Lessons from Berkshire Hathaway’s 1966 Letter

In 1966, BRK maintained steady despite challenging market conditions, demonstrating strong financial resilience.

Now is the time to review the 1966 letter, which was published on December 2, 1966.

TL; DR

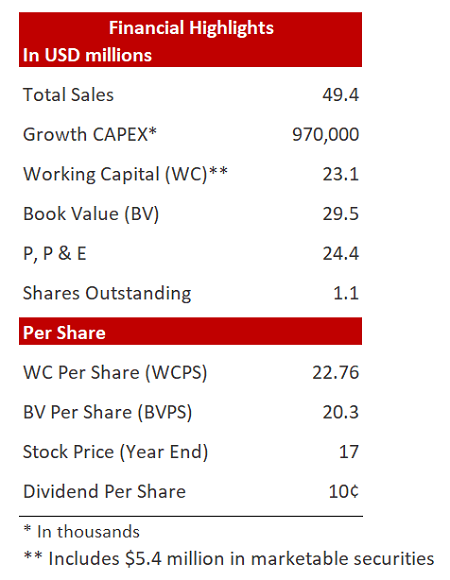

Despite challenging markets, the company achieved steady sales of $49.4 million and strengthened its financial position with $23.1 million in working capital and a $29.5 million book value.

Key initiatives included significant investments in technology and a new dividend policy.

The company also emphasized flexibility in capital management to enable potential acquisitions and adapt to industry changes.

Financial Highlights

Operating Conditions

Berkshire reported total sales of $49.4 million, roughly equivalent to the previous year, though shifts in product mix affected individual divisions differently.

The sales picture for the last half of 1966 was one of generally depressed markets. Heavy imports of yarn-dyed goods plus a change in styling trends caused loss of sales and depressed prices in our Box Loom Division.

— WARREN BUFFETT

The Synthetic Division saw a decrease in sales, offset by increases in the Home Fabrics and Box Loom Divisions. However, external factors like heavy imports and changing style trends depressed market conditions and prices, particularly in the latter half of 1966.

The growth of our Home Fabrics Division over the past few years is, in large part, due to our development of both new products and new applications of old products. In the past year, we have increased our expenditures for development so as to provide fabrics that will yield more stable prices and volumes.

— WARREN BUFFETT

Financial Performance Overview (1961-1966)

The period was characterized by cyclical fluctuations typical of the textile industry, with profitable years followed by periods of loss.

Notably, 1966 was profitable and saw the restoration of Berkshire’s financial strength to levels seen in 1960, despite prior losses and significant capital expenditures in the early 1960s.

As one might expect, in a business as highly cyclical as the textile business, the past decade for Berkshire Hathaway has been a recurring story of a period of earnings followed by a period of relatively heavy losses. The past year has been a significant one in this history because, not only was 1966 a year of profitable operations, but, also, it witnessed the restoration of our financial strength to the level that existed at the end of 1960.

— WARREN BUFFETT

Financial Strategy and Capital Management

Berkshire emphasized maintaining a robust financial condition to navigate the cyclical nature of the textile industry and to prepare for potential acquisitions.

The company reported a strong position with $23.1 million in WC and a net worth (BV) of $29.5 million by the end of 1966, despite dividends exceeding earnings and substantial stock repurchases reducing share count and equity.

While dividends exceeded net earnings during this six-year period, the major reason for the 22% decrease in net worth has been the repurchase by the Company of its own stock, pursuant to a program whereby the Company’s outstanding shares have been reduced to 1,017,547 shares—a 37% reduction compared with the shares outstanding on October 1, 1960. This decrease in outstanding shares has been appropriate, considering the reduction in scale of the Company’s operations due to closing of unprofitable mills.

— WARREN BUFFETT

Investments and Technological Adaptation

The company continued to invest in new technologies to improve manufacturing efficiency and product quality, spending approximately $970,000 in 1966.

The Home Fabrics Division’s rapid growth could necessitate up to $7 million in further investments in inventory and receivables if growth continued.

You will also enjoy ❤️ 👇

Lessons from Berkshire Hathaway’s 1965 Letter

The 1965 annual letter marked Warren Buffett's first year at the helm of Berkshire Hathaway.

Investment Strategy and The Importance of a Strong Financial Condition

BRK held $5.4 million in marketable securities, including municipal bonds, commercial paper, and common stock, to ensure liquidity and to generate a realistic return on capital. Directors planned to invest a major portion of these funds in marketable common stocks to potentially enhance income and gain indirect exposure to earnings outside the textile business.

It has always been among the goals of Berkshire Hathaway to maintain a strong financial condition. Indeed, it has been this practice that has enabled the Company to survive in the light of the highly cyclical nature of its business.

— WARREN BUFFETT

Flexibility for Acquisitions

Buffett mentions that BRK has been actively looking for suitable acquisitions within and potentially outside the textile field.

In addition to the cyclical nature of our business, there are other reasons why a strong financial condition is advisable. As you have been advised previously, the Company has been searching for suitable acquisitions within, and conceivably without, the textile field. Although to date none has been successfully concluded, we continue to have an active interest in such acquisitions. The present state of the money market, in which funds are virtually unobtainable for acquisition purposes, makes it imperative that we have available the liquid assets with which to consummate such acquisitions, should the hoped-for opportunities present themselves. Present uncertainties such as war, tax rates and decreased level of business activity also all combine to emphasize the continuing need for a strong financial condition.

— WARREN BUFFETT

The Dangers of Technological Changes

The textile industry is prone to technological changes that can rapidly make existing equipment and processes obsolete.

Finally, the threat of technological change is ever present in the textile field. We have an investment of $24.4 million ($6.3 million after accrued depreciation) in plant and equipment. This is an investment which the textile machinery industry is constantly striving to render obsolete. An important change at any level of our manufacturing process could require major capital expenditures at tomorrow’s replacement prices. We shall continue to weigh most carefully the possible rewards and risks of any capital expenditure program. However, should we decide that it is in our best interests to make capital expenditures, we must be in a financial position to do so. Sufficient working capital would be particularly necessary if the advent of important cost-cutting equipment coincided with a period of depressed textile earnings, making outside capital difficult or impossible to obtain.

— WARREN BUFFETT

Investing in Marketable Securities

Because of the uncertainties in knowing when the Company may be called upon to produce substantial sums of cash, and the possibility that this might not occur for a considerable period of time, your directors have felt that we should be as zealous to achieve a realistic return on this portion of our capital as we are on the other funds that are at the time invested in plant, inventories, receivables, etc. Accordingly, it is the present intention of the directors to proceed toward the interim investment of a major portion of these funds in marketable common stocks. This should hold promise not only of greater income than can be achieved through alternative investment possibilities in the field of non-equity marketable securities, but also provides us with the opportunity to participate in earnings derived outside of our textile business, even if only temporarily and indirectly.

— WARREN BUFFETT

Dividend Policy

Reflecting the improved financial stance, a dividend policy was introduced, distributing a reasonable portion of after-tax earnings while preserving financial strength. A dividend of 10¢ per share was declared in November 1966, reflecting this new policy.

This restoration of the Company’s financial position now permits a dividend policy reflecting the distribution to our stockholders of a reasonable proportion of current after-tax earnings. Such a policy, however, must be consistent with the need for preserving the strength of our present financial position.

— WARREN BUFFETT

Summary

In 1966, BRK maintained steady despite challenging market conditions, demonstrating strong financial resilience with $23.1 million in WC and a BV of $29.5 million. The company invested in technology to enhance manufacturing efficiency and managed a diversified investment portfolio to ensure liquidity and returns. The introduction of a dividend policy, distributing 10 cents per share, marked a commitment to shareholder value. Buffett also emphasized the strategic flexibility maintained for potential acquisitions, underscoring Berkshire's preparedness to leverage opportunities in and beyond the textile industry.

Download BRK’s full letter 👇

Download this post 👇

Got a burning question or a topic you're curious about? I'd love to hear from you! Please drop a comment 💬 below or shoot me an email 📧 at grahamqualityinvestor@gmail.com