Lessons from Berkshire Hathaway’s 1965 Letter

The 1965 annual letter marked Warren Buffett's first year at the helm of Berkshire Hathaway.

I've been reviewing Berkshire Hathaway's Warren Buffett's annual letters. Searching on Google I found this analysis of the 1965 letter, made by the team of the now-defunct hedge fund S&C Messina.

This is the first letter written by Buffett after he took control of the textile company through the Buffett Partnership. Although the letter's authorship is attributed to Warren Buffett in the compiled Berkshire Hathaway Letters to Shareholders, it formally ends with the names of Malcolm G. Chace, Jr., Chairman of the Board, and Kenneth V. Chace, President.

In this post, I’m going to share my notes on this analysis, including some images that belong to the original analysis by S&C Messina.

At the end of the post, I will include the original analysis of S&C Messina so that you can download it.

TL; DR

Berkshire was undervalued in 1965, trading at $18.50/share against a book value of $24.10 per share. The company boasted a 9.3% ROE and a P/E 8.3x, making it a deep value investment opportunity.

Buffett introduced a new method for presenting earnings to provide a realistic view of financial health, adjusting for federal income tax charges that would have applied without loss carryovers.

Despite reporting profits for 1964 and 1965, Buffett was transparent about the non-recurring losses and the ongoing challenges due to facility closures.

Significant strides were made in enhancing liquidity and operational efficiency, including reductions in inventory and debt, as well as investments in cost-reducing machinery.

The company repurchased over 120,000 of its own shares, demonstrating strong cash reserves and a commitment to enhancing shareholder value.

Notable leadership transitions included the resignation of Seabury Stanton, with Kenneth V. Chace taking over as President.

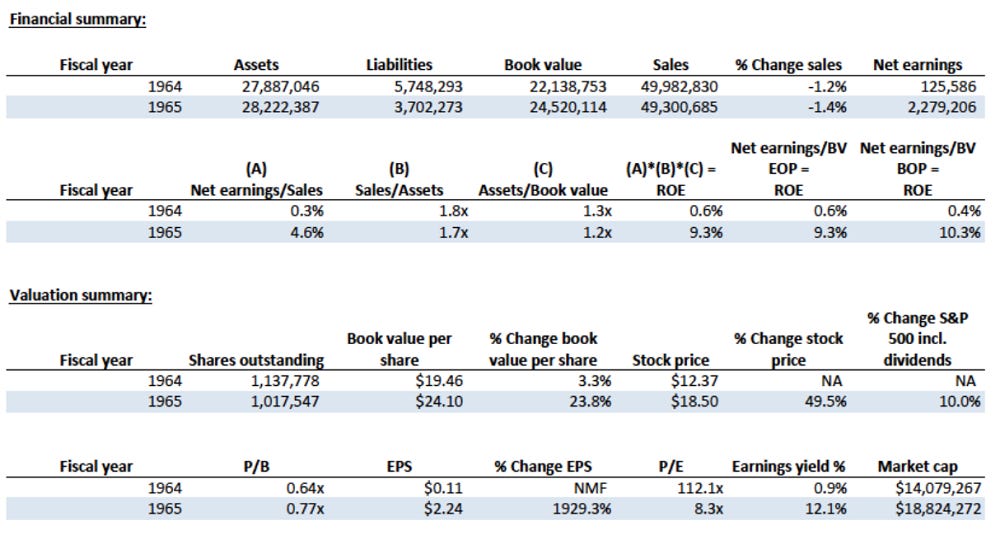

Financial & Valuation Summary

The analysis starts with a financial & valuation summary of the company.

As you can see below, in 1965, BRK was cheap:

$18.50/share with a Book Value Per Share (BVPS) of $24.10.

9.3% ROE vs. 0.6% in 1964.

P/B 0.77x

$2.24 of EPS

P/E of 8.3x.

12.1% Earnings Yield

Indeed, the company was a deep value situation.

Shift in Earnings Presentation

Buffett introduced a new way of representing the company's earnings to accurately reflect its financial health. The 1965 results adjusted the net earnings from the previous year (1964) and introduced a line item for federal income tax charges that the company would have incurred without the benefit of previous loss carryovers. This was intended to temper shareholder expectations about future performance by presenting a more conservative view of earnings power.

You will also enjoy ❤️ 👇

Lessons from Berkshire Hathaway’s 1966 Letter

In 1966, BRK maintained steady despite challenging market conditions, demonstrating strong financial resilience.

Realistic Depiction of Financial Challenges

While the letter reported positive net earnings for 1964 and 1965—the first since 1960—it also made clear that these figures did not include substantial non-recurring losses from the closure of major facilities. Buffett's disclosure emphasized the ongoing challenges and the financial impacts of restructuring the business, highlighting his commitment to transparency.

Enhanced Liquidity and Operational Efficiency

The analysis points out significant improvements in Berkshire’s liquidity and operational efficiency. Buffett reported substantial reductions in inventory and debt, alongside strategic investments in new machinery aimed at cost reduction and quality improvement. This approach not only optimized working capital (WC) but also strengthened the company's financial footing.

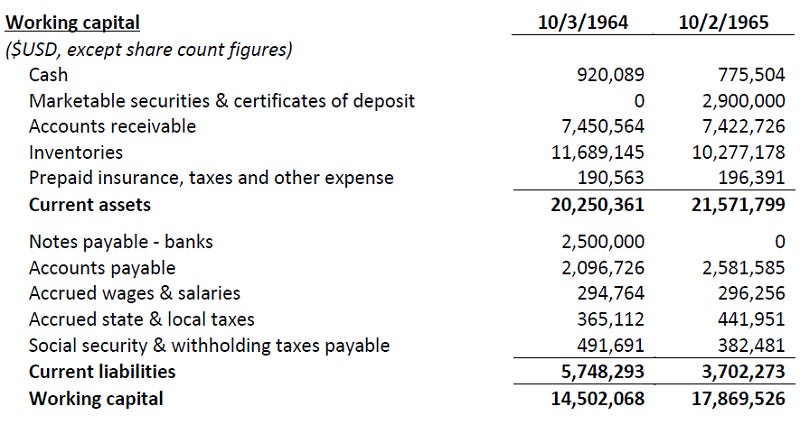

The following table shows the increase in WC from 1964 to 1965:

Inventory and Debt Reduction: Buffett reported a strategic decrease in raw material, stock in process, and clothing inventories, which reduced by $1,411,967. Additionally, significant debt repayments were made, with $2,5M in bank loans paid off during the year. These actions freed up cash and reduced the company’s financial burden.

Share Repurchases: During 1965, Berkshire Hathaway also purchased 120,231 of its own shares, reducing the total number of outstanding shares to 1,017,547 by the end of the fiscal year. This not only helped in enhancing shareholder value but also reflected the company's strong cash position to support such buybacks.

Cost Reduction Initiatives: The analysis highlights Buffett's efforts in reducing overhead costs significantly within the fiscal year. An amount of approximately $811,812 was invested in new machinery aimed at cost reduction and quality improvement. This not only helped in improving operational efficiency but also positioned the company to continue these improvements in the subsequent fiscal year.

Increase in WC: As a result of these initiatives, there was a notable increase in WC from $14,502,068 in 1964 to $17,869,526 in 1965, a 23.2% change. In fact, the WC Per Share was almost similar to the stock price. With a strong WC position, BRK improved its liquidity position enabling the company to better manage its short-term obligations.

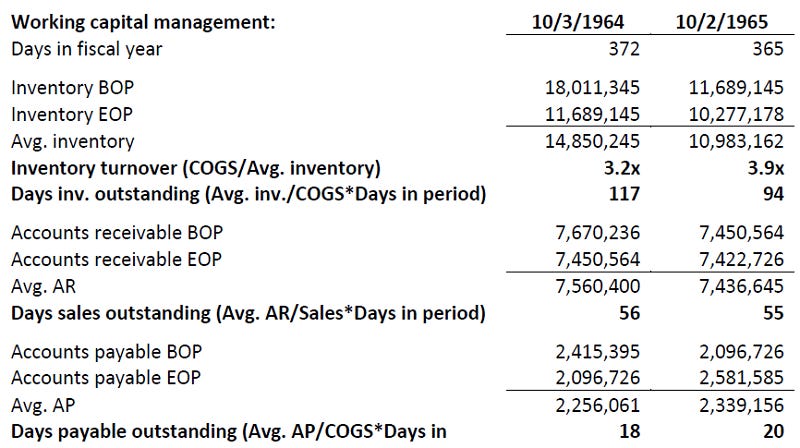

Enhancement of Cash Conversion Cycle (CCC): Berkshire Hathaway managed to improve its CCC significantly. This was achieved by faster inventory turnover (from 117 days in 1964 to 94 days in 1965), slight improvements in days sales outstanding (DSO), and days payable outstanding (DPO). This indicates more efficient management of cash flows, leading to enhanced liquidity.

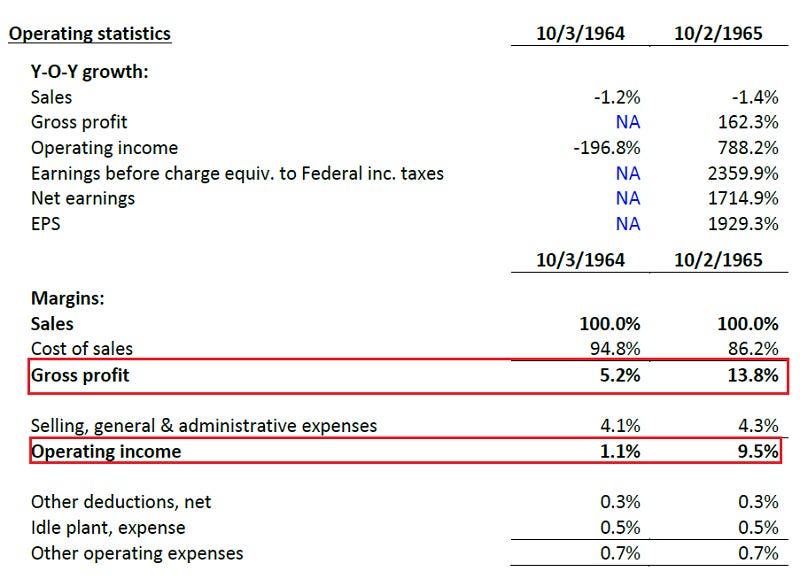

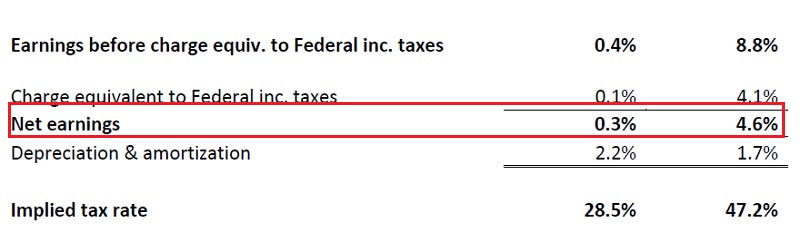

Now, S&C Messina also made an analysis of BRKs improvement in margins from 1964 to 1965.

Gross profit margin increased from 5.2% to 13.8%

Operating Margin increased from 1.1% to 9.5%

Net margin increased from 0.3% to 4.6%.

Leadership and Organizational Changes

Significant leadership changes were highlighted, including the resignation of Seabury Stanton as Director and President, and John K. Stanton as director and Treasurer and Clerk. Kenneth V. Chace was elected as the new President, and Harold V. Banks took over as Treasurer and Clerk.

Summary

The 1965 annual letter marked Warren Buffett's first year at the helm of Berkshire Hathaway, showcasing the company as significantly undervalued with a strong potential for growth. Buffett introduced a transparent, conservative earnings reporting method and implemented strategic operational improvements. Key moves included significant debt reduction, inventory management, and shareholder-focused actions like share repurchases.

Download S&C Messina’s full analysis 👇

Download this post 👇

Got a burning question or a topic you're curious about? I'd love to hear from you! Please drop a comment 💬 below or shoot me an email 📧 at grahamqualityinvestor@gmail.com