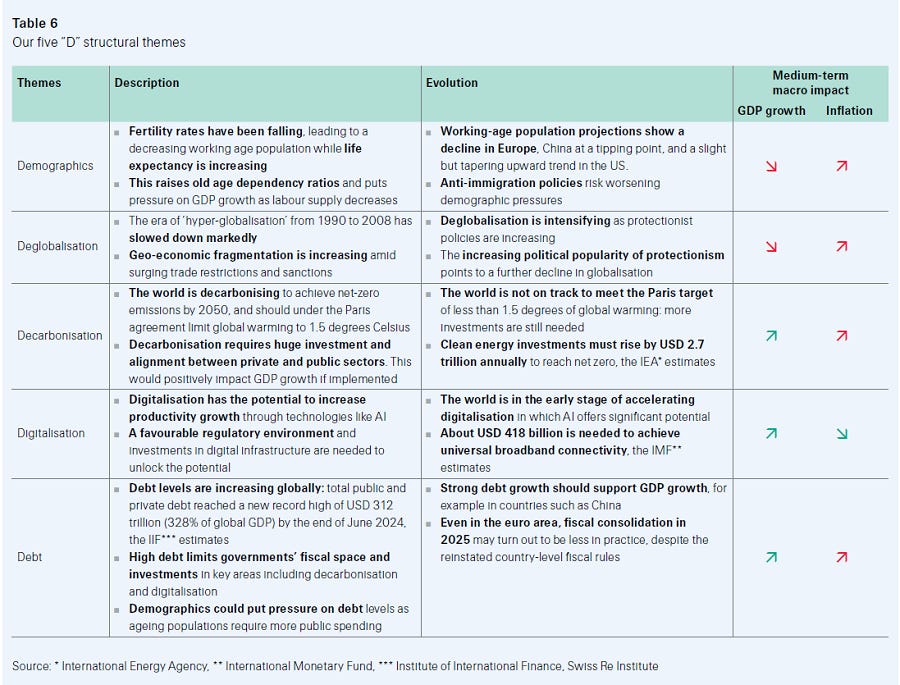

The “5Ds” Shaping the Long-Term Economic Outlook

Structural themes—demographics, deglobalization, decarbonization, digitalization, and debt—continue to influence the macroeconomic landscape. These “5Ds” present both risks and opportunities for insurers:

Demographics: Aging populations in advanced economies are creating demand for life and health insurance, while shrinking working-age populations pose growth challenges.

Deglobalization: Trade tensions and protectionist policies are reshaping supply chains, impacting marine and trade credit insurance.

Decarbonization: The global push toward net-zero emissions is spurring investments in green energy, creating new opportunities for insurance coverage while increasing exposure to environmental risks.

Digitalization: Rapid technological advancements are transforming insurance distribution and claims management but also heighten cyber risk.

Debt: Elevated public and private debt levels may constrain government spending and economic growth, with implications for long-term insurance demand.

Opportunities for Insurers

In this complex economic environment, insurers have opportunities to adapt and thrive:

Emerging Markets: Countries with robust GDP growth, such as India and parts of Southeast Asia, offer untapped potential for personal and commercial insurance.

Product Innovation: Inflation-protected products and index-linked savings plans can address consumer needs in uncertain times.

Investment Strategies: Higher interest rates provide opportunities to improve investment yields, supporting profitability despite market volatility.

Key Trends

Digital Transformation and Innovation

The insurance industry in 2025 is heavily influenced by the ongoing wave of digital transformation. Advanced technologies such as artificial intelligence, big data analytics, and blockchain are redefining how insurers assess risks, underwrite policies, and manage claims. Digital platforms enable seamless integration of insurance into consumer transactions, fostering the rise of embedded insurance. Personalization is now a standard expectation, as predictive analytics allow insurers to offer tailored products based on individual behaviors and needs. These advancements are not only enhancing customer experience but also streamlining operations and reducing costs. However, they also require significant investment and come with risks such as cyber vulnerabilities and operational dependencies on technology.

Climate Change and Catastrophe Risks

Climate change remains a dominant force shaping the insurance landscape. The increasing frequency and intensity of natural disasters, including hurricanes, wildfires, and floods, are leading to rising insured losses and amplifying the need for innovative risk solutions. Parametric insurance, which provides payouts based on predefined metrics rather than lengthy claim processes, is gaining traction as a faster and more efficient way to address climate-related losses. Meanwhile, the global push for decarbonization and investments in renewable energy and green infrastructure are creating new insurance opportunities while also introducing unique risks. Insurers must navigate these challenges while contributing to climate resilience and sustainability.

Evolving Demographics and Consumer Preferences

Demographic shifts are reshaping the demand for insurance products. Aging populations in developed markets are driving the growth of life and health insurance products such as annuities, long-term care coverage, and wellness-focused policies. Simultaneously, younger generations, particularly millennials and Gen Z, are demanding more flexible and usage-based insurance models that align with their preferences for digital and on-demand services. The rise of the sharing and gig economies further blurs the lines between personal and commercial insurance needs. To remain competitive, insurers must adapt their offerings to meet the diverse requirements of these demographic groups while fostering trust and engagement.

Cybersecurity and Technological Risks

As the digital world becomes more interconnected, cyber risks are becoming one of the fastest-growing threats to the insurance industry. The increasing reliance on technology in daily life and business operations has created vulnerabilities that cybercriminals are exploiting with greater sophistication. Demand for cyber insurance is growing rapidly, with coverage expanding to address data breaches, ransomware, and business interruption risks. Insurers are also contending with systemic risks posed by cyberattacks, where one event can impact multiple entities simultaneously. Additionally, the proliferation of artificial intelligence introduces new risks, such as intellectual property theft and algorithmic biases, prompting insurers to continually evolve their policies and underwriting strategies.

Emerging Markets and Growth Opportunities

Emerging markets, particularly in Asia and Latin America, represent significant growth opportunities for the global insurance industry. Rising incomes, urbanization, and greater awareness of the importance of insurance are fueling demand for both life and non-life products. China and India stand out as leaders in premium growth, with governments and private sectors investing heavily in expanding insurance penetration. Digital and mobile-first approaches are enabling insurers to reach underserved populations in these regions, offering innovative solutions such as microinsurance and crop insurance. Collaborating with local entities and tailoring products to specific market needs are critical for success in these high-potential markets.

Regulatory and ESG Pressures

The regulatory landscape in 2025 reflects growing emphasis on consumer protection, sustainability, and transparency. Environmental, social, and governance (ESG) considerations are increasingly shaping how insurers operate and invest. Governments and regulatory bodies are pushing for greater integration of ESG principles, requiring insurers to demonstrate commitment to reducing carbon footprints, promoting equitable access to insurance, and supporting socially responsible investments. Additionally, stricter regulations on data privacy, solvency, and market conduct are demanding more robust compliance measures. Insurers must navigate these regulatory changes while leveraging them as opportunities to align their operations with societal expectations and strengthen trust with stakeholders.

Key Insurance Segments

The insurance industry in 2025 is defined by significant transformations across its major segments, driven by demographic shifts, technological advancements, climate risks, and evolving consumer preferences. These changes are reshaping the life, property and casualty (P&C), health, and auto insurance markets, each presenting unique challenges and opportunities.

The life insurance sector is poised for robust growth, with premiums expected to rise at a real annual rate of 3%, driven by aging populations in developed markets and the expansion of middle classes in emerging economies like China and India. This demographic shift is fueling demand for retirement products such as annuities and long-term care insurance. At the same time, flexible, hybrid policies that combine savings and protection are gaining popularity. The sector also faces challenges like managing longevity risk and adapting to consumer demands for digital-first experiences, but innovation and expansion into underserved markets offer strong growth potential.

P&C insurance remains a critical pillar of the industry, balancing steady demand with pressures from increasing natural catastrophe risks. Climate change is driving higher insured losses, necessitating advancements in risk modeling and the adoption of innovative solutions like parametric insurance. While premium growth in developed markets is moderating, emerging economies are seeing significant expansion due to rising urbanization and asset accumulation. Specialty lines, such as renewable energy and cyber insurance, offer new opportunities, but insurers must remain vigilant in maintaining profitability amidst these risks.

The health insurance market continues to grow rapidly as healthcare costs rise and awareness of preventative care increases. Private health insurance is expanding in both advanced and emerging markets, driven by government initiatives to relieve pressure on public systems and increasing consumer demand for wellness-focused coverage. Hybrid policies integrating wellness incentives, telemedicine access, and mental health support are gaining traction. However, medical inflation and regulatory pressures remain persistent challenges, requiring insurers to innovate in both product design and operational efficiency.

Auto insurance is undergoing a transformative shift as technology, regulation, and changing mobility trends reshape the market. The rise of electric vehicles (EVs), connected cars, and autonomous driving systems is altering traditional risk profiles, moving from driver-centric to software-centric concerns. Telematics and usage-based insurance models are becoming more prevalent, offering personalized premiums and rewarding safe driving behaviors. Climate change and extreme weather events are also influencing claims patterns, while regulatory incentives for EV adoption are prompting insurers to develop tailored products. In emerging markets, growing vehicle ownership and urbanization are driving premium growth, though challenges such as high-tech repair costs and evolving liability structures around autonomous vehicles require strategic adaptation.

Across these segments, insurers face the overarching challenges of rising costs, increasing consumer expectations for digital engagement, and the demand for innovative, flexible products. However, opportunities abound, particularly in emerging markets, where digital-first strategies and microinsurance models are unlocking new customer bases. Success in 2025 will depend on insurers’ ability to harness technology, adapt to evolving risks, and respond to changing consumer needs, positioning themselves as agile and forward-thinking leaders in a rapidly transforming industry.

Conclusion

The insurance industry in 2025 stands at the precipice of significant transformation, shaped by a complex interplay of macroeconomic forces, technological advancements, climate-related challenges, and evolving consumer demands. While uncertainties abound, the opportunities for growth and innovation have never been greater.

Navigating this dynamic landscape will require insurers to embrace change and adopt a forward-thinking mindset. Whether it’s through harnessing the power of technology to streamline operations, expanding into underserved markets, or designing innovative products that meet emerging needs, the industry has multiple pathways to success. Proactively addressing challenges such as climate risk, cybersecurity threats, and demographic shifts will not only protect profitability but also enhance the resilience and relevance of insurance in a rapidly changing world.

Ultimately, the winners in this new era will be those who can balance risk management with innovation, leveraging data-driven insights and customer-centric strategies to stay ahead. By preparing for alternative scenarios, capitalizing on emerging trends, and fostering collaboration across sectors, insurers can position themselves not only to survive but to thrive in 2025 and beyond.

As the industry moves forward, the core mission of insurance—to protect, support, and provide peace of mind—remains unchanged. However, the ways in which this mission is fulfilled will evolve, offering new opportunities to drive growth, resilience, and positive societal impact. The time to act is now, and the future of insurance belongs to those who are ready to embrace it.

Sources

Swiss Re Institute. Growth in the shadow of (geo)politics Global economic and insurance market outlook 2025‒26. November 2024. Available at: https://www.swissre.com/institute/research/sigma-research/sigma-2024-05-global-economic-insurance-outlook-growth-geopolitics.html

Accenture. Insurance Revenue Landscape 2025: Innovate for resilience. April 2021. Available at: https://www.accenture.com/ca-en/insights/insurance/revenue-landscape-2025-innovate-for-resilience

McKinsey & Company. Global Insurance Report 2025: The pursuit of growth. November 2024. Available at: https://www.mckinsey.com/industries/financial-services/our-insights/global-insurance-report

Noria. The Insurance Industry 2025: A Digital Transformation Roadmap. 2024. Available at: https://www.noria.no/documents/Noria_eBook_The_Insurance_Industry_2025_171205_v8.pdf

Download this report 👇

BTW

I’ve launched 6 ebooks to support this newsletter and align with the principles and objectives of WorldlyInvest. These ebooks serve as guides to learning and applying various value investing strategies.

As a special launch offer, you can get each ebook for just $10.99 USD.

By purchasing, you’ll not only gain valuable insights but also support this newsletter’s growth.

Got a burning question or a topic you're curious about? I'd love to hear from you! Please drop a comment 💬 below or shoot me an email 📧 at worldlyinvest@gmail.com