10 High-Conviction Investment Ideas from Graham & Doddsville (Spring 2025)

A deep-dive summary of the Spring 2025 Graham & Doddsville newsletter—highlighting contrarian picks, deep value plays, and the reasoning behind them.

One of my most enjoyable reads is the Graham & Doddsville newsletter from Columbia Business School.

The Spring 2025 issue just came out, and I spent the weekend diving into it.

This edition features interviews with five seasoned investors:

Beeneet Kothari, Tekne Capital Management

Roger Fan, RF Capital Management

Scott Rosenthal, Hotchkis & Wiley Capital Management

Benjamin Beneche & Ramesh Narayanaswamy, Tourbillon Investment Partnership

It also includes three student-led investment ideas.

In this summary, I’m sharing my notes on the most interesting investments discussed in the issue.

If you wanna read more investment ideas, check my following summaries:

Ideas featured

Zengame Technology (SEHK: 2660)

Sprouts Farmers Market (NASDAQ: SFM)

RB Global (NYSE: RBA) — formerly Ritchie Bros.

Carlisle Companies (NYSE: CSL) — includes Carlisle Construction Materials (CCM)

Eternal Ltd. (NSEI: ETERNAL) — formerly Zomato

Siemens (XETRA: SIE.DE)

Nippon Sanso (TYO: 4091)

Nintendo (TYO: 7974)

Howden Joinery (LSE: HWDN)

Berkshire Hathaway (NYSE: BRK.A / BRK.B)

Zengame Technology (SEHK: 2660)

Roger Fan of RF Capital Management presents Zengame Technology as one of his highest conviction positions—despite the volatility it has endured over the past two years. Zengame is a mobile gaming company based in Hong Kong, operating a portfolio of over 50 casual freemium games, including Fingertip Sichuan Mahjong and Fishing Master. These titles consistently rank among the top iOS downloads in their category in China, with monetization driven by ads and in-app purchases. Originally bought at HK$1.15 per share, the stock surged to HK$6 before falling back to around HK$2.20 due to a weak 2024 in which revenue declined nearly 20%.

Yet despite the market’s cold shoulder, Fan sees immense value: the company trades at just 5x earnings and free cash flow, with no debt, a net cash position, and a 6.9% dividend yield. It also trades around tangible book value and even close to its net current asset value—a rare occurrence for a profitable tech business. Founders Ye Sheng and Yang Min, both veterans of Tencent’s gaming division, hold over 40% of the stock, aligning their interests with shareholders.

The company is extremely cheap. If you look at the multiples, Zengame has a negative enterprise value due to all its cash and short-term investments. Let's just stick with backing out the cash portion for now, that makes it about 2x EV/EBIT, a 29-48% pretax return on invested capital, depending on how you adjust for cash. It's trading for 5x earnings and free cashflow. It's a 0.8x tangible book and around 1x net current asset value. There's no debt, a 6.9% dividend yield, and the company is net cash.

Fan classifies Zengame as a "no-growth" business moving forward—flat revenue and earnings being the base case. But the margin of safety is compelling. Even under these conservative assumptions, the stock is mispriced, and any growth—whether from monetization improvement, breakout success of a new title, or overseas expansion—offers significant upside.

What about capital allocation? It has not been stellar, with management hoarding cash rather than deploying it into buybacks or dividends, but believes that the company’s undervaluation reflects excessive pessimism. This is a deep value idea in the truest sense: a healthy, cash-rich business trading below liquidation value with asymmetric upside over a 2–3 year horizon.

[Founders] They're not so focused on allocating that capital the best way that they can in terms of share buybacks, in terms of dividends, etc. My perspective of the two founders and what they're trying to optimize for is just making the best games that they can. They're trying to create the best games and user experiences that they can for the marketplace. They can certainly put more thought and effort into capital allocation, but I think where they're coming from, it's standard practice.

Sprouts Farmers Market (NASDAQ: SFM)

Sprouts is another core holding for Roger Fan, and like Zengame, it has delivered multi-bagger returns since Roger initiated the position in 2020 around US$15–16 per share. Today, the stock trades above US$70 (despite recent pullbacks), reflecting a successful growth story built on one of the most durable consumer trends: health and wellness.

Sprouts is a U.S. specialty grocer targeting a specific niche—health-conscious, higher-income, and predominantly female shoppers with specialized dietary needs (keto, paleo, vegetarian, gluten-free, etc.). With 440 stores across 24 states and a growing presence in urban and suburban markets, the company operates in a US$200 billion addressable market—specifically the “natural and organic” slice of the broader US$1.4 trillion grocery industry.

Fan points to the company’s outstanding execution in the last 12 months, with pretax earnings up over 30% and EPS up 50%. Despite that, he is honest about the valuation: the stock now trades at over 40x earnings, 32x FCF, and nearly 27x EV/EBITDA. For traditional value investors, that may be a hard pill to swallow. But he believes that Sprouts still offers a compelling long-term hold for those who evaluate companies based on quality and structural growth rather than just raw valuation multiples. A new loyalty program, slated to be a key comp driver in 2026, could deepen customer stickiness and improve monetization further.

Their comparable store sales look great. This is really impressive given food retailers are struggling as a group, and their e-commerce sales have also grown significantly. I think adding Uber Eat as a partner has really helped them and they also continue to open new stores. They've got something like 110 stores in the pipeline right now for existing markets, and they say that there's potentially 1,200 sites all across the US that can support Sprouts locations. This includes the Northeast, the Midwest, and all the states that Sprouts currently isn't in.

He sees the brand’s identity—wellness, clean eating, lifestyle alignment—as only becoming more relevant in the years ahead, bolstered by macro trends like the rise of alcohol-free beverages and longevity-focused food products. While he isn't adding to the position at today’s prices, he’s not trimming either. For investors with a growth orientation or tolerance for higher multiples, Sprouts still offers durable competitive advantages, demographic tailwinds, and operating momentum that justify its premium valuation.

RB Global (NYSE: RBA)

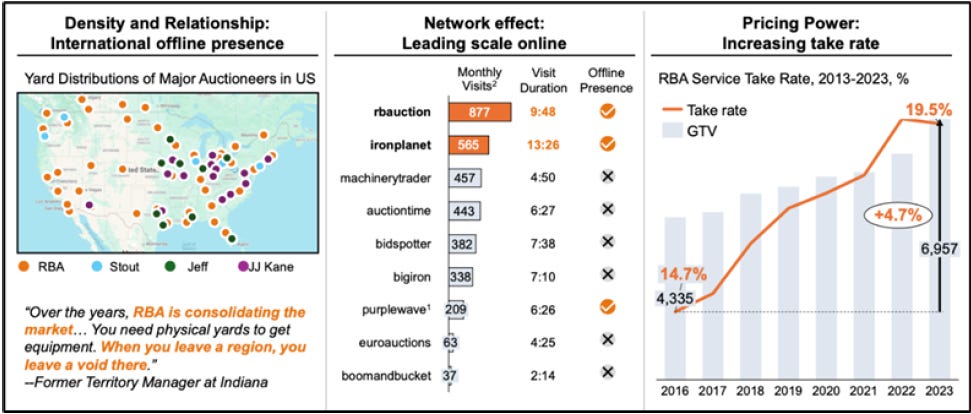

The student-led pitch on RB Global (formerly Ritchie Bros.) is a standout in this issue, winning 1st place in the 2024 Neuberger Sustainable Investing Challenge.

The core thesis is that RB Global is a best-in-class auction platform for heavy equipment and auto salvage that is being mispriced due to market skepticism around its large 2023 acquisition of IAA. RBA’s legacy business—auctions of used commercial equipment—has long been a stable, asset-light model benefiting from counter-cyclical dynamics: when new equipment is expensive or scarce, auctions become more popular. RBA charges take rates on both buyer and seller sides, with consistent gross transaction volume (GTV) growth through economic cycles.

In 2023, RBA acquired IAA, the second-largest player in the U.S. auto salvage market, putting it in direct competition with Copart. While Copart has historically been the gold standard, the pitch argues that IAA is rapidly closing the gap in areas that matter most to insurance clients: salvage returns, technology, user experience, and catastrophe response. Interviews with insurers and former executives suggest that IAA now provides salvage recovery rates on par with Copart. The company has made platform upgrades that streamline processing (e.g., a loan payoff feature), added catastrophe recovery capacity, and secured major exclusive contracts—one insurer recently shifted 40,000 salvage vehicles annually to IAA.

The market’s concern is that Copart’s scale is unassailable, but the pitch disputes that view. With RB Global’s yard network, growing take rates, and the ability to cross-sell services, the combined platform offers significant operating leverage and a long runway for margin expansion.

The student team models a US$149 base-case price target (16% IRR over 3y), with upside to US$170+ in a bull case. Risks include integration missteps, macroeconomic slowdown affecting GTV, and long-term disruption in the salvage market.

Carlisle Companies (NYSE: CSL)

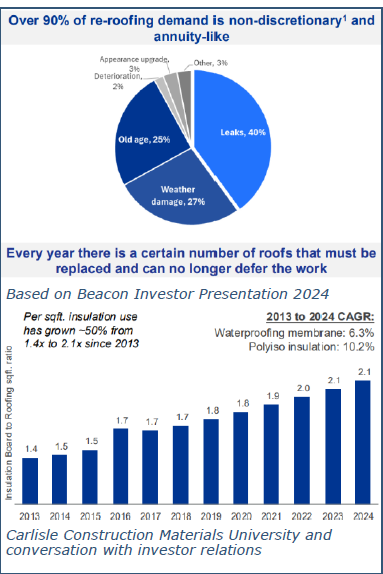

Carlisle Companies is pitched by a Columbia MBA student as a textbook example of a mispriced industrial compounder that has quietly transformed itself into a focused building products powerhouse.

Previously a diversified conglomerate, Carlisle completed a multi-year pivot to become a pure-play provider of commercial roofing systems, insulation materials, and weatherproofing solutions under its flagship Carlisle Construction Materials (CCM) segment. This shift has substantially improved its margin profile and earnings quality.

Carlisle now commands ~33% market share in commercial roofing, a sector with highly attractive economics: long replacement cycles, high regulatory requirements (especially around insulation and fire protection), and relatively low sensitivity to discretionary spending. The business is also exposed to multiple secular tailwinds. The average age of U.S. commercial buildings exceeds 50 years, meaning reroofing demand is durable and predictable. Stricter energy efficiency codes are driving demand for better-insulated roofs, especially in regions with extreme weather.

What makes Carlisle especially compelling is its capital allocation track record. Over the past 5y, it has returned US$5.7B to shareholders, including US$3.3B in buybacks. Management’s long-term targets include 6% organic growth, 20% operating margins, and 15% ROIC. Despite achieving many of these metrics already, the stock trades at just 13x next year’s earnings—well below peers with similar margin and growth profiles. The student pitching the idea sees 73% upside over the next 3y, with a base-case target price of US$598 per share. Carlisle is not flashy, but the thesis is simple: own a dominant niche business with high returns on capital, secular tailwinds, and a history of capital discipline that the market has yet to properly reward.

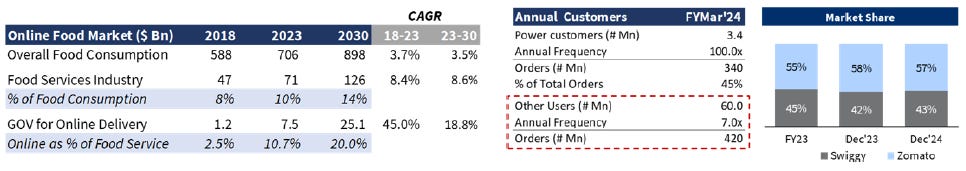

Eternal Ltd. (NSEI: ETERNAL, formerly Zomato)

Eternal Ltd., the newly branded holding company of Zomato and Blinkit, is pitched as a misunderstood compounder at the heart of India’s digital consumption economy.

The company is the leading platform for food delivery in India (via Zomato) and rapid grocery delivery (via Blinkit), operating in one of the world’s fastest-growing, youngest, and most digitally connected populations. Following a recent ~35% drawdown in share price, much of the market has turned bearish due to aggressive reinvestment in Blinkit and fears of rising losses. But the student behind this pitch argues the market is missing the forest for the trees.

Zomato’s core food delivery business has already achieved breakeven and shows signs of operating leverage as it scales. Blinkit, while still loss-making, is growing quickly and approaching profitability on a per-store basis in urban centers. Importantly, both platforms are benefiting from strong network effects: more users attract more restaurants and grocers, which improves selection, lowers delivery times, and builds loyalty. Eternal also benefits from extremely high mobile and internet penetration in India, where smartphones are often the primary means of accessing services.

Management incentives are well-aligned. Eternal’s CEO and executive team have significant exposure to long-term stock performance through ESOPs that vest only if the share price appreciates. Additionally, Eternal’s cash burn has been decreasing as CAC fall and retention improves. The student projects a base-case 20.5% IRR over 5y, assuming moderate user growth and improving contribution margins. While risks include regulatory tightening or price wars in quick commerce, the pitch argues that Eternal’s moat is already deepening—and patient investors are being given a rare opportunity to own the leader in a massive emerging market platform business at an attractive valuation.

Siemens (XETRA: SIE.DE)

Scott Rosenthal of Hotchkis & Wiley makes the case for Siemens as a classic European industrial giant trading at a discount, not because of business weakness but because of its conglomerate structure and regional listing.

Siemens operates across three key verticals—digital industries, smart infrastructure, and mobility—each of which is tightly aligned with 21st-century megatrends like factory automation, energy transition, and urbanization. Its customer base includes governments, manufacturers, and utilities that sign multi-year contracts and depend on Siemens for mission-critical infrastructure.

Despite this, the company trades at a multiple lower than many U.S. peers with similar or even weaker fundamentals. Rosenthal argues this stems from structural issues: European equities are out of favor, and Siemens’ complex financial reporting (which includes partial ownership of separately traded entities like Siemens Energy) obscures its underlying cash generation. But Siemens is changing. It has divested several non-core businesses and is becoming more focused, with improving ROIC and earnings visibility.

Scott especially likes Siemens’ positioning in digital factory automation, where it competes with names like Rockwell and Schneider Electric, but at a far more reasonable valuation. As global supply chains reconfigure post-COVID, and AI-driven manufacturing gains traction, Siemens is set to benefit disproportionately due to its strength in control systems, sensors, and industrial software. The thesis isn’t built on explosive growth, but rather on consistent compounding and a potential re-rating as the market begins to appreciate Siemens’ strategic importance.

Today, Siemens represents a collection of attractive assets that we think have a great deal of long-term growth

potential at high incremental rates of return, which makes them quite valuable. We think the market is starting to pay attention as management is increasingly willing to discuss the business in public forums, but we still believe the value of these assets has been underappreciated, creating a compelling investment opportunity for us.

Nippon Sanso (TYO: 4091)

Nippon Sanso is the Japanese affiliate of the global industrial gas powerhouse Linde, and Scott Rosenthal believes it's one of the most quietly compelling long-duration compounders available today.

While most investors look to U.S. or European-listed players like Linde and Air Liquide for exposure to industrial gases, Nippon Sanso is often overlooked due to its regional listing and smaller market cap. But it possesses the same core attributes: high barriers to entry, long-term contracts, mission-critical applications, and pricing power across economic cycles.

The company supplies oxygen, nitrogen, and other specialty gases to sectors like semiconductors, healthcare, steel manufacturing, and electronics—industries that are growing, heavily regulated, and intolerant of supply interruptions. Its competitive advantage lies in its embedded infrastructure: vast proprietary pipeline networks and long-term customer relationships that are expensive and logistically complex to replicate. Additionally, Nippon Sanso is quietly expanding across Asia-Pacific and leveraging Linde’s global knowledge base to grow more efficiently in these markets.

What makes the opportunity particularly attractive to Rosenthal is valuation. Nippon Sanso trades at a material discount to Linde despite similar margin structure, recurring revenue, and capital efficiency. The gap stems largely from investor apathy toward Japanese equities and limited analyst coverage, not from company-specific issues. Rosenthal believes this presents a classic arbitrage for long-term investors: buy a high-quality, moated essential service at a non-premium price in a market where secular tailwinds are only intensifying. It’s a low-volatility, high-certainty bet on Asia’s industrial and technological growth.

Nippon Sanso is a business with great real estate, operating in an attractive industry, and attractive industry, and is well understood by many investors around the world. However, Nippon Sanso has historically not taken advantage of its unique position within its attractive industry attractive industry and has consequentially delivered operating performance that trails that of its peers. We think that's changing.

Nintendo (TYO: 7974)

Tourbillon Investment Partnership features Nintendo as a cornerstone holding in its portfolio, describing it as a rare combination of enduring IP strength, pristine financials, and misunderstood optionality. Despite being a household name globally, Nintendo often flies under the radar of serious institutional investors because of its cyclical console business model. But Tourbillon argues that this view is outdated. The reality is that Nintendo’s business is now much more diversified and structurally resilient than many assume.

Nintendo’s IP—Mario, Zelda, Pokémon, Animal Crossing—is among the most valuable in entertainment history. These franchises allow for recurring, cross-generational engagement and monetization. Recent moves to expand into movies (Super Mario Bros. grossed over US$1B), theme parks (Super Nintendo World), and subscription models (Nintendo Switch Online) mark a strategic shift toward ecosystem monetization beyond one-off hardware sales. With a new console rumored to be in development and the Switch lifecycle having far exceeded expectations, Tourbillon believes Nintendo is poised to drive another multi-year cycle of engagement and profitability.

With four of the top 10 best-selling video game best-selling video game franchises of all time being Nintendo franchises and a history of durability, going back to the mid-eighties, Nintendo stands out from the crowd in a sector that has historically been prone to booms and busts with franchises coming and going. That’s been gradually evolving for the sector, with the change in monetization moving into more recurring revenue subscriptions and in-game transactions, away from the game itself representing the bulk of the economic profits associated with a title, making the whole industry more durable. Even within that, Nintendo has been absolutely standout.

Financially, the company is in outstanding shape: a net cash position, high margins, and one of the most loyal user bases in gaming. The risk-adjusted returns are compelling given the sticky customer base and ability to repackage and resell existing content with minimal development costs. While market sentiment fluctuates around hardware sales, Tourbillon sees Nintendo as an underappreciated IP platform with recurring revenue opportunities. Long term, the thesis rests on the transformation of Nintendo from a “device company” into a “franchise ecosystem”—and the market hasn’t fully priced in this evolution.

Howden Joinery (LSE: HWDN)

Howden Joinery is Tourbillon’s pick for a UK-based niche compounder that has demonstrated resilient, long-term growth despite operating in a cyclical sector.

The company designs, manufactures, and distributes fitted kitchens—primarily to small, independent tradespeople—through a vertically integrated network of over 800 depots. Unlike mass-market kitchen providers that sell to large developers or D2C, Howden has built its business around the needs of professional installers: offering ready-to-fit products, rapid local service, and competitive pricing.

“Howden only sells to tradespeople or professional installers. It's not a consumer facing business as it doesn’t sell to the public. That has led to a series of emergent properties that make it difficult to replicate. Howden has an in-stock model that promises availability close to the builder—85% of customers are within five minutes of a depot. There are nearly 900 depots today, growing at a mid-single-digit pace. As it is a vertically integrated model and Howden has the ethos of sharing that scale benefit with the customer, it can offer ~15% cheaper prices. These advantages build up over time, so Howden has at least 70% market share in the trade, 30% share of new kitchens by value and 40% by unit sales.”

Tourbillon views this model as deceptively powerful. The fragmented nature of the tradesman market gives Howden pricing power and operational control, while its scale advantage allows for in-house manufacturing, distribution, and innovation. Gross margins are consistently strong, and FCF conversion is high. Even during downturns, kitchen refurbishment is a “semi-discretionary” expense—people may delay it, but eventually must replace failing cabinetry or appliances. As a result, Howden has navigated UK housing market volatility better than many retailers.

The company also has a long runway for growth: continued depot expansion in the UK and nascent international operations, particularly in France, offer additional upside. Tourbillon sees Howden as a high-ROIC, capital-efficient business that reinvests at attractive rates. While it doesn’t grab headlines, its ability to compound value over time makes it a foundational holding for investors who value consistency, alignment, and business model quality.

Berkshire Hathaway (NYSE: BRK.A / BRK.B)

Tourbillon concludes its interview by reaffirming a long-standing belief in the staying power of Berkshire Hathaway as a foundational portfolio holding.

While some investors view Berkshire as a “Buffett legacy” stock, Tourbillon considers it an enduring business model with strong downside protection and long-term compounding power. At its core, Berkshire is a unique mix of wholly owned operating companies (GEICO, BNSF, utility and industrial businesses) and a US$350B+ public equity portfolio, all sitting atop a fortress-like balance sheet with over US$150B in cash.

What differentiates Berkshire, according to Tourbillon, is not just its assets but its capital allocation philosophy. Even after Buffett’s eventual departure, the culture of prudence, decentralization, and owner-mindedness is likely to persist—thanks to both structural design and succession planning. Moreover, recent moves such as accelerated share repurchases show that Berkshire can continue to create value even in a low-return environment. The firm sees repurchases as a meaningful signal of undervaluation and internal confidence.

Berkshire also serves as a stabilizer in the portfolio. In an era of speculative mania, leverage, and declining corporate governance standards, Berkshire remains a bulwark of fundamental business quality. It’s not the highest-octane position, but that’s the point: it offers ballast when others are chasing beta. Tourbillon values it as a reliable vehicle for long-term wealth compounding, particularly for those who appreciate margin of safety, patience, and simplicity in a world that often values the opposite.

The reinsurance business is General RE and National Indemnity, which have 40% of all the capital in the industry, even though they only write around 7% of the premiums. They've managed to amass huge amounts of excess capital. On our assessment, it's around US$220 billion, which can then be reinvested into public equities or fully-owned businesses. That's very different to its peers, Markel or Fairfax, where the composition of the assets is very different. They have much less in businesses and much more in fixed income, government bonds, and cash simply because they haven't gotten over that catch-22 of generating so much surplus insurance capital, which is perhaps impossible in today's regulatory environment. It was very different back in the seventies, when Warren was building that business.

Well done! Thanks!

I used to own CSL, bought at a single digit P/E, sold after 100% gain, still a solid company.

It is interesting that RF has a position in deep value with a single digit P/E and another with premium valuation.

I concur with a few of these and have skin in the game as well. I will read the letter too. You did an excellent job summarizing the letter.