Lessons from Tom Murphy for Investors 💡

Discover key psychological biases from Charlie Munger's 'The Psychology of Human Misjudgment' and learn how they affect investing decisions in Part I of this series.

Hey, guys! 👋

I'm happy to share some invaluable lessons from the legendary Tom Murphy, a true mastermind in the media industry. 📺

✨ If you're curious about how disciplined management and smart capital allocation can transform a company, this post is a must-read. Let’s dive into the strategies that helped Murphy turn a small broadcasting company into a media powerhouse!

Enjoy!

And remember:

🐦 Follow me on Twitter

💼 Follow me on LinkedIn

🎉 FYI! I’ve just released a series of brand-new, free ebooks designed to help you master the strategies of some of the greatest investors of all time.

📥 Download them below!

Tom Murphy may not be a household name, but his influence on the media industry and corporate management is profound. As the CEO of Capital Cities Broadcasting, Murphy transformed a small, regional broadcasting company into a media powerhouse, eventually acquiring ABC and merging with Disney. His approach to management and capital allocation offers invaluable lessons for investors looking to understand the dynamics of successful business leadership.

In this post, you'll learn about Murphy's strategies for focusing on core strengths, disciplined capital allocation, operational efficiency, and strategic acquisitions—principles that are crucial for anyone looking to make informed, long-term investment decisions.

TL; DR

Tom Murphy avoided over-diversification, focusing instead on improving and expanding Capital Cities' core broadcasting business. This approach allowed for steady, efficient growth.

Murphy prioritized using internal cash flow and debt over issuing new stock for acquisitions, ensuring minimal shareholder dilution and maximizing long-term value.

A lean management structure with decentralized decision-making empowered local managers and reduced bureaucracy, contributing to high profitability.

The acquisition of ABC in 1986, backed by Warren Buffett, exemplified Murphy's strategic foresight and ability to integrate operations to enhance value.

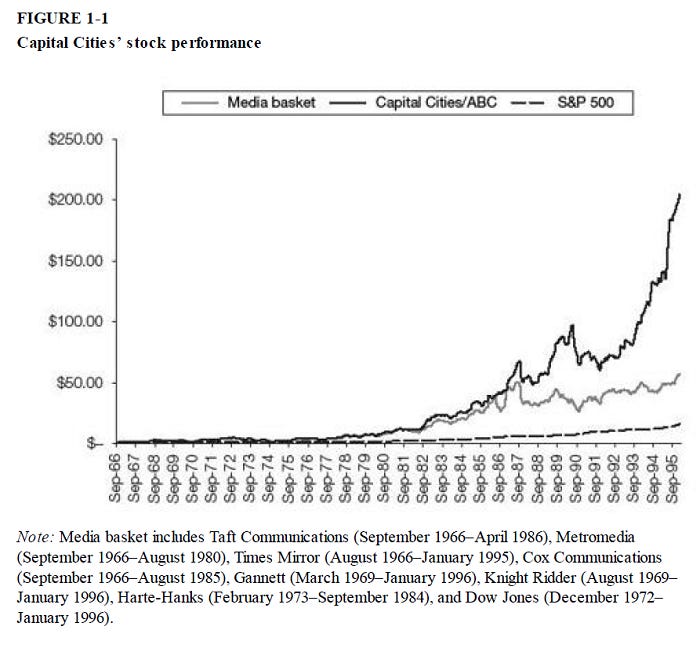

Under Murphy’s leadership, Capital Cities delivered a 19.9% annual return over 29 years, far outperforming the S&P 500 and its media peers.

Tom Murphy’s Approach at Capital Cities

When Tom Murphy took the helm of Capital Cities Broadcasting in 1966, the company was a small player in a market dominated by giants like CBS. By the time Murphy merged Capital Cities with Disney three decades later, it had grown to surpass CBS in market value. This incredible transformation was not due to flashy corporate strategies or high-profile marketing but to Murphy's disciplined, methodical approach to management.

1. Focus on Core Strengths

Murphy resisted the trend of aggressive diversification that many companies pursued during his tenure. While his competitor, CBS, expanded into various unrelated businesses, Murphy doubled down on Capital Cities' core strengths—broadcasting. He believed in acquiring radio and television stations, improving their operations, and consistently repurchasing shares to increase shareholder value. This focus on core strengths allowed Capital Cities to grow steadily and avoid the pitfalls that often accompany overdiversification.

2. Disciplined Capital Allocation

One of Murphy's most notable contributions was his disciplined approach to capital allocation. He preferred to use internal cash flow and debt to fund acquisitions rather than issuing new stock, ensuring minimal dilution for shareholders. Murphy also made a point of repurchasing Capital Cities’ shares when they were undervalued, a strategy that significantly enhanced shareholder returns over the long term. His acquisition strategy was patient and deliberate, focusing on deals that promised long-term value rather than quick profits.

3. Operational Efficiency and Decentralization

Murphy believed in lean operations and decentralization, allowing local managers the autonomy to run their units effectively. This approach was rooted in his belief that those closest to the operations—local managers—were best positioned to make decisions. Headquarters staff was kept minimal, with no unnecessary layers of management, fostering a culture of independence and entrepreneurship. This lean setup contributed to Capital Cities’ ability to respond quickly to market changes and maintain high profitability.

4. Strategic Acquisitions

Tom’s acquisition of ABC in 1986, with financing from Warren Buffett, was a landmark achievement. It was the largest non-oil and gas transaction at the time, positioning Capital Cities as a major player in the media industry. Post-acquisition, Murphy applied his lean, decentralized approach to ABC, cutting unnecessary costs and improving margins significantly. This acquisition not only demonstrated Murphy’s strategic foresight but also his ability to integrate and streamline operations effectively.

5. Long-Term Value Creation

Murphy’s ultimate success at Capital Cities was reflected in the extraordinary returns for shareholders. If you had invested a dollar with Tom Murphy when he became CEO in 1966, that dollar would have grown to $204 by the time he sold the company to Disney, representing a remarkable 19.9 percent IRR over 29 years. This performance far outpaced the S&P 500 and an index of leading media companies during the same period.

Why Tom Murphy's Story Matters for Investors

Tom Murphy's story is a powerful reminder of the importance of disciplined management and capital allocation in creating long-term value. His approach offers several key lessons for investors:

Focus on Core Competencies: Like Murphy, investors should prioritize companies that focus on their core strengths and avoid the pitfalls of overdiversification.

Capital Allocation Matters: Understanding how a company allocates its capital—whether through reinvestment, acquisitions, or share repurchases—can provide insights into its long-term potential.

Operational Efficiency is Key: Companies that maintain lean operations and empower local management often perform better over the long term, as they can adapt quickly to changes and maintain high profitability.

Patience Pays Off: Murphy’s patient, long-term approach to acquisitions and growth underscores the value of patience in investing. Quick wins are rare; long-term success requires strategic foresight and disciplined execution.

Summary

Tom Murphy's tenure at Capital Cities is a masterclass in disciplined, value-driven leadership. His ability to transform a small broadcasting company into a media giant, while delivering exceptional returns to shareholders, offers invaluable lessons for investors. By studying Murphy's approach to management and capital allocation, investors can better understand what it takes to achieve long-term success in business and investing.

Learning from leaders like Tom Murphy is crucial for anyone serious about investing. His story not only provides a blueprint for corporate success but also highlights the enduring value of a disciplined, patient approach to both management and investing.

Download this post 👇

Got a burning question or a topic you're curious about? I'd love to hear from you! Please drop a comment 💬 below or shoot me an email 📧 at grahamqualityinvestor@gmail.com