A Stable Microcap Trading Like a Deep Value Situation

A 100+ year-old microcap trading at just 0.4x EV/Revenue and 2.8x EV/EBITDA — despite delivering 12.5% ROIC and 22% owner earnings yield.

Executive Summary

Hamilton Beach Holdings (HBB) is a slow grower microcap consumer appliance company with a durable brand and a lean operating model that delivers respectable profitability — but its stock trades like a deep value company. Despite being a profitable company with mid-teens ROIC over the 5y, the company is valued at just 7.2x earnings and 0.4x EV/Revenue, suggesting the market sees it as in structural decline. However, HBB’s challenges are more cyclical and transitional than terminal: working capital volatility and tariff exposure have clouded its underlying economics. The market is mispricing three key elements — durable brand equity and profitability, emerging growth in healthcare and DTC channels, and lack of analyst visibility. With a valuation range of $33–$61/share and clear catalysts (tariff mitigation, DTC scaling, and premium mix shift), HBB offers a nice upside re-rating opportunity for patient value investors.

Company overview

The company operates an asset-light business model focused on the design, marketing, and distribution of small electric household and commercial appliances. It does not manufacture its own products, instead outsourcing production to third-party suppliers, primarily in Asia. This approach enables HBB to maintain a lean cost structure, benefiting from lower capital intensity and modest R&D spending, while achieving gross margins between 20%–26% in recent years.

Founded in 1910, Hamilton Beach is one of the most recognized brands in the U.S. small kitchen appliance industry1. In 2017, it was spun off from NACCO Industries, which had owned the business since 1990. Today, the company’s portfolio includes products such as blenders, coffee makers, toasters, slow cookers, and air purifiers, sold under both its own brands and through licensing agreements with well-known third-party brands.

Their revenues are primarily generated in North America, with the US, Canada, and Mexico accounting for the majority of sales. The business is diversified across two primary end markets: consumer (residential) and comercial, selling ~25-30M annual units. ~15% of FY2023 sales were attributed to premium product offerings, while 8% came from commercial-grade appliances designed for restaurants, hotels, and food service operators such as McCafe and Dairy Queen.

Retail distribution remains the dominant channel, with large partners like Amazon and Walmart responsible for 50% of total sales. However, HBB is actively investing in its DTC platform to reduce channel dependency and improve margins. This strategic pivot addresses the competitive pressures posed by retailers offering white-label products or stocking competing brands.

In addition to its core appliance business, the company has recently entered the connected healthcare space with a suite of smart health devices and supporting software. Although this segment currently represents only ~1% of total sales, management sees long-term potential in this category, supported by increasing consumer demand for wellness technology.

Brand partnerships and licensing are also a key revenue driver. HBB distributes or co-develops products under brands such as Clorox (Brita water filters and air purifiers), CHI (hair care tools), Bartesian (cocktail appliances), and Numilk (plant-based milk machines2). These arrangements allow the company to expand its product offering without materially increasing internal R&D.

Over the past 5y, HBB has delivered modest top-line growth, with revenue increasing at a 1.7% CAGR (a slow grower). However, maintains low CapEx requirements and reinvests a minimal percentage of revenue into R&D (1.3%–2.1%), focusing mainly on incremental product improvements and licensing agreements.

Despite its mature market and slow growth profile, the company has delivered solid returns on invested capital, averaging 12.5% over the last 5y. It operates with a conservative balance sheet and limited financial leverage, which, combined with stable cash flow generation, positions it well to navigate cyclical downturns and invest selectively in growth initiatives such as healthcare and digital DTC capabilities.

Industry Overview

HBB operates in the U.S. premium small kitchen appliances industry (blenders, air fryers, coffee makers, etc.), which is projected to reach $30.4B by 2030, growing at an annual rate of 4.7%.3 It’s not a high-growth industry, but it maintains steady expansion driven by demographic trends—especially urban dwellers who, due to convenience, limited time, and health concerns, prefer cooking at home.

It’s a fragmented market with many players trying to grab market share. HBB holds only ~3% of the market4 and competes not only with established brands but also with private-label products and low-quality products from China.

For example, Hamilton Beach is one of the most recognized names in the category. However, we’re talking about a product that’s pretty much a commodity—where purchase decisions are mostly driven by price rather than brand trust or quality5, even though the company has been around for 100+ years.

In short, this is an industry with virtually no moat, where any new player can jump in and start stealing market share with commodity products.

For a deeper dive into the market dynamics, competitive landscape, and global trends, you can access my industry report.

Management & Capital Allocation

HBB is a family-controlled business. Through a dual-class share structure, the Rankin family holds approximately 84% of the voting rights via Class B shares. Notably, they have not been active sellers of their equity holdings, though most recent share acquisitions have come via RSUs, not open-market purchases—limiting the signaling power of insider buying.

In 2024, the company executed a smooth leadership transition. Following the retirement of longtime CEO Gregory Trepp, R. Scott Tidey—formerly EVP of Global Sales, Marketing & Innovation—was appointed as the new CEO. The transition was internal, suggesting strong bench strength and organizational continuity. That said, Trepp’s retirement resulted in an unusually high compensation-to-net-income ratio of 31% in 2024, compared to a 5y avg. of 21%.

Executive compensation consists primarily of time-based RSUs that vest over 3y. The company does not use stock options or performance-based equity awards. While annual bonuses are tied to financial metrics such as adjusted operating income and return on total capital employed (ROTCE), the long-term equity component lacks alignment with shareholder outcomes, as it vests regardless of performance. This undermines incentives to deliver sustained shareholder value over time.

Capital Allocation

Capital allocation has been conservative and generally well-executed. Management has demonstrated a willingness to divest or shut down underperforming operations. Notably, the company exited its unprofitable Kitchen Collection retail business in 2020 and transitioned its Brazil operations to a licensing model in 2022, improving capital efficiency.

The company maintains a prudent financial posture. It pays a regular quarterly dividend and has been selective with share repurchases, avoiding large-scale buybacks that might stretch the balance sheet. There are no near-term debt maturities, and liquidity is ample: HBB has access to a $125M revolving credit facility, primarily used to fund seasonal working capital needs in advance of peak Q4 sales.

Importantly, HBB avoids shareholder dilution and financial risk when pursuing acquisitions. In 2024, it acquired HealthBeacon, a connected healthcare device and software company, for $7.5M using cash on hand.

Investment Thesis

Why HBB is Undervalued

Despite requiring minimal reinvestment and occasionally producing strong FCF, Hamilton Beach trades @ just 0.4x EV/Revenue and 2.8x EV/EBITDA — far below peer averages. While cash generation has been volatile due to working capital swings and tariff-related inventory management, the company consistently delivers mid-20s gross margins and 12.5% average ROIC, pointing to durable core economics. The market appears to be over-discounting short-term disruptions and assuming structural decline, while overlooking the company’s ability to generate normalized cash flow under more stable conditions.

His connected health platform (HealthBeacon) and growing DTC channel both offer long-term margin expansion and recurring revenue potential — but neither is currently reflected in the stock price. The healthcare business is scaling patient subscriptions and recently secured a partnership with OptumHealth, while DTC sales are growing faster than total company revenue. These assets represent free call options the market is not pricing in, due to their early-stage status.

The company has zero analyst coverage6 and minimal institutional visibility. This lack of coverage contributes to a persistent valuation gap despite operational stability, improving margins, and capital discipline.

Why This Opportunity Exists

Is actively shifting 66% of its U.S.-bound production out of China by the end of 2025 to mitigate tariff exposure, a move that should protect and eventually expand margins.

Its healthcare platform is gaining commercial traction with institutional partners and is on track to reach scale by 2026.

Its premium product portfolio and DTC infrastructure are expanding and gaining share, offering structural margin benefits over legacy channels.

Valuation

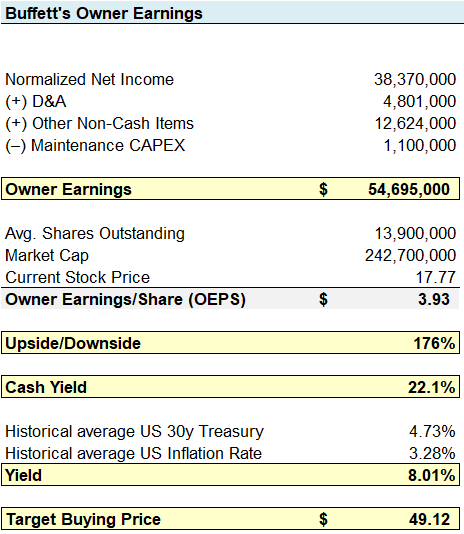

Buffett’s Owner Earnings

Mr. Buffett would say that Hamilton Beach exhibits significant undervaluation relative to its underlying cash-generating power.

At the current market price of $17.77/share, the stock trades at a 22.1% owner earnings yield, nearly 5x higher than the historical average U.S. 30-year Treasury yield (4.7%) and 7x the long-term average inflation rate (3.3%). Applying a conservative required yield of 8%—well above both risk-free and inflation benchmarks—HBB’s intrinsic value is $49.12/share, or 176% upside.

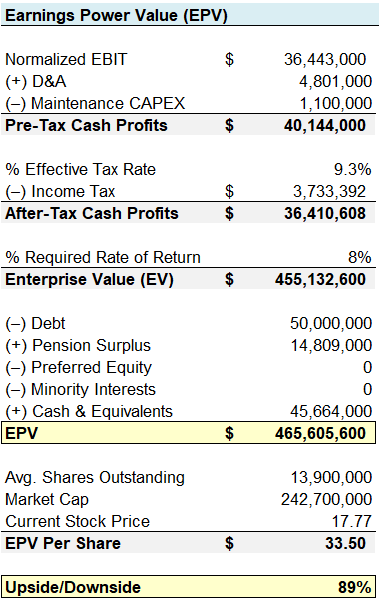

EPV

My Earnings Power Value (EPV) valuation offers a conservative, no-growth perspective on intrinsic value — and even under these restrained assumptions, Hamilton Beach appears significantly undervalued with a EPV/Share of $33.50, or 89% upside.

I exclude any contribution from future growth, margin expansion, or optionality from new initiatives such as connected healthcare devices or the DTC channel. EPV simply reflects the durable earnings power of the core business under current conditions.

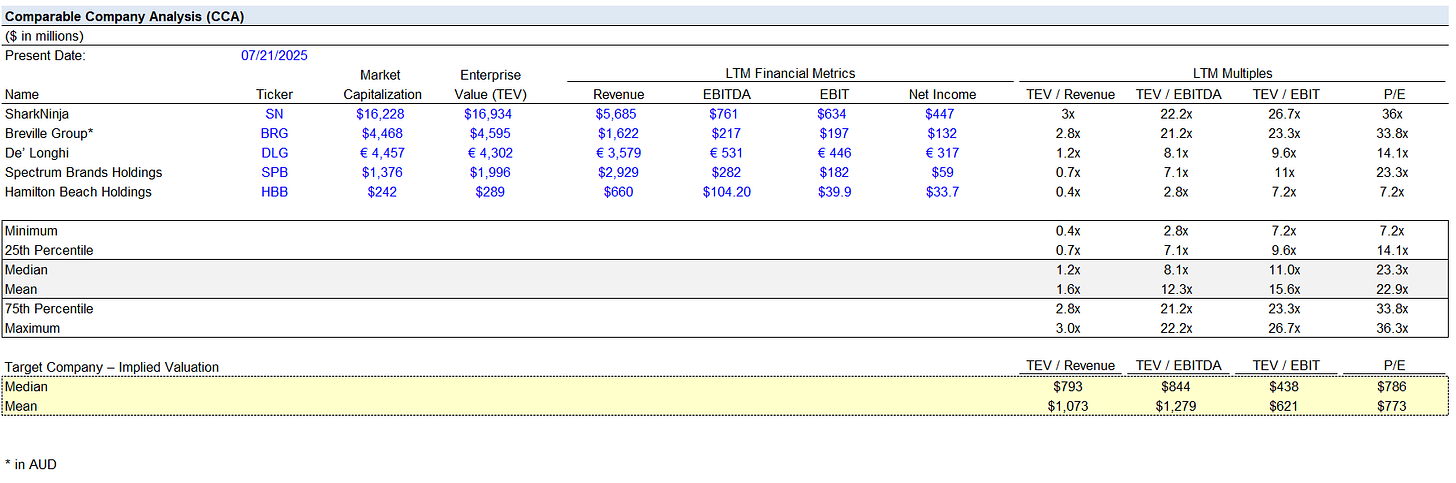

Comparables

While peers trade at median valuations of 1.2x EV/Revenue, 8.1x EV/EBITDA, 11.0x EV/EBIT, and 23.3x P/E, HBB currently trades at just 0.4x EV/Revenue, 2.8x EV/EBITDA, 7.2x EV/EBIT, and 7.2x P/E—placing it firmly at the bottom of its peer group.

Applying these median peer multiples to Hamilton Beach’s financials, and adjusting for the company’s capital structure by subtracting $50M of debt, adding back $45.7M in cash, and properly treating its $14.8M pension surplus as an asset (the same adjustments I did with the EPV framework), yields a range of implied equity valuations: EV/Revenue implies a $57.79/share; EV/EBITDA $61.48/share; EV/EBIT implies a more conservative $32.26/share; and the P/E results in $56.55/share. These valuations represent upside of 81% to 246% from the current share price of $17.77.

Risks

1. Exposure to U.S.–China Tariffs and Sourcing Concentration

The company remains materially exposed to escalating US tariffs on Chinese imports — with rates as high as 145% on certain appliances. This creates a direct margin headwind and introduces volatility in pricing, inventory planning, and retailer negotiations. Given that a significant portion of the company’s products are still sourced from China, this is a credible and near-term risk.

Mitigation: Management has already shifted 15% of U.S.-bound production out of China and targets 66% by year-end 2025. The company has also received foreign trade zone certification to reduce customs costs and has proactively adjusted prices and built inventory to manage near-term impacts.

2. Unproven Profitability of the Healthcare Segment

The company’s strategic expansion into connected health through HealthBeacon remains early-stage and is not expected to reach break-even before 2026. While the healthcare segment supports a higher-margin, recurring-revenue model, it introduces operational and commercial risks in a market where HBB lacks a track record. A failure to scale could impair future earnings or result in capital misallocation.

Mitigation: While still unprofitable, the segment is showing positive early momentum — including three consecutive quarters of subscription growth and a strategic partnership with OptumHealth. Importantly, the core appliance business remains cash-generative and unaffected by the health segment’s performance in the near term.

3. Dependence on Major Retail Channels

Roughly 50% of HBB’s revenue flows through large distribution partners such as Amazon and Walmart. These retailers also promote competing brands and private-label alternatives, putting HBB at risk of margin pressure, lower shelf visibility, or loss of share. Channel concentration also reduces pricing power and negotiating leverage.

Mitigation: Management is actively investing in its DTC platform, which grew in the mid-single digits in Q1 2025 and carries structurally higher margins. While still small, the DTC channel is strategically important and supported by ongoing investment in personalization, digital marketing, and premium brand storytelling.

Catalysts

Supply Chain Realignment and Margin Recovery: HBB is actively shifting its sourcing footprint to reduce exposure to punitive US–China tariffs. Management plans to transition 66% of U.S.-bound production out of China by year-end 2025, up from 15% as of Q1. This shift, combined with pricing adjustments already underway, is expected to stabilize or expand gross margins. As these improvements flow through the income statement, they could restore investor confidence in normalized earnings and support a re-rating of the company’s valuation.

Scaling and Monetization of the Healthcare Segment: The company’s connected health initiative, HealthBeacon, is beginning to show commercial traction. It delivered three consecutive quarters of subscription growth and secured a strategic partnership with OptumHealth—an institutional milestone. While not expected to break even until 2026, growing scale and validation from pharma and payer partnerships could prompt investors to assign value to this underappreciated, potentially high-margin business line.

Premium Portfolio and DTC Expansion: Hamilton Beach is repositioning its product and channel mix toward higher-margin opportunities. Premium brands like CHI, Bartesian, and Numilk are gaining traction in ecommerce, while the upcoming launch of Lotus—its fully owned, wellness-oriented kitchen brand—will replace the discontinued Wolf Gourmet. Parallel investment in direct-to-consumer capabilities supports structurally better margins and customer lifetime value. As these initiatives gain scale, they could lift earnings quality and justify higher valuation multiples.

DISCLOSURE: No position

Hamilton Beach Investor Presentation. August 28, 2024. Available at: https://s22.q4cdn.com/547337446/files/doc_presentations/2024/Aug/28/investor-presentation-2024.pdf

“What Happened To Numilk After Shark Tank?” Food Republic, 2023. Available at: https://www.foodrepublic.com/1373821/numilk-shark-tank-now/

United States Small Kitchen Appliances Market – Growth, Trends, and Forecasts (2024–2029). Mordor Intelligence. Available at: https://www.mordorintelligence.com/industry-reports/us-small-kitchen-appliances-market

Hamilton Beach Investor Presentation. August 28, 2024. Available at: https://s22.q4cdn.com/547337446/files/doc_presentations/2024/Aug/28/investor-presentation-2024.pdf

Small Appliance Market – Global Snapshot and Growth Drivers (Infographic). Openbrand, 2024. Available at: https://openbrand.com/newsroom/blog/small-appliance-market-infographic

You can see this through earnings calls transcripts, where sometimes there is only one analyst/investor and other times there is none.