The Best Ideas I Found in Q1 2025 Investor Letters (Part III)

I’m back with a third part of the letters that I like to read and write-down the most interesting parts.

If you missed the Part I & Part II of the Q1 2025 Letters, go and read it. Quite a few interesting ideas!

TL;DR

Companies mentioned in the letter

Aris Water Solutions (ARIS)

San Juan Basin Royalty Trust

Hawaiian Electric Industries, Inc. (HE)

AI and Data Center Demand

The current AI-driven data center boom may rival the scale and cost of World War II. Meta alone plans to spend over US$60 billion on data centers in 2025, and estimates suggest that U.S. data center investment could reach US$1.8 trillion by 2030—comparable, in inflation-adjusted terms, to the U.S. war effort from 1941 to 1945. This investment cycle is largely driven by the resource-hungry nature of AI and the explosion of digital data.

The build-out of extremely large data centers has the potential to be the greatest deployment of private investment capital in history.

At the heart of the energy demand is the Large Language Model (LLM) AI typified by ChatGPT. These systems require massive amounts of computing power to perform their statistical operations—calculating probabilities for each next word in a response, not based on understanding, but on brute-force pattern matching across the entire internet.

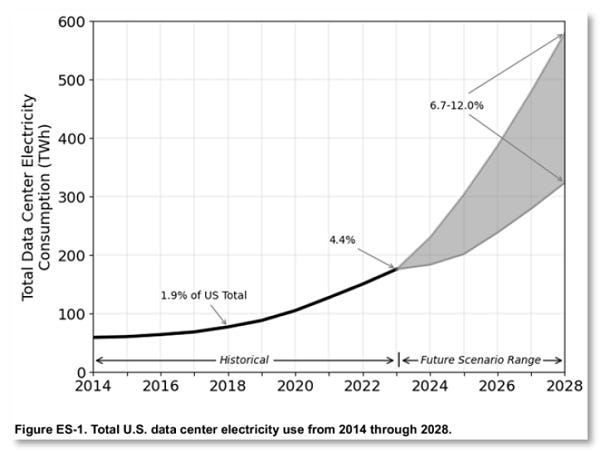

A single ChatGPT request can require hundreds of billions of calculations, and as usage skyrockets, so too does electricity consumption. According to a Berkeley Lab study, data centers may account for as much as 12% of U.S. electricity usage by 2028, up from 4.4% in 2023. That would be a staggering shift, especially in a country with flat power generation and an aging grid.

The only AI the public has interacted with is the Large Language Model type, like ChatGPT. It’s easy to find lists of very large markets for it.

Among them: voice search and fake review detection (for e-commerce); proofreading and writing (for legal contracts, or for pretend investment research on financial news websites); data, intelligence, and cyber threat analysis and response (for commercial and military users); facial recognition, and gait and body language analysis (for surveillance and law enforcement); and back-office automation and portfolio analysis (for the banking sector). Other applications for AI include image and video generation, GPS navigation and autonomous driving, and robotics and industrial automation.

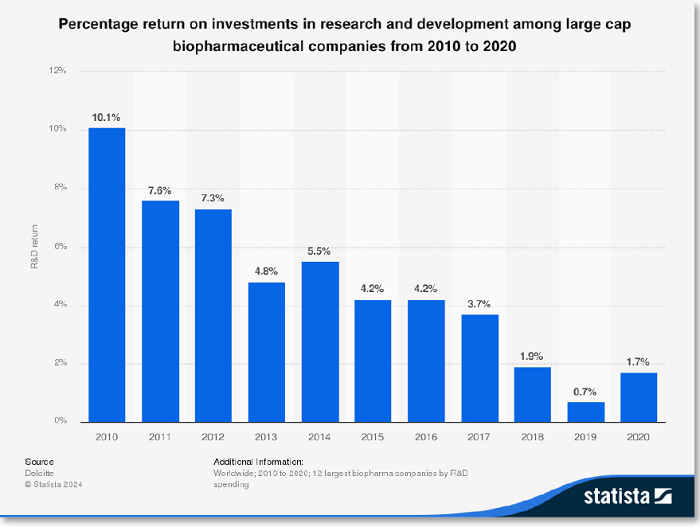

But AI isn’t just about LLMs. Horizon highlights Large Math Models (LMMs) as an even more transformative but lesser-known AI application. Unlike LLMs, which depend on pre-existing data, LMMs generate their own data through high-performance simulations. This makes them especially suited to areas like drug discovery, where novel proteins or molecules must be modeled in dynamic, complex 4D environments (three-dimensional space plus time). The result: simulations that can accelerate drug development from 10 years down to 18 months, while dramatically reducing the costs and risks of failure in late-stage clinical trials.

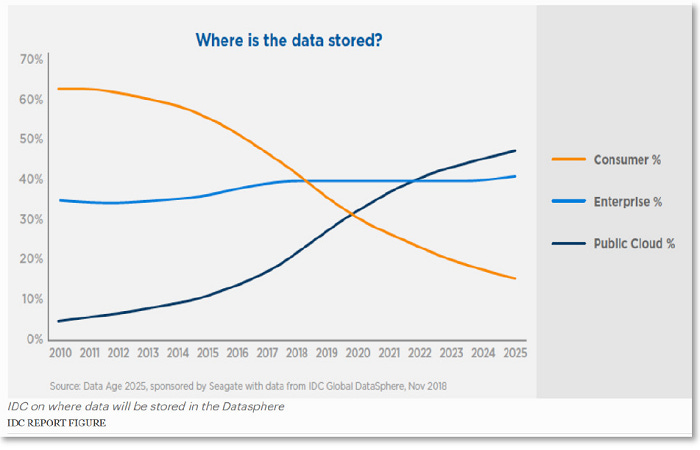

To illustrate the scale, the commentary cites a study that required 2 petabytes of data—equal to 13 years of high-definition video—to digitally reconstruct just one cubic millimeter of mouse brain tissue. This shows not only the computational heft of AI but also the permanent storage demands that will drive long-term growth in data center infrastructure.

Ultimately, Horizon argues that this surge in AI and data center investment is economically rational, not speculative. LMMs offer real cost savings in billion-dollar drug development processes, and their use is expanding into adjacent industries like materials science and energy. Even if some AI applications—like surveillance or job replacement—are socially controversial, the promise of curing diseases or creating better materials ensures widespread adoption. This inevitability, they suggest, will place massive long-term demand on electricity, water, and raw materials, offering critical insight for portfolio positioning.

Portfolio Positioning in Data Center companies

With trillions in capital pouring into the construction and operation of these facilities, the key question isn’t whether to invest in this transformation—it’s how.

The first approach is direct: invest in companies like GE Vernova, a manufacturer of high-capacity gas turbines for power generation. The company has a multi-year backlog and increasing capacity to meet new orders, including for small modular nuclear reactors. While such companies stand to benefit from the data center boom, they are also **massive consumers** of the very commodities that are becoming scarce—such as steel and electricity—and thus may not offer the best risk-adjusted returns.

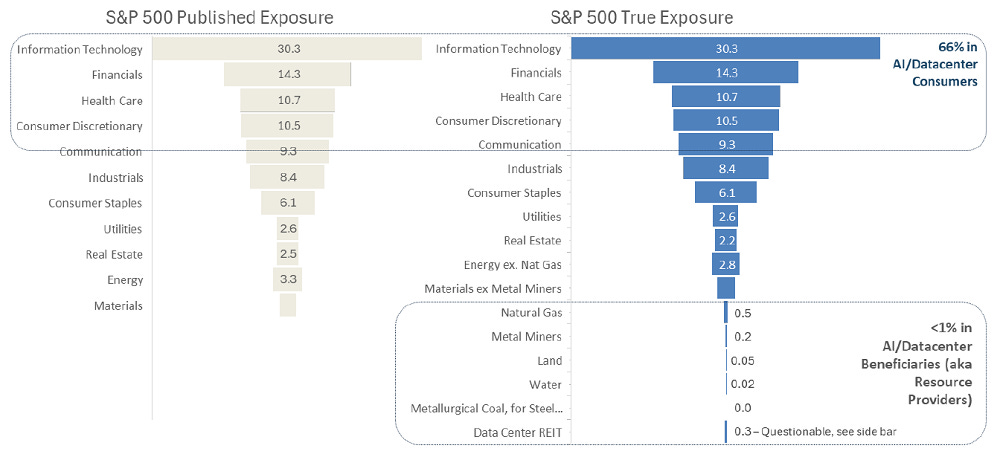

The second, more prevalent approach is indexation, which appears to offer wide exposure to AI beneficiaries through large index funds. Sectors like health care, financials, and IT—which dominate the S&P 500—are deeply linked to AI adoption. Pharmaceutical firms can use AI for drug discovery, banks for operational efficiencies and balance sheet optimization, and tech giants for cloud services. However, Horizon cautions that this index-based exposure is deceptively concentrated. With over 66% of the S&P 500 now tightly coupled to the AI value chain, there’s an increase in correlated risk rather than true diversification.

What’s more, the companies driving the AI revolution—like cloud providers and pharmaceutical giants—are consumers, not providers, of the critical resources required to support this transformation. These include natural gas, water, steel, and land. Yet, resource producers make up a minuscule portion of the indexes: less than 4% overall, with metals mining at 0.25%, and natural gas exposure only about 1%. Water and land-based providers are practically invisible in benchmark ETFs.

Horizon emphasizes the paradox: while AI-linked companies absorb the lion’s share of investor capital, the enablers of this infrastructure—such as natural gas producers or water logistics firms—remain neglected. The imbalance suggests that resource scarcity, not just AI capabilities, may drive future returns. They even note that some water ETFs contain little actual exposure to water as a commodity, and that REITs holding data center infrastructure suffer from structural limitations like high leverage and poor per-share value compounding.

The team proposes a contrarian thesis: rather than following capital flows into the high-visibility AI names, investors might achieve superior returns by focusing on limiting-factor assets—those commodities and infrastructures without which the data center revolution cannot happen. These assets are not only under-owned and under-indexed, but also poised to benefit from inevitable supply-demand imbalances.

Portfolio Insights

Horizon Kinetics challenges the conventional framework used by index-based investing and traditional stock screeners, which rely heavily on descriptive attributes—such as sector classifications, market caps, trading volumes, and historical earnings growth. These measures, the team argues, are inherently backward-looking and offer little predictive value when it comes to future performance.

Instead, Horizon advocates for focusing on predictive attributes—less quantifiable factors that indicate a company may have outsized return potential over time. One example is the presence of dormant assets: unmonetized land or legacy holdings that may not show up meaningfully on the balance sheet but could generate substantial value under the right circumstances. Another example is a company caught in a time arbitrage opportunity, where market participants heavily discount near-term uncertainty and fail to price in a more favorable long-term outcome.

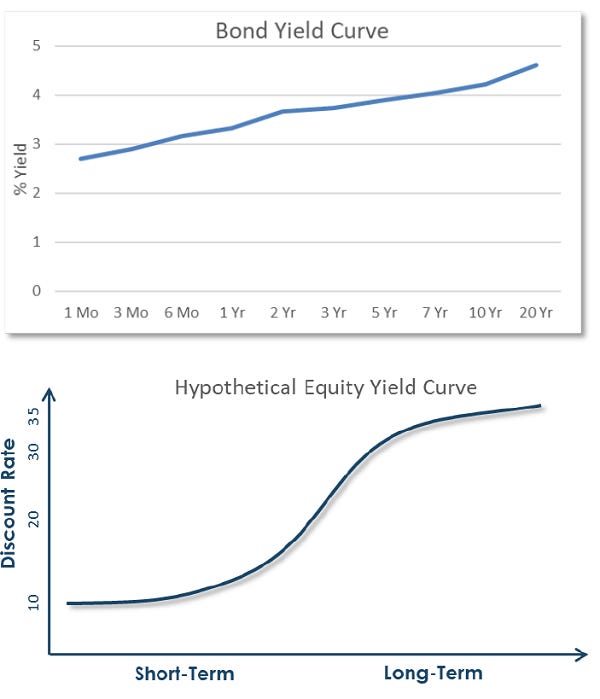

This concept of “equity yield curve” investing is central to Horizon’s approach. Just like bond investors demand a higher yield for lending over longer durations, equity investors often discount future returns too steeply when there’s uncertainty about timing. But if the payoff is large and the resolution timeframe is reasonably knowable—even if it’s two or three years out—then the annualized return can be enormous. Horizon shares an historical case from Pacific Gas & Electric preferred shares during bankruptcy proceedings, where a patient investor could realize a 35% annualized return simply by waiting for the resolution.

The takeaway is that high-conviction, time-dislocated opportunities—especially those with some contractual or legal pathway to value realization—often exist **outside the visibility of index-based investors**. Horizon is deliberately positioning its portfolios in such opportunities today, especially where they intersect with the AI and data center infrastructure themes. While the broader market pours capital into obvious “AI winners,” Horizon is focused on the **inputs**: companies with strategic exposure to electricity, water, land, and hard infrastructure that will be indispensable for supporting this multi-trillion-dollar AI buildout.

This approach favors companies with misunderstood timelines, unconventional assets, or regulatory structures that temporarily obscure their intrinsic value—but that offer asymmetric returns once revalued. These are not fast trades, Horizon acknowledges, but rather deliberate long-duration bets with a high probability of success for investors willing to wait.

The hidden diamond in Data Center:

The Recurring Business of Shared Cloud Responsibilities.

The overlooked insight here is that while AI and data centers are grabbing the headlines, the real constraint in this buildout isn’t technology—it’s resources. The market continues to price AI like it’s software: infinite scalability, low marginal cost, perpetual growth. But the physical world has limits—land, energy, water, even regulatory bandwidth. We’re about to find out how hard it is to pour trillions into capex without tripping over those limits.

The risk isn’t that AI growth stops. It’s that the capital cycle shifts—AI demand stays high, but resource scarcity drives bottlenecks and cost overruns. That’s where patient capital can play: finding those underappreciated infrastructure and resource bets, the literal inputs that make this whole thing possible.