WorldlyInvest Weekly #7

The growht of the semiconductor industry; How a microcap soared 37x in 2024; Li Lu and what value investing is; The importance of leadership; Spotify's deep dive; and more.

DISCLOSURE: The following weekly edition contains an affiliate link to Amazon. If you purchase through this link, I may earn a small commission at no additional cost to you. Your support helps keep this newsletter free and focused on delivering high-quality content for you.

Quote of the Week

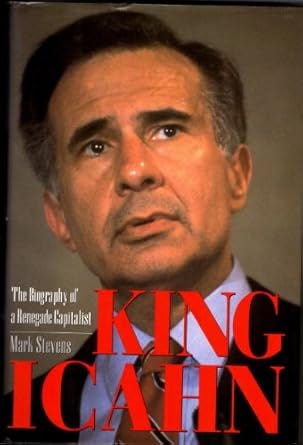

Happy birthday Carl!

Some people get rich studying artificial intelligence. Me, I make money studying natural stupidity.

— CARL ICAHN

ICYMI

In his final interview, Ben Graham critiqued the Efficient Market Hypothesis and why invest in index fund is a good strategy

The Best of the Week

Will Semiconductor Industry’s Historic Growth Continue?

The Pareto Investor shares his insights on the semiconductors industry. The industry has experienced remarkable growth, with annual shareholder returns averaging 25% from 2015 to 2019 and economic profits surging from $3.5 billion (2000–2004) to $49.3 billion (2016–2020). North America leads with 60% of global profits, followed by Asia (36%) and Europe (4%). Driven by the pandemic’s digital acceleration and industry consolidation, semiconductors are vital across sectors like AI, automotive, IoT, and 5G. Looking ahead, demand for high-performance chips in autonomous vehicles, machine learning, and connected devices is expected to sustain growth.

You Can’t Miss These Readings

How This Micro-Cap Stock Soared 37x in 2024

Polymath Investor shares this interesting case study of how TSS Inc., a micro-cap data center and AI infrastructure provider, achieved a 3,700% gain in 2024, driven by strong earnings and underreaction patterns. Despite reporting Q2 net income up 345% and 41% gross profit growth, the stock only rose 18%, as investors initially overlooked its potential due to low visibility and OTC trading.

Value Investing According to Li Lu

Kingswell writes a summary of Li Lu’s speech at Peking University. Li Lu outlined six core principles of value investing, emphasizing that price is what you pay, but value is what you get.

Rolling the Dice: The Leadership Gamble

James Emanuel writes how strong leadership is the cornerstone of business success, using examples like Steve Jobs, who revived Apple, and contrasting it with struggles at IBM and Intel under weaker management. Emanuel emphasizes that investors should focus on people, not just companies, as a change in leadership often changes a company’s trajectory.

Recommended Book

King Icahn: The Biography of a Renegade Capitalist

Happy birthday, Carl Icahn!

Activist investor Carl Icahn is a classic Ben-Graham value investor. Written by Mark Stevens, this biography reveals how Icanh’s bold investments and corporate battles shaped the markets and made him a legend.

Stock Ideas

International Petroleum Corporation

Idea Hive presents International Petroleum Corporation (IPCO) as an attractively priced oil and gas producer with a significant growth asset, Blackrod, which is expected to start production in 2026 and reach 30,000 barrels of oil equivalent per day by 2028.:

FCF is expected to surge with increased production and reduced capital capex from 2026 onwards.

Blackrod’s contingent resources (1,025m boe) could significantly expand reserves and future output.

Management repurchased 71 million shares since 2017 (~37% of total).

American Coastal Insurance Company

William shares his investment thesis on American Coastal Insurance Company (NASDAQ:ACIC), a company specialized in Florida catastrophe insurance, focusing on commercial condominium policies:

Grew from $3M to $303M premiums (2007–2013) through strong underwriting and partnerships.

ACIC consistently outperforms peers with low combined ratios (57% in Q3 2024) even during severe hurricane seasons.

Strong capital returns, including a recent special dividend and opportunistic share repurchases.

Spotify

Yehoshua Zlotogorski shares his deep dive on Spotify. Contrary to the belief that Spotify is at the mercy of record labels, the author argues Spotify has strong pricing power, a powerful moat, and long-term growth drivers.:

Cost reductions across R&D, sales, and marketing have boosted FCF margins to 14.5% in 2024.

Network Effects: Social music-sharing features like playlists and Spotify Wrapped drive engagement and lower customer acquisition costs.

Switching Costs: Personalized playlists, listening history, and recommendations create stickiness..