The Best Ideas I Found in Q2 2025 Investor Letters (Part III)

From the letters of JDP Capital (Jeremy Deal) and Emeth Value Capital (Andrew Carreon).

Did you miss the best ideas of Q1 2025?

No biggie, below you can download a PDF with 24 pages of the best ideas of Q1 2025 from investors letters

Also some best ideas of the Q2 2025

Investment thesis on

Spotify (NYSE: SPOT)

SoftwareOne Holding (SWX: SWON)

Spotify (NYSE: SPOT) – JDP Capital

Jeremy has held Spotify for over six years and seen a significant return, with the stock appreciating more than 5x over that period and rising 71.5% in the first half of 2025 alone.

The core thesis rests on Spotify’s ability to capture and monetize attention through spoken-word content—a space Jeremy believes is still undervalued relative to video and other media formats. While Spotify’s platform has long excelled at delivering a personalized user experience, the real opportunity lies in how efficiently the company can now monetize its audience as both usage and tools scale.

Similar to YouTube and Meta, Spotify continues to demonstrate that owning consumer attention at scale can be more valuable than owning the content being consumed. While other platforms have been ultra successful at monetizing video, unlocking the value of audio has historically required a different approach. Spotify has made enormous progress in closing the monetization gap between audio and video but we are still very early on this journey.

A critical turning point arrived in June 2025, when courts in the U.S. and Europe ruled against Apple’s App Store payment restrictions. The result: Spotify can now direct users to external payment systems from within its app, bypassing Apple’s 15–30% commission and eliminating a key source of customer acquisition friction. This ruling not only improves Spotify’s unit economics and lowers churn but also unlocks new business lines where in-app purchasing is essential—such as audiobooks, education content, and third-party partnerships.

Spotify can now evolve faster into a grown-up marketplace platform allowing artists, authors, podcast creators, and content owners of all walks of life to directly monetize their audiences with products and services.

Jeremy notes that while Spotify’s current advertising business remains modest (~€2 billion, or about 10% of revenue), its scale—145 million U.S. users and over 600 million globally, on track to reach 1 billion in 18 months—offers significant headroom. In comparison to platforms like YouTube or Meta, which generate tens or hundreds of billions in ad revenue, Spotify’s ad business appears underdeveloped, providing a long runway for growth.

On valuation, Spotify screens expensive—about 30x projected 2026 EBITDA. But Jeremy argue this overlooks the company’s long-term earnings power. If Spotify can reach its stated goal of €20 billion in operating earnings, and do so without significant capital needs, the current valuation may prove conservative.

(JDP’s letters are not publicly available. If you want to get them, go to https://jdpcap.com/)

SoftwareOne Holding (SWX: SWON) – Emeth Value Capital

SOWN is a Swiss-based global provider of software reselling and digital IT services. Andrew believes that the company is caught between two identities: a fading perception of it as a commoditized software reseller and the reality of a fast-evolving, service-driven company deeply embedded in the global shift to cloud and software-as-a-service. This identity misalignment, combined with recent governance events and legacy reporting, has created a material valuation gap that Andrew believes is both unjustified and likely to close.

SoftwareOne’s origins are rooted in Microsoft license reselling—a low-margin, volume-based business that many public investors reflexively avoid. But over the last several years, the company has been quietly and steadily transforming into a full-spectrum IT services platform. It now offers software lifecycle management, FinOps, multi-cloud advisory, digital transformation consulting, and managed services to over 65,000 corporate clients across more than 90 countries. Its strongest growth—and highest-margin contributions—now come from these recurring and value-added services. In fact, while software resale still generates most of the revenue, Andrew points out that nearly half of SoftwareOne’s gross profit now comes from services, and that portion continues to grow at a low double-digit pace.

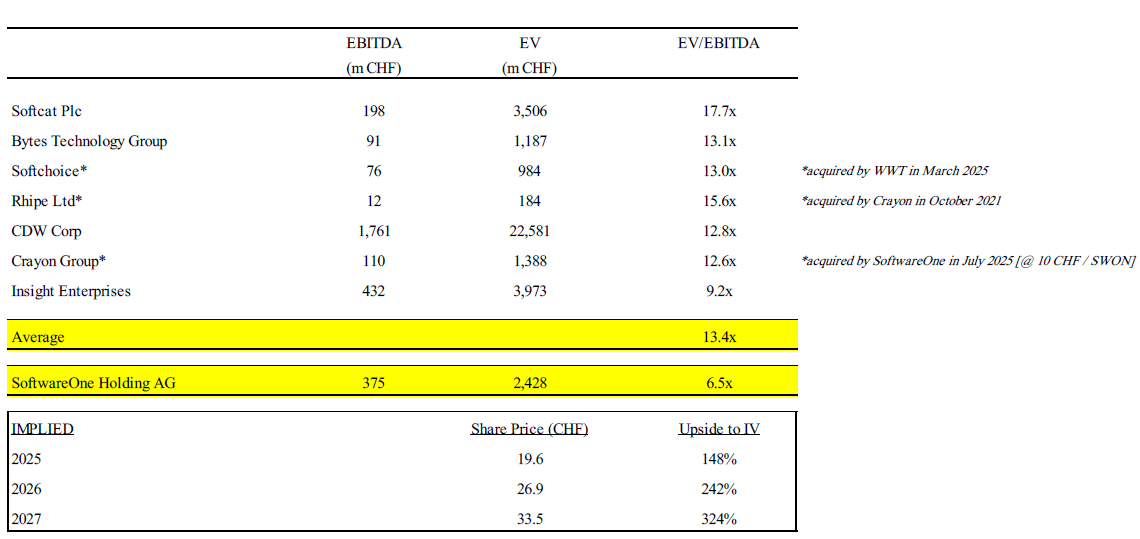

The market, however, has been slow to adjust. SWON remains classified and perceived by many as a low-margin distributor—a view reinforced by its reporting structure, which doesn’t fully separate or highlight the economics of its services business. As a result, it trades more like a wholesaler than a consultative SaaS-enabled business. Andrew’s core argument is that this perception gap—not business performance—is at the heart of the opportunity. The company is profitable, growing, asset-light, and carries a net cash position. But it remains deeply undervalued:

This mispricing has been compounded by governance distractions. In 2023, a consortium led by Bain Capital and SoftwareOne’s founding shareholders launched a failed take-private bid, which created uncertainty and friction at the board level. That bid ultimately fell apart, but its implications are critical to Andrew’s thesis. First, it confirmed that sophisticated buyers were willing to pay a premium for the business. Second, the failure of the bid set the stage for improved governance and leadership. Enter Brian Duffy, the company’s new CEO and former executive at SAP. Duffy has already begun reshaping the company’s focus: clarifying its growth strategy, simplifying the reporting structure, emphasizing margin expansion, and aligning leadership incentives around shareholder value. He has also publicly acknowledged that the board is considering strategic alternatives, including a potential breakup or divestiture of the software resale business to unlock the true value of the services operation.

SoftwareOne is one of the few global-scale platforms that straddles both resale and advisory. Its scale, customer base, and vendor relationships are all attractive to both private equity and strategic buyers. If the company were to spin off, sell, or reorganize its resale business—which is still cash generative but structurally lower multiple—it would allow the services business to be more easily valued in line with peers. IT consulting and managed services firms, especially those focused on cloud enablement, routinely trade at 12–18x EBITDA. Even a modest re-rating of SoftwareOne’s blended business to 11–12x would imply 50–80% upside, according to Andrew’s estimates.

In the meantime, Andrew notes that the company has ample levers to create value internally. Management recently announced a share buyback program, signaling a shift toward more disciplined and shareholder-aligned capital allocation. The balance sheet is clean, with no net debt. Organic growth remains solid, and the company is well-positioned to benefit from the secular tailwinds in enterprise cloud migration, software expense optimization, and AI-related infrastructure upgrades.

One of the most interesting parts of the thesis is the idea that SWON is a misunderstood business model, not a broken one. The public markets are still pricing it as if it's a legacy reseller, but the clients engaging with SoftwareOne don’t see it that way. They rely on it as a multi-cloud advisor, a FinOps guide, and a long-term managed service partner. In that sense, the disconnect is between what the business does in practice and how it is categorized and valued by investors.