Your Guide to 2025: Markets and Investments Outlook

Discover key insights from the top 2025 investment and markets outlooks by leading financial institutions

2025 is here, and the world’s leading financial institutions released their annual investment outlooks, offering insights into the global economic landscape, emerging trends, and actionable strategies for investors. These reports provide valuable perspectives on topics such as economic growth, the impact of central bank policies, opportunities in equities and fixed income, and the transformative power of AI and sustainability.

Ready?

INVESCO’s 2025 Investment Outlook

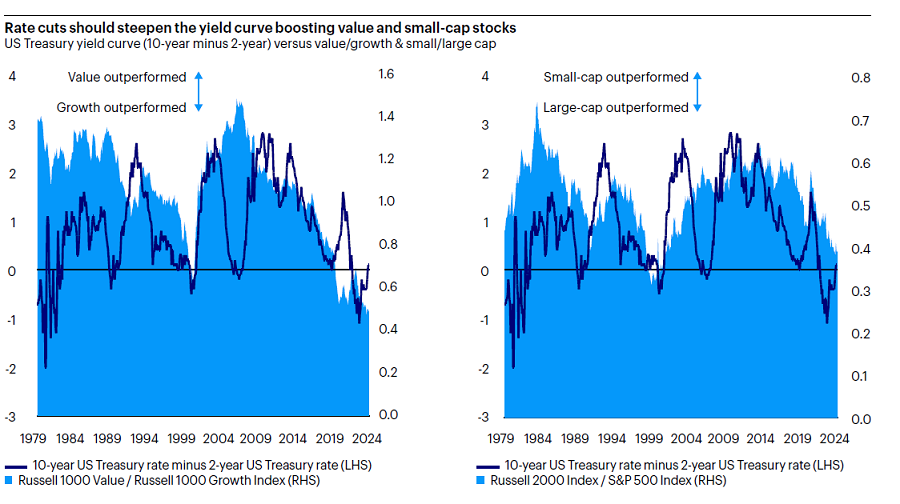

Kristina Hooper, Chief Global Market Strategist et al., provides a comprehensive analysis of the global economic and financial landscape for the year ahead. The report highlights key trends, including projected economic reacceleration, central bank rate cuts, and favorable conditions for risk assets such as small-cap and value stocks.

Key Takeaways

Economic Recovery Expected: Global growth is projected to slow in the near term but reaccelerate through 2025, with inflation near target levels.

Central Bank Easing: Rate cuts by major central banks, including the Federal Reserve, are expected to support growth and risk assets.

Investment Opportunities: Small-cap and value stocks, non-US developed markets, and high-yield fixed income are positioned for strong performance.

Emerging Markets Benefit: Policy easing and a softer US dollar favor emerging markets, with China's domestic stimulus playing a key role.

Risks to Monitor: Key risks include potential policy errors, inflation resurgence, and fiscal tightening in major economies.

Download the full report 👇

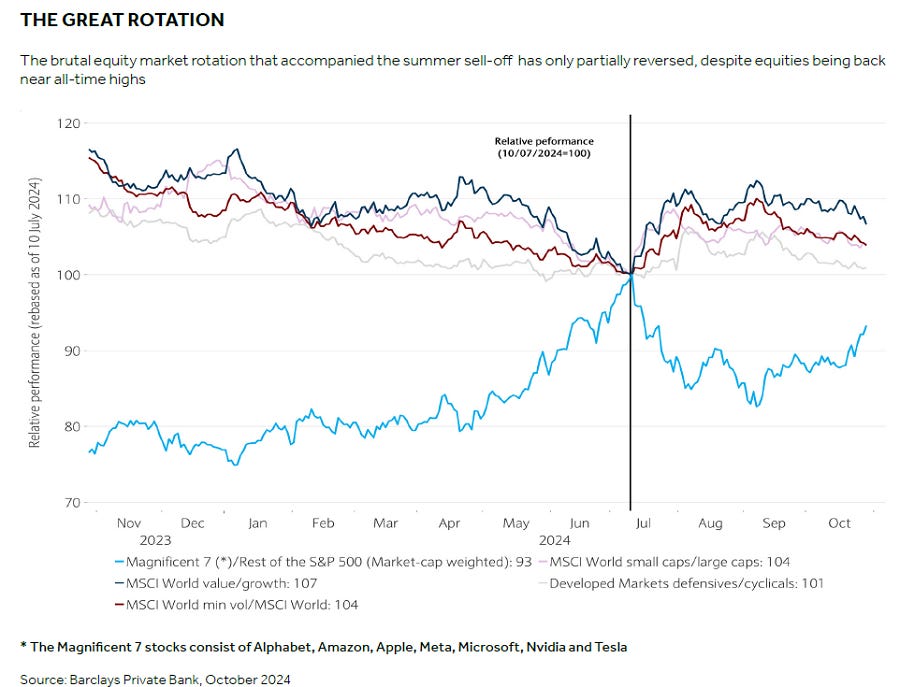

Outlook 2025 (Barclays Private Bank)

Published by Barclays Private Bank, the report covers key themes such as macroeconomic trends, investment strategies, the impact of artificial intelligence, and sustainability.

Key Takeaways

Global Economic Outlook: While global GDP growth is expected to slow to 3% in 2025, regional variations persist. The US is forecasted to grow at 2.1%, while the Eurozone and China anticipate more subdued growth of 0.7% and 4%, respectively. Rate cuts in major economies are likely to play a pivotal role in shaping economic activity.

Equity Market Dynamics: Following strong equity performance in 2024, returns may moderate in 2025. A focus on quality companies with strong fundamentals, especially in defensive sectors, is recommended. Market breadth is improving, creating opportunities in undervalued regions and sectors.

Fixed Income Strategies: With bond yields potentially past their peak, investors are advised to consider government bonds for stability and securitized credit for diversification. Emerging market debt remains attractive for its yield and diversification benefits despite geopolitical and economic risks.

The Role of AI in Investments: AI continues to be a transformative force but faces challenges such as energy demands, implementation complexities, and societal trust issues. Selective investment in industries where AI can drive productivity is key, as broad-based gains are limited in the near term.

Sustainability and ESG Factors: Investors are encouraged to integrate ESG considerations, focusing on key issues such as biodiversity, cybersecurity, and governance. The report highlights the need for companies to demonstrate resilience and adaptability in meeting regulatory and societal expectations related to sustainability.

Download the full report 👇

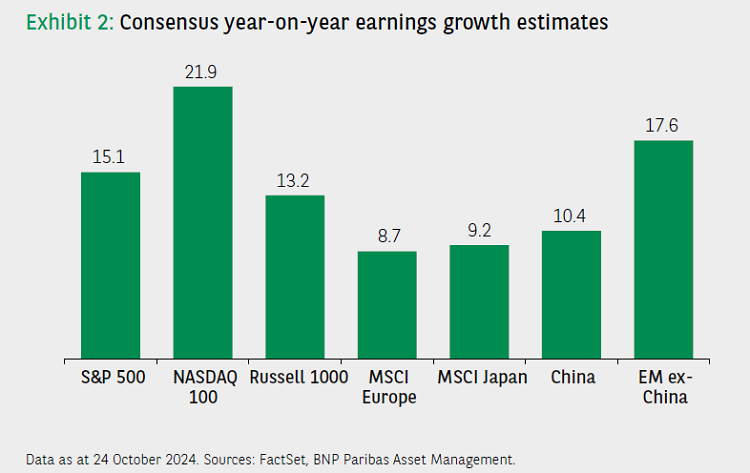

Investment Outlook for 2025 (BNP Paribas Asset Management)

The report explores key themes such as sustainability, macroeconomic shifts, private assets, and emerging market dynamics.

Key Takeaways

Economic Growth and Central Bank Policies: Global economic growth is projected to moderate, with the US expected to achieve a "soft landing," while Europe faces structural challenges, and China's recovery hinges on policy measures. Central banks are cutting interest rates, fostering a positive environment for equities and fixed income, though recession risks remain.

Sustainability as a Key Investment Theme: Transition finance, climate adaptation, and natural capital investments are at the forefront of sustainable investing. These themes provide opportunities to support environmental and social goals while targeting long-term value creation.

Opportunities in Private Assets: The private credit market is expanding, with new regulations like ELTIF 2.0 democratizing access for retail investors. Partnerships and sustainability frameworks are reshaping the private credit landscape, offering robust diversification potential.

Emerging Markets Outlook: Emerging market debt is poised to benefit from lower developed market interest rates and resilient economic fundamentals. Local currency bonds are particularly attractive due to high real yields, but careful country selection is crucial.

The Future of Fixed Income: As central banks unwind quantitative easing, fixed income markets regain prominence. Opportunities lie in corporate credit, emerging market bonds, and US mortgages, with rising dispersion creating arbitrage opportunities for active investors.

Download the full report 👇

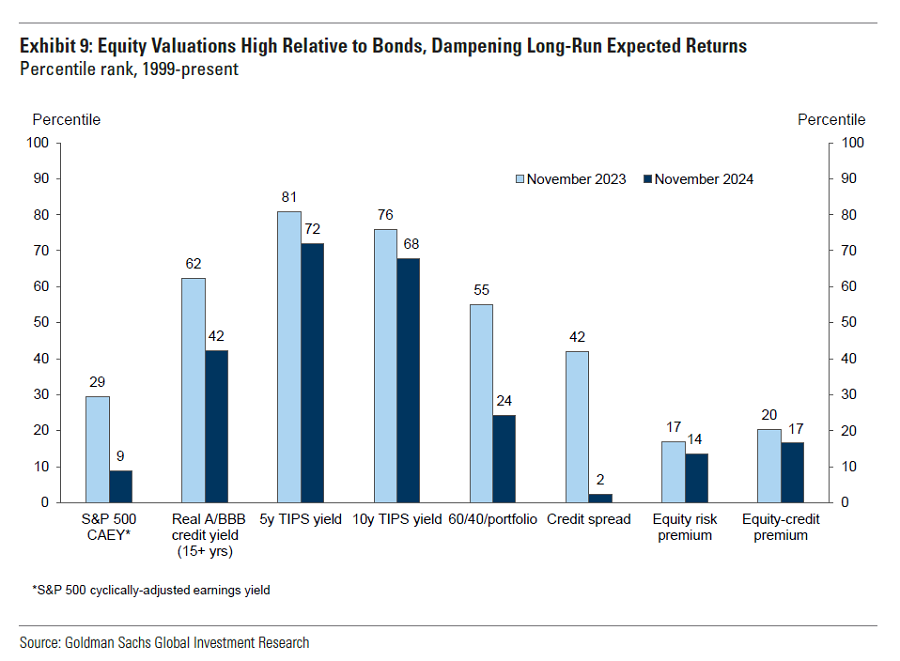

Markets Outlook 2025 (Goldman Sachs)

GS’ report provides an in-depth analysis of the global financial landscape, focusing on key investment themes and market dynamics. It highlights macroeconomic factors, geopolitical risks, and sector-specific trends shaping opportunities and challenges in 2025.

Key Takeaways

Soft Landing with Risks: The US economy is expected to achieve a soft landing with solid growth and cooling inflation, supporting higher equities and a stronger dollar. However, elevated tail risks from potential trade wars and geopolitical disruptions could disrupt this base case.

Impact of Tariffs and Trade Policy: Tariffs targeting China are expected but manageable, while broader tariffs pose significant risks to global growth, inflation, and equity markets. Trade tensions may reinforce dollar strength, with wider repercussions for non-US assets.

Sector and Regional Divergence: US growth is projected to outperform developed market peers, supported by fiscal expansion and regulatory easing. Europe and emerging markets face headwinds from stronger US dollar dynamics and geopolitical uncertainties.

Energy and Commodities Outlook: Oil prices are forecasted to remain range-bound ($70–$85 per barrel) with upside risks from geopolitical tensions. The medium-term outlook skews towards lower prices due to ample supply and potential trade-related demand slowdowns.

Diversification and Tail Risk Hedging: With heightened market uncertainty, diversification across asset classes and regions is critical. Long US dollar positions and exposure to gold and oil provide hedges against geopolitical and inflationary risks. US Treasuries and TIPS, along with European Bunds and Gilts, offer portfolio diversification.

Download the full report 👇

Investment Outlook Q1 2025 (HSBC Global Private Banking)

The report focuses on themes such as disruptive technologies, climate action, evolving societal trends, and regional growth engines, particularly in Asia.

Key Takeaways

Asia’s Resilient Growth: Asia ex-Japan is forecasted to grow by 4.4% in 2025, driven by robust domestic demand in India, ASEAN, and China’s policy stimulus. Investment opportunities lie in resilient domestic leaders with limited US exposure and companies benefiting from intra-regional trade.

Disruptive Technologies Driving Innovation: Key themes include Intelligent Automation & AI, NextGen Medicines, and advancements in digital infrastructure. These technologies are reshaping industries and creating investment opportunities in sectors such as aerospace, healthcare, and renewable energy.

Climate Action as an Investment Priority: The energy transition and circular economy themes are gaining momentum, with investments in low-carbon technologies and infrastructure. Innovations in renewable energy, nuclear technology, and biodiversity solutions present growth areas.

Opportunities in Real Estate: Global commercial real estate values are stabilizing after significant declines, particularly in Europe and the US. Investment volumes remain low but are expected to recover with further interest rate cuts. The residential sector shows resilience due to stable rental demand, while distressed office properties offer high-risk, high-reward opportunities for value-add strategies.

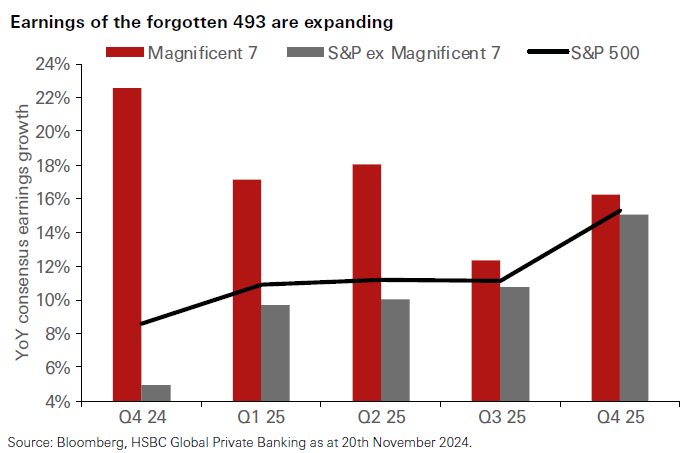

Earnings Tailwinds and Rate Cuts: Global equity markets are expected to benefit from earnings growth, supported by fiscal policies, innovation, and rate cuts. Active credit selection in fixed income offers opportunities to lock in attractive yields amid falling cash rates.

Download the full report 👇

2025 Investment Outlook (JP Morgan Asset Management)

The report highlights key themes, including the implications of post-pandemic economic normalization, the challenges of policy shifts under a new administration, and opportunities across various asset classes. It emphasizes the importance of portfolio rebalancing and active investment strategies to navigate the evolving financial landscape.

Key Takeaways

Economic Normalization with Policy Uncertainty: The U.S. economy is transitioning to a more typical growth rate of 2.1% in 2025, supported by stable consumer spending and easing inflation. However, policy changes, including potential tax cuts, tariffs, and immigration restrictions, introduce uncertainties that could impact growth and inflation trajectories.

Investment Opportunities in Fixed Income: As the Federal Reserve continues its rate-cutting cycle, investors are encouraged to extend duration, embrace high-quality credit, and explore municipal bonds for tax-equivalent yield benefits. The fixed-income market reflects a return to pre-2008 norms, with attractive yields and tighter spreads.

Equity Market Dynamics: U.S. equities are expected to continue their bull run, with broadening market leadership beyond the "Magnificent 7." Earnings growth is projected to reach 15% in 2025, driven by improving margins and capital investments. Sectors like industrials, energy, and consumer discretionary show strong recovery potential.

Global Investment Themes: International equities present mixed opportunities. Japan and India benefit from structural reforms and economic momentum, while Europe faces challenges from potential U.S. tariffs. Emerging markets outside China, such as India and Taiwan, offer attractive growth prospects tied to secular trends like AI and renewable energy.

Real Estate and Alternatives: Real estate valuations are stabilizing, with industrial and multifamily sectors leading recovery. Alternatives, including private equity and credit, remain essential for diversification and enhanced returns, benefiting from secular tailwinds such as the energy transition and supply chain restructuring.

Download the full report 👇

Private Equity 2025 Outlook (Schroders)

The report examines key market trends, including the impact of rising interest rates, the rebound in valuations, and the growing appeal of small and mid-market buyouts. It also highlights the role of GP-led secondaries as a strategic tool for navigating liquidity challenges.

Key Takeaways

Valuation Rebound and Lower Entry Multiples: Falling interest rates and easing inflation are expected to boost EV multiples in 2025. Small and mid-sized buyouts, which offer a 5-6x EV/EBITDA discount compared to large-cap peers, remain an attractive entry point for investors seeking value.

Resilience of Small and Mid-Cap Buyouts: Historically, small and mid-cap private equity funds have outperformed listed markets during periods of volatility. Their focus on less cyclical industries, recurring revenue models, and growth-oriented sectors like healthcare and technology positions them as robust investment options.

Rise of GP-Led Secondaries: GP-led secondaries, or continuation funds, have become a popular strategy, offering benefits like reduced blind pool risk, improved alignment of interests, and immediate capital deployment. This approach enhances liquidity and extends the growth potential of portfolio assets.

Shift Towards Larger Exits Amid Ample Dry Powder: Despite a subdued IPO market, private equity firms are well-positioned for exits through larger deals. The significant dry powder in large-cap funds ensures strong demand for high-quality assets, supporting favorable exit multiples.

Outlook for 2025: Private equity markets are poised for growth, with improving economic conditions fostering higher multiples and robust performance. The focus on small and mid-cap markets, combined with the strategic use of GP-led secondaries, aligns with long-term resilience and value generation.

2025 Thematic Outlook: AI and geopolitics (iShares)

Jay Jacobs, U.S. Head of Thematic and Active ETFs at BlackRock states that global markets are being shaped by two dominant forces: the rapid evolution of AI and shifting geopolitical landscapes. These themes are not only influencing technology and economic policy but also creating significant opportunities and challenges for investors.

Key Takeaways

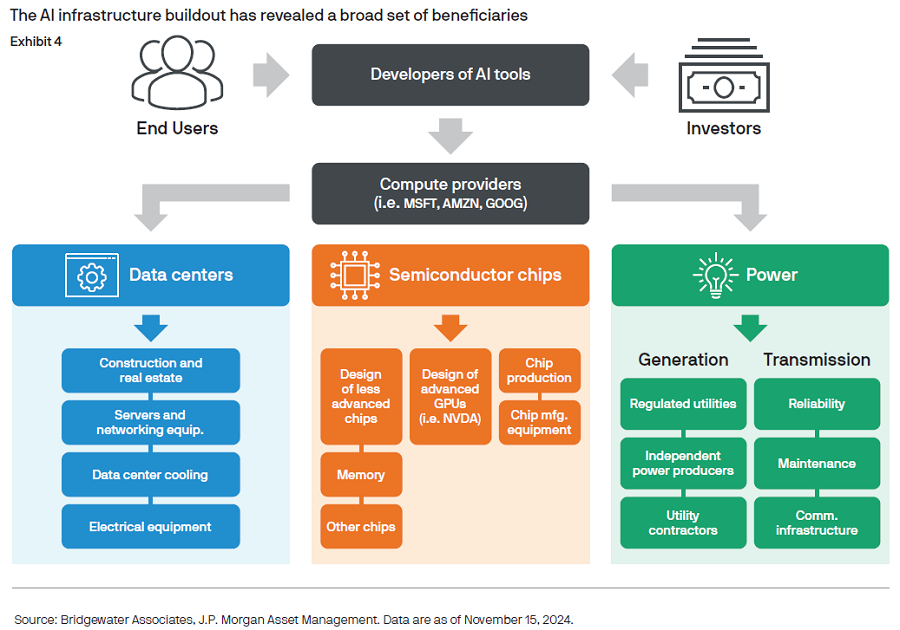

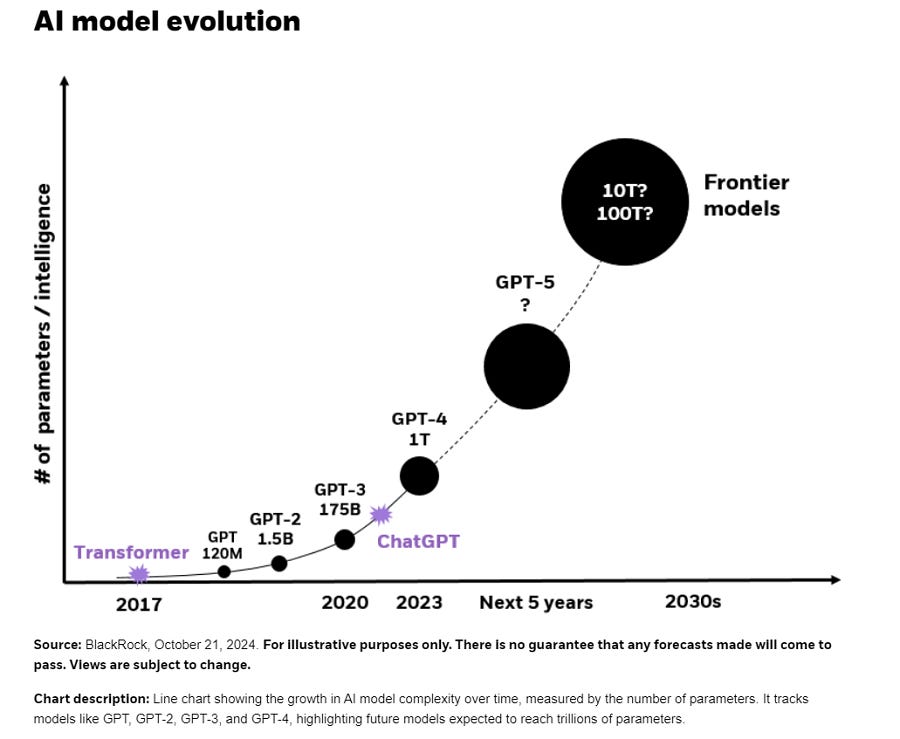

AI's Build Phase Accelerates: The AI revolution is entering a critical phase of infrastructure development, focusing on advanced chips, expansive data centers, and more sophisticated AI models. These advancements aim to propel AI adoption across industries, with a significant leap expected in the performance and efficiency of tools like Nvidia's next-generation GPUs and OpenAI's forthcoming GPT-5 model.

Economic Implications of Rate Cuts: A shift to a lower interest rate environment is anticipated, which could alleviate pressure on interest-sensitive assets, creating growth opportunities for sectors such as biotech, cryptocurrencies (e.g., Bitcoin), and infrastructure development.

Rebuilding the Physical Economy: Investment in infrastructure, manufacturing, and housing is poised to grow, driven by bipartisan policy support in the post-election environment. This development underscores a move towards strengthening the U.S. physical economy.

Cybersecurity's Rising Significance: As AI drives the value of proprietary data, cybersecurity investments are becoming essential. With global cybercrime costs projected to exceed $10 trillion by 2025, the sector presents substantial growth potential for investors.

Geopolitical and Regulatory Impact on AI: The global push to control AI technology is creating fragmented regulations, affecting the U.S. tech sector's global operations. Companies with more domestic focus may fare better under emerging protectionist policies.

BTW

I’ve launched 6 ebooks to support this newsletter and align with the principles and objectives of WorldlyInvest. These ebooks serve as guides to learning and applying various value investing strategies.

As a special launch offer, you can get each ebook for just $10.99 USD.

By purchasing, you’ll not only gain valuable insights but also support this newsletter’s growth.

Got a burning question or a topic you're curious about? I'd love to hear from you! Please drop a comment 💬 below or shoot me an email 📧 at worldlyinvest@gmail.com