The Best Ideas I Found in Q2 2025 Investor Letters (Part II)

From the letters of Wedgewood Partners (David Rolfe) and Gate City Capital (Michael Melby).

PRESENTED BY

Did you miss the best ideas of Q1 2025?

No biggie, below you can download a PDF with 24 pages of the best ideas of Q1 2025 from investors letters

Also some best ideas of the Q2 2025

Investment thesis on

Zoetis (NYSE: ZTS)

Heartland Express (NASDAQ: HTLD)

But first, a quick update from our friends:

I’m excited to share that my friends at TIL.LAW have just launched their new book, Fundamentals.

The author and managing member of The Investments Lawyers, Michael Huseby, simplifies the complexities of fund formation, covering everything from fund structuring and compensation to key legal terms, negotiation strategies, fundraising, securities laws, and more.

This is the perfect guide if you WANT TO LAUNCH YOUR OWN FUND

So don’t get too shy and get your copy NOW

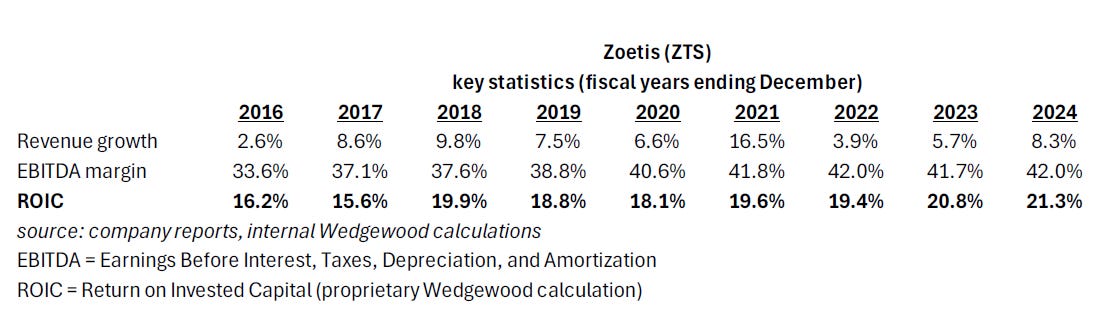

Zoetis (NYSE: ZTS) – Wedgewood Partners

Zoetis is the global leader in animal healthcare, offering a wide array of products and services for both pets and livestock. Its portfolio includes medicines, vaccines, diagnostic tools, and related services. The company operates in over 100 countries, with approximately 55% of its revenue coming from the U.S.

It’s revenue is split about 70% pets and 30% livestock. In the U.S., the business is pet-focused, while in developing countries, livestock dominates.

The pet segment benefits from rising pet ownership, increased pet longevity due to better care, and the growing view of pets as family members.

The livestock segment is driven by global population growth and rising incomes, particularly in countries like Brazil, leading to greater demand for animal protein.

The industry has several growth drivers:

Secular growth in pet ownership, especially during and after the COVID-19 pandemic.

“Pet humanization” trend, with more owners seeking advanced treatments instead of euthanasia for sick animals.

Growing demand for high-quality meat protein in emerging markets.

Under-penetration of existing treatments: Even products like Apoquel (a leading pet dermatology medication launched 12 years ago) continue to see double-digit volume growth due to the expanding pet population and broader adoption.

Valuation

After years of high valuation due to investor enthusiasm (especially during the COVID-19 pet boom), Zoetis's stock has fallen below the Russell 1000 Growth Index valuation and trades at a P/E multiple last seen a decade ago, despite the company being larger, more profitable, and still growing at healthy rates.

Conclusion

Wedgewood believes Zoetis is a classic example of a high-quality business that temporarily fell out of favor. With favorable industry trends, strong financial metrics, and a now-attractive valuation, they see this as a compelling long-term opportunity.

We often say that there are no undiscovered gems in the U.S. large-cap growth company universe, realistically: the largest, fastest-growing companies in the world’s largest public equity market generally have been noticed by more than a few people. This, by definition, is why they have large-cap market capitalizations. However, much to our surprise, we do occasionally manage to find a relatively unknown stock in our universe.

In the case of Zoetis, and other pet-related stocks that we continue to study, we definitely noticed the positive industry trends, and the quality business models for many years. However, from watching the valuations of the stocks in the industry, it was very clear that everyone else had noticed, as well, and the market generally was happy to pay almost any price, irrespective of valuation, to own these businesses.

Rather, we tend to buy great companies when they fall out of favor. Perhaps there are controversies surrounding the companies, or temporary issues we firmly believe will dissipate or be quickly corrected. Often, the market just loses interest in a company or industry.

We claim to be long-term investors, and our behavior over 30+ years bears this out; therefore, we tend to get excited when we have been monitoring a great business for many years, and the market eventually presents us with an opportunity to buy it at an attractive entry point.

This has now happened with Zoetis.

Heartland Express (NASDAQ: HTLD) – Gate City Capital

HTLD is a U.S.-based truckload carrier focused on medium- to long-haul freight transportation. The company is known for its conservative financial management, durable margins, and disciplined approach to capital allocation. Unlike many competitors, Heartland maintains a net cash balance sheet and a long-standing commitment to operational efficiency — characteristics that have historically allowed it to outperform through freight cycles.

The business is currently facing one of the worst downturns in recent memory, driven by soft demand, overcapacity, and low spot rates. However, Gate City Capital views these pressures as cyclical rather than structural. The firm believes that Heartland, despite near-term earnings compression following its 2022 acquisition of Contract Freighters Inc. (CFI), remains well positioned to benefit as the freight market normalizes.

Historically, Heartland has operated with EBITDA margins above 20%, near the top of the industry. Although margins are currently depressed, Gate City expects a return to normalized profitability as CFI is fully integrated and market conditions improve. Importantly, Heartland’s strong balance sheet and cash flow allow it to remain flexible during the downturn — continuing to invest, pay dividends, and buy back shares.

On valuation, the stock trades at approximately 9–11x normalized earnings based on estimated earnings power of $1.20–$1.40 per share, and about 4x normalized EBITDA. This represents a meaningful discount to both historical valuation multiples and peer group averages, particularly given the company’s high-quality fundamentals and track record of resilience.

In Gate City’s view, Heartland Express offers investors an attractive combination of downside protection and upside optionality — a cyclical compounder poised to benefit from both earnings recovery and multiple re-rating.

Gate City has historically had success investing in cyclical industries when the industry is at or near a cyclical low. In 2025, the trucking industry entered its third straight down year as hopes for a recovery were dashed as tariff-related trade disruptions hurt freight demand.