What I Found in the Latest CBS Student Investment Theses (Fall 2024 Edition)

8 investment ideas from Columbia Business School’s Analyst’s Edge (Fall 2024). Deep dives on MELI, Tesla, Ubiquiti, Sirius XM, and more.

In a previous post, I shared what I learned after reading 46 investment theses from Columbia Business School’s 5x5x5 Russo Student Investment Fund.

More recently, I also summarized 10 High-Conviction Ideas from the Spring 2025 edition of Graham & Doddsville — another great source of CBS ideas that combines interviews with seasoned investors and standout student pitches.

Today, I’m returning to Columbia Business School (CBS) once again to explore a third source of ideas: the latest student investment theses from The Analyst’s Edge — Fall 2024 edition.

The Analyst’s Edge is an application-only course at CBSwhere 8 to 10 students each year learn what it takes to become world-class investors. Each student writes a full investment thesis on a stock of their choice — often actionable, deeply researched, and grounded in the Graham & Dodd investing tradition that has long shaped Columbia’s value investing culture.

In this post, I’ll share what I found after reading this latest batch of theses. The ideas range from global compounders to special situation plays — all written with the disciplined lens of fundamental investors.

And if you’d like to read the full set of theses yourself, I’ll leave the PDF of the memo book for download at the end of this post.

If you wanna read more investment ideas, check my following summaries:

Ideas featured

Arch Capital Group (ACGL)

First Service Corporation (FSV)

MercadoLibre (MELI)

Otis Worldwide Corporation (OTIS)

SBA Communications Corp (SBAC)

Sirius XM Holdings (SIRI)

Tesla (TSLA)

Ubiquiti Inc. (UI)

Arch Capital Group (ACGL)

Recommendation: Long

Analyst: Andrew Meylan

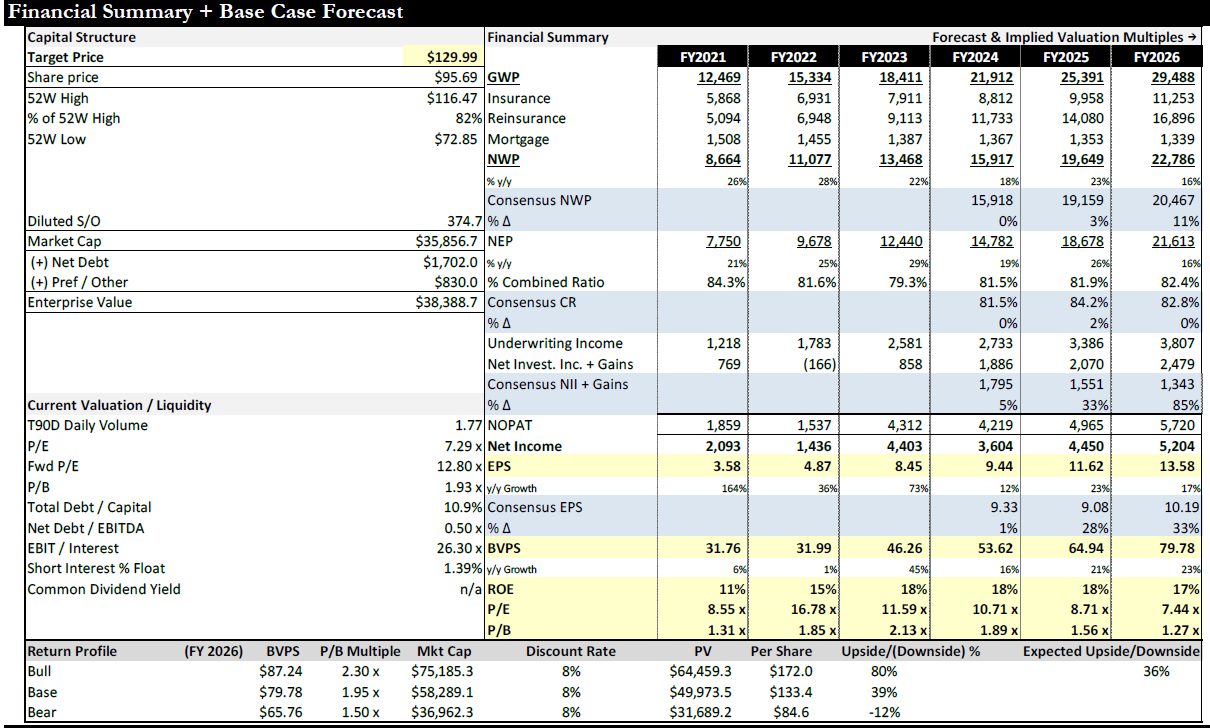

The thesis on Arch Capital Group (ACGL) is built around the company’s strong positioning in a persistently hard P&C insurance market. The current hard cycle, which has lasted 7y—longer than the typical 2-4y cycle—is driven by elevated catastrophe (CAT) losses that show no signs of abating. Climate change is exacerbating the severity and frequency of natural disasters, creating ongoing demand for specialized insurance and reinsurance products.

The company operates across specialty insurance, reinsurance, and mortgage insurance markets, with an emphasis on niche segments like small-to-mid-sized business (SMB) commercial insurance and property catastrophe (Property CAT) reinsurance. Its distribution model relies heavily on broker relationships, where it enjoys a strong reputation due to its best-in-class claims handling.

The company is expected to benefit from continued rate increases and premium growth in reinsurance and specialty P&C lines. The base case projects a 13% growth rate in insurance Gross Written Premiums (GWP) and 20% in reinsurance, supported by capacity constraints and disciplined underwriting. The thesis highlights that reinsurance premiums are still below long-term trend and will continue to reprice upward.

ACGL’s underwriting discipline has improved materially since the soft market period (2017-2020), with its combined ratios now structurally lower due to better risk selection and greater use of machine learning tools in underwriting. This should allow it to maintain superior margins even as the market evolves.

An additional source of earnings growth comes from investment income. With higher interest rates, Arch’s best-in-class investment team is expected to drive significant EPS growth as cash flows are reinvested at higher yields. Current market forecasts underestimate this earnings tailwind.

Management is viewed positively—non-promotional, conservative in reserving, and aligned with shareholders through performance-based incentives. The new CEO has deep experience at ACGL but will need to prove capable of steering the company through future cycles.

Risks include a potential softening of insurance/reinsurance markets, muted results in the critical 1/1/2025 reinsurance renewal, or mismanagement under the new CEO. The U.S. government could also take a larger role in CAT risk, limiting growth opportunities.

Overall, the thesis expects ACGL to outperform thanks to strong industry tailwinds, operational excellence, and undervaluation relative to peers. Even in a conservative base case (which assumes no multiple expansion), the stock offers 39% upside to target price.

FirstService Corporation (FSV)

Recommendation: Long

Analyst: Jack Ran

The thesis on FSV presents it as a long-term compounder benefiting from both organic and inorganic growth opportunities. The company operates in two segments: FirstService Residential (FSR) — the largest residential property manager in the U.S., and FirstService Brands (FSB) — a portfolio of essential property services such as restoration, fire protection, and roofing.

The core of the thesis is that FSV can sustainably grow by expanding its captive ecosystem: FSR manages homeowners associations (HOAs), providing a steady base of properties and relationships where FSB services can be cross-sold. Over time, this creates a “wallet share” opportunity across millions of managed homes.

The organic growth drivers include the structural trend toward more homes being built into HOAs (now over 85% of new U.S. homes), continued share gains from mom-and-pop property managers, and strong growth in the highly fragmented roofing and restoration industries.

FSV also has a strong M&A flywheel: it acquires businesses at ~6.7x EBITDA on average, often with structures that incentivize sellers to stay and grow the businesses. With many private-equity-backed competitors now stressed, FSV is well-positioned to consolidate these markets.

Management is a key strength: founder and Executive Chair Jay Hennick owns 6% of the company and has a proven capital allocation track record, having also built Colliers. He emphasizes discipline — avoiding overpaying for deals and ensuring cultural fit.

Risks include potential acquisition missteps, slowing organic growth, or stretching beyond its core verticals. However, with strong industry tailwinds, disciplined leadership, and a unique cross-sell model, the thesis projects that FSV can continue compounding at an attractive rate, with an estimated ~15% IRR over a long-term horizon.

MercadoLibre (MELI)

Recommendation: Long

Analyst: Chris Zeng

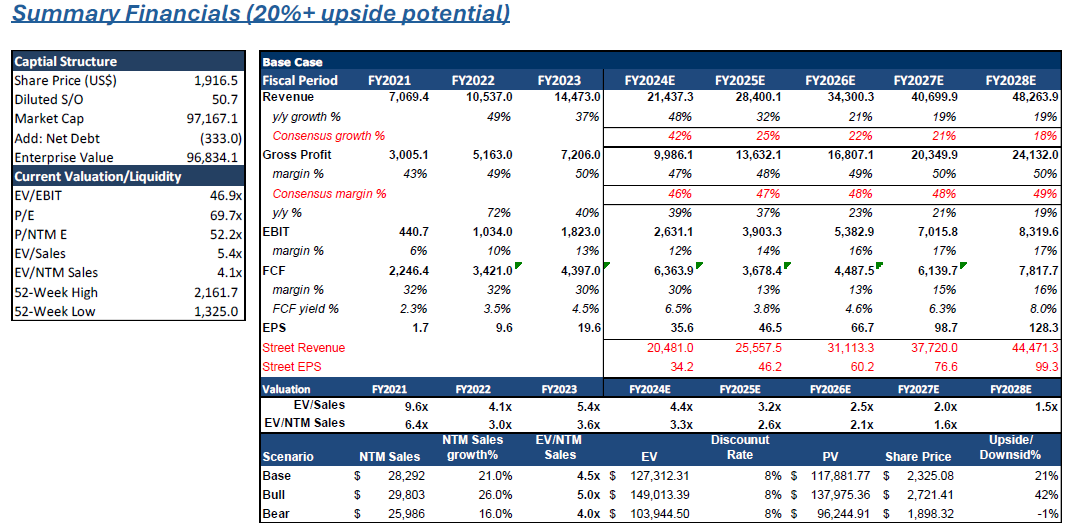

The thesis on MELI highlights the company’s position as the dominant e-commerce and fintech platform in Latin America, with a powerful ecosystem and long runway for growth. The analyst argues that MELI will continue to benefit from secular trends driving digital adoption across the region, while its unique integrated model — combining marketplace, payments (Mercado Pago), credit, logistics, and other services — deepens its competitive moat.

MELI holds the #1 market share in Latin America for e-commerce, with significant advantages in logistics, brand trust, and scale. The e-commerce market in LatAm remains underpenetrated, with strong growth ahead: only ~56% of adults shop online today, and per-capita spending is expected to grow at a 21% CAGR.

The fintech segment, Mercado Pago, is an even larger opportunity, with total retail payment volume in LatAm estimated at $2.35 trillion. Mercado Pago is growing off-platform payment volume faster than on-platform, and is helping drive financial inclusion in a region with low credit card penetration. MELI’s credit business leverages proprietary data from the marketplace and payment platforms to manage risk better than traditional banks.

Key drivers include MELI’s flywheel effects — the integration of marketplace activity, logistics (Mercado Envios), and payments creates increasing user stickiness. Logistics is a strong moat: MELI operates the fastest and most reliable delivery network in the region, outperforming Amazon and newer entrants. Other potential growth drivers include insurance (leveraging marketplace data for targeted offerings) and Q-commerce (quick delivery services).

Risks include near-term margin pressure from logistics investments, credit card expansion (especially in Mexico), and rising competition from Amazon, Shopee, and emerging players like Temu and Shein. However, the analyst argues that recent margin compression is a moat-widening investment and that MELI’s network effects, brand, and data advantages will help it maintain leadership.

Valuation is attractive: MELI trades at 4x EV/NTM Sales, well below historical levels (it traded at 19x at the 2021 peak), while still growing revenues at ~40% YoY. The thesis expects further margin improvement and operating leverage as the business scales, and sees MELI as a long-term compounder and a key proxy for LatAm’s accelerating digital economy.

Otis Worldwide Corporation (OTIS)

Recommendation: Long

Analyst: Dimitry Karavaikin

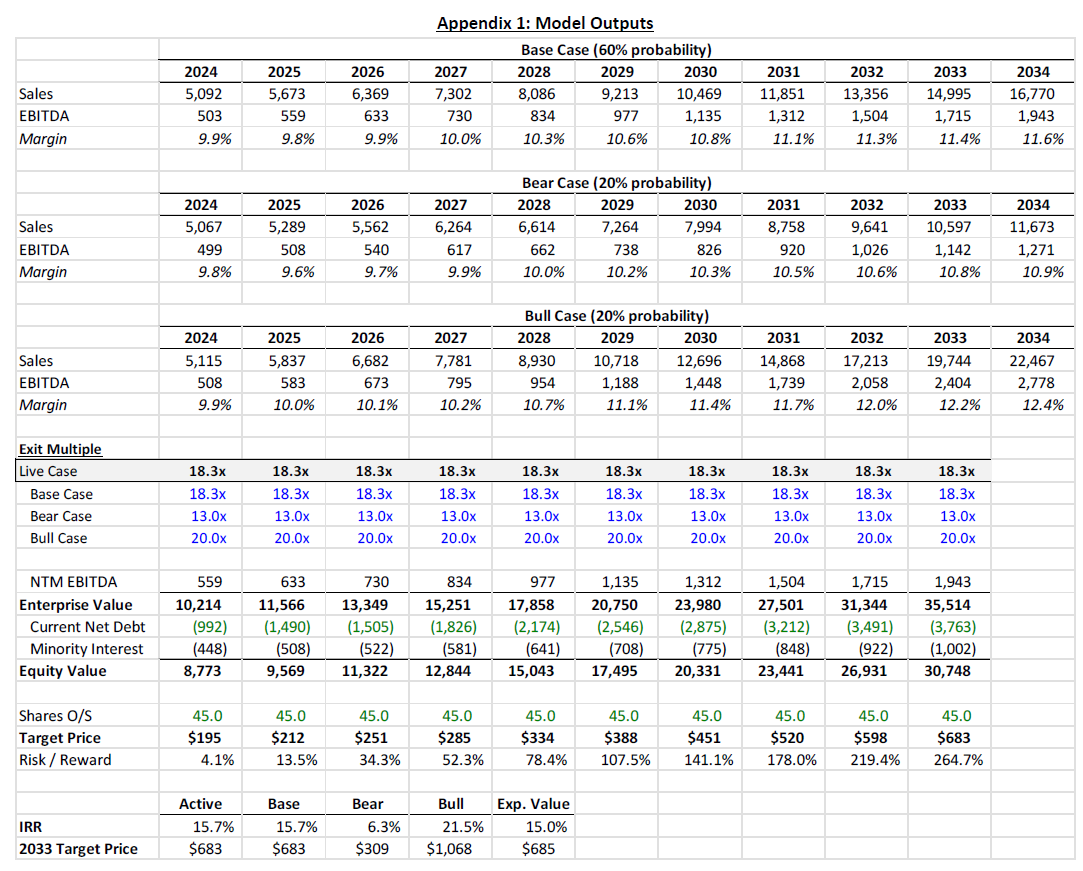

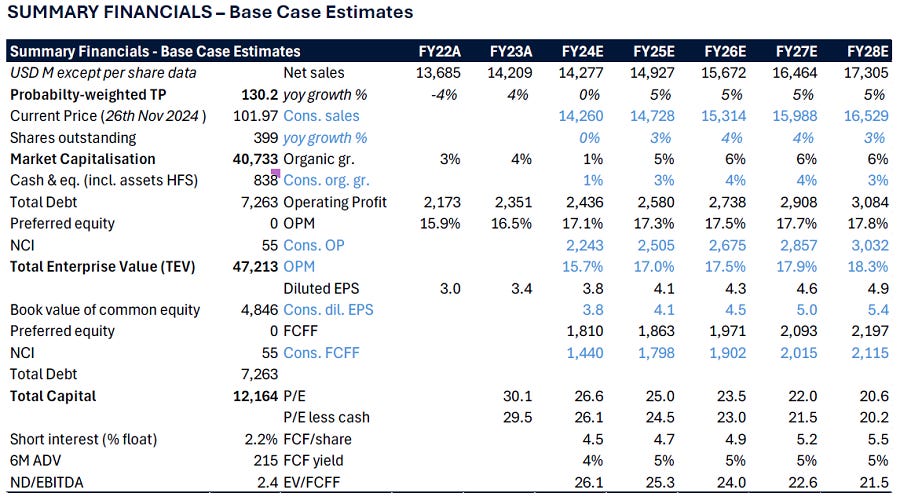

The thesis on OTIS centers on the structural transformation of the elevator industry and Otis’s unique positioning to benefit from this shift. Dimitry argues that the market is underestimating how “normal” earnings and margins for elevator majors are evolving toward a higher-quality, more recurring mix — centered on servicing, modernization, and connected solutions — rather than new equipment sales.

The companyis the global leader in elevator services with an installed base of ~2.3 million elevators. Servicing and maintenance of this base is a sticky, high-margin business, with growing importance as the global elevator fleet ages. More than 10 million elevators globally are now >15 years old, creating a large modernization opportunity. In Europe alone, 1.5 million additional units will cross the 15-year mark by 2030; China is expected to add 1.8 million such units.

Additionally, connected elevators and predictive maintenance technology give OEMs like Otis a competitive edge over independent service providers (ISPs). Once an elevator is equipped with proprietary connected systems, it is harder for customers to switch to an independent — creating “stickier” service revenue and potential monetization opportunities.

The market remains overly focused on China new elevator orders, which are volatile and not the primary driver of long-term profitability. The analyst argues that servicing and modernization are becoming the true earnings drivers. Otis is already winning back share in China post-spin (after previously being constrained under United Technologies ownership), and margins are improving globally.

The base case assumes steady 6% organic growth in servicing, margin improvements in modernization, and limited growth in new equipment. Under these assumptions, Otis could generate ~$3B in FCF by 2033 — much higher than what the current stock price implies (~1.5% long-term FCF growth is priced in).

Risks include slower-than-expected modernization margin expansion, connected services failing to be monetized, or better-than-expected competitive offerings from ISPs. However, current sentiment is already weak, creating a favorable setup — elevator stocks still trade cyclically based on China news, while Otis’s earnings mix is becoming more resilient.

Overall, Otis is viewed as a “boring but beautiful” long-term compounder, with increasing service margins, a favorable modernization wave, and potential upside from connected services. The thesis targets 30% upside in the base case, with potential for much higher returns if the digital opportunity is realized.

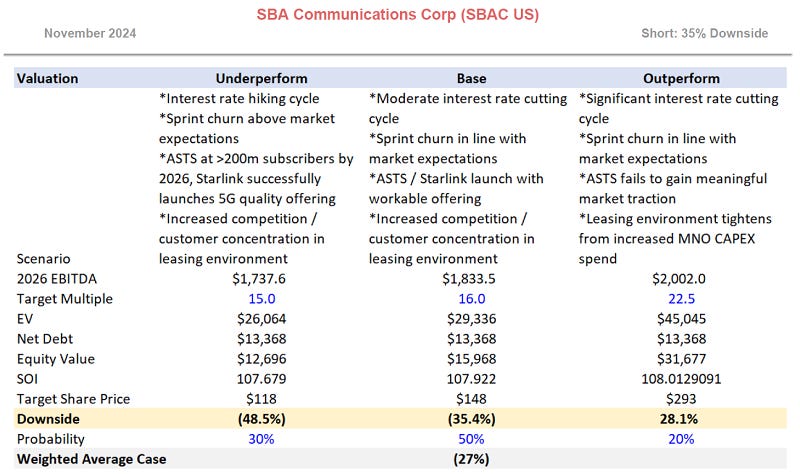

SBA Communications Corp (SBAC)

Recommendation: Short (Target: 35% downside)

Analyst: George Macarthur-Stanham

The thesis on SBAC is a short recommendation, based on structural headwinds that George believes will erode the company’s growth prospects and unit economics. Historically, tower companies like SBAC have been strong performers, benefiting from the surge in mobile data demand, rolling broadband CAPEX cycles (2G to 5G), and cheap debt. Today, however, several of these tailwinds are fading.

SBAC’s core U.S. tower leasing business (70% of revenue, 80% of profit) faces a slowing growth environment. U.S. mobile network operator (MNO) CAPEX spend is declining (–12% YoY in 2023), and forward guidance suggests flat or declining spend. Meanwhile, smartphone penetration and video consumption are near saturation. These trends signal that new leasing demand will be weaker going forward.

Industry consolidation is compounding these pressures: the T-Mobile/Sprint merger led to tower churn as redundant sites were decommissioned. This reduces the unit economics of affected towers — a tower with multiple tenants has far superior returns vs. a single-tenant site. The top 3 MNOs now represent ~90% of SBAC’s domestic leasing revenue, reducing pricing power. Recent data shows revenue per tower is already declining despite contractual escalators.

The most disruptive threat, however, is direct-to-cell satellite technology (e.g. AST SpaceMobile, Starlink). These technologies will allow MNOs to offer coverage to phones via satellite, bypassing towers in certain geographies (especially rural and underserved areas). AST is backed by Verizon and AT&T, two of SBAC’s largest customers. The analyst projects that as this technology scales — with commercial launches starting in 2025 — it will materially impact tower leasing demand and CAPEX plans.

SBAC has responded by expanding into higher-risk international markets (Latin America), but results so far are underwhelming: revenue per tower has barely grown, and margins have eroded. The analyst argues that international expansion does not offset the structural risks in the U.S. business.

Valuation is also seen as too rich: SBAC trades at 21x EV/EBITDA, above historical levels, despite a deteriorating growth outlook. The base case projects 35% downside as the market reprices SBAC as a lower-growth infrastructure asset — no longer a secular growth story.

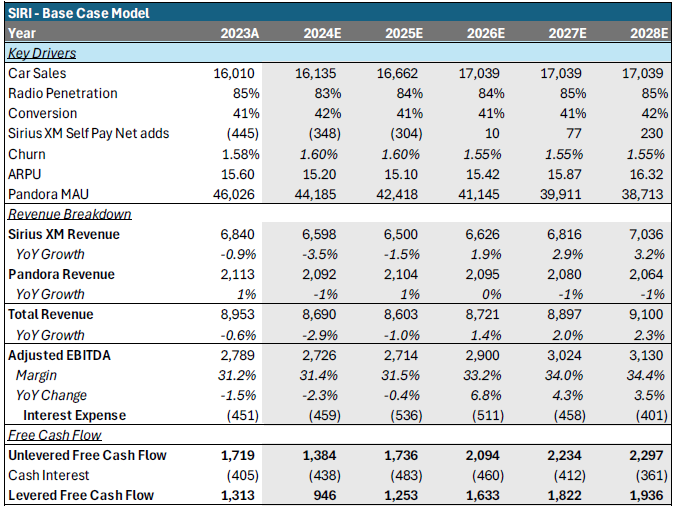

Sirius XM Holdings (SIRI)

Recommendation: Long

Analyst: Tristan van Biema

Tristan argues that the market is overly pessimistic about the company’s prospects and is mispricing a high-margin subscription business as though it were a declining linear radio company. The stock, which historically traded at ~15x forward EBITDA, now trades at ~7x EBITDA due to concerns around disintermediation, declining auto sales, and falling subscriber conversion — which Tristan believes are overblown.

SIRI operates two complementary audio platforms: SiriusXM satellite radio (~34 million subscribers), and Pandora (6 million subscribers + ~46 million MAUs). SiriusXM remains dominant in the in-car audio market, where 76% of listening time still goes to linear platforms — a trend that remains stable even among younger demographics. Moreover, SiriusXM’s share of in-car listening has remained above 20% since 2018, outperforming AM/FM radio, which has declined.

A key driver of the bullish thesis is the auto cycle. Recent subscriber net additions have been negative — but this is largely due to depressed U.S. auto sales (SARS ~16 million vs. ~17.7 million pre-pandemic). Importantly, SiriusXM penetration in new vehicles has actually increased from ~75% to ~84%, meaning that as auto sales normalize, subscriber additions should rebound — with positive net adds projected for 2026.

Tristan also argues that fears of disintermediation from CarPlay/Android Auto are overstated: SiriusXM performs better in cars with these technologies, and OEM relationships remain strong. Moreover, management is improving conversion with new pricing tiers and modernized experiences (e.g. SiriusXM 360L), and is adding exclusive spoken-word content to differentiate from pure music streaming.

Valuation is highly attractive: SiriusXM trades at the same EV/EBITDA multiple as struggling ad-driven radio peers, despite being a subscription-first business with low churn (1.6%), superior margins, and stable FCF generation. Base case targets 58% upside over three years (~18% IRR), driven by normalized auto sales, improved subscriber trends, and multiple rerating.

Risks include weaker OEM relationships (especially in EVs), continued declines in conversion, or key content losses (e.g. sports rights, Howard Stern). However, the base case expects that even with flat conversion rates, subscriber growth will resume as the auto market normalizes.

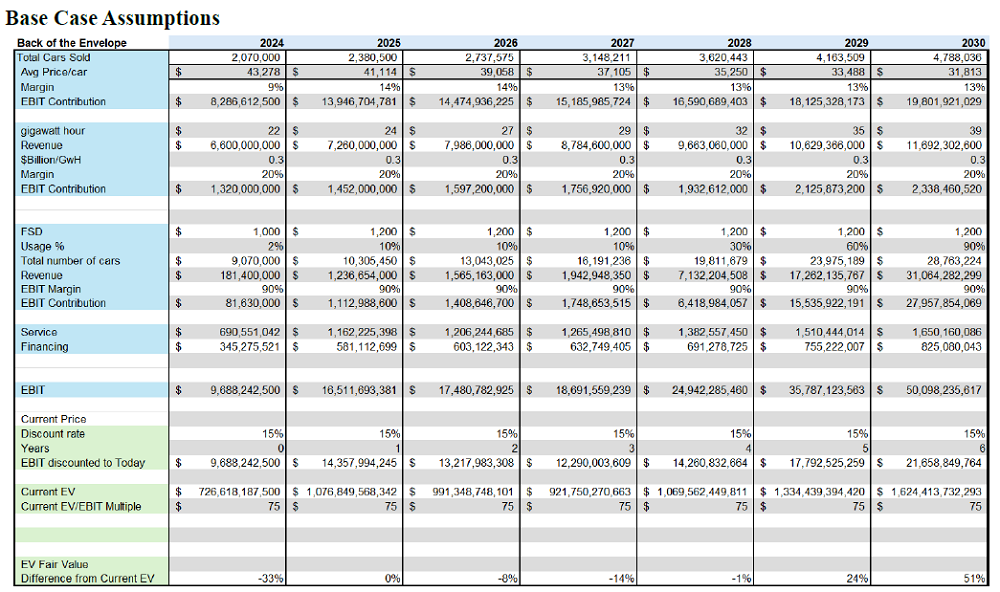

Tesla (TSLA)

Recommendation: Long

Analyst: Landon Clay

The market is significantly underestimating the long-term impact of autonomous driving (Full Self-Driving / FSD), the explosive potential of energy storage, and the optionality embedded in Tesla’s broader innovation pipeline (including the Optimus humanoid robot). Landon forecasts a 73% probability-weighted upside based on 6-year projections, with potential to 5x 2023 EBIT by 2030.

Tesla is positioned not simply as an EV manufacturer but as a vertically integrated tech ecosystem, with competitive advantages in data, manufacturing, and AI. Its massive fleet of ~7 million cars acts as a global data collection engine for training FSD. This dataset gives Tesla an edge over competitors relying on LIDAR and HD maps. The upcoming FSD Version 13 is expected to drive higher adoption (currently sub-10%), with robotaxi ambitions potentially unlocking massive new revenue streams.

The company’s energy storage business — currently growing at ~26% QoQ CAGR — is emerging as a second core business. Tesla already holds 20% GWh market share, and Bloomberg projects 30x growth in global energy storage by 2035. With its Shanghai Megafactory and U.S. capacity expansion, Tesla is positioned to be a top player in this market, generating high-margin recurring revenue.

The Optimus robot is a long-dated call option. While speculative, Landon notes that success here could create trillions in market value. Tesla’s AI training stack and proprietary manufacturing give it a credible path to lead in this space — though realization is likely 5–10 years out.

On the core EV business, TSLA remains the global leader in production efficiency, battery technology, and brand loyalty. The shift to the new “unboxed” production process could increase manufacturing efficiency by 40%, enabling margin expansion even as ASPs decline. The U.S. market still has significant room to grow EV penetration (currently ~10% of new sales), and FSD success could further accelerate demand.

Key risks include failure of FSD to reach full autonomy, key-man risk around Elon Musk, geopolitical or commodity price shocks, and potential regulatory hurdles. However, the thesis argues that Tesla’s innovation-driven culture, scale advantages, and multi-business model flywheel give it asymmetric upside compared to traditional auto peers.

At current valuation (with EV/EBIT multiples expected to compress from ~116x to ~75x), the analyst sees significant room for Tesla to compound value across its automotive, energy, and AI segments over the next decade.

Ubiquiti Inc. (UI)

Recommendation: Long

Analyst: Vincent Lo

The thesis argues that the market is materially underestimating the company’s growth prospects and brand strength in a highly commoditized networking equipment industry. Vincent positions Ubiquiti as the “Apple of networking” — a company with both cost leadership and premium brand equity that is poised to disproportionately benefit from global fiber (FTTH) and 5G infrastructure upgrades.

Ubiquiti operates with a highly differentiated business model:

It sells direct-to-consumer via online channels and an engaged user community — without a traditional salesforce.

It outsources manufacturing to low-cost geographies (Vietnam, post-China relocation), allowing it to deliver high-performance, affordable products.

The company builds brand equity through design, reliability, and a cult-like community of users — it is often called the “Apple” or “Hermès” of networking gear on social media.

The networking industry is entering a major global upgrade cycle driven by:

U.S. fiber expansion (BEAD program) — U.S. fiber households expected to double from 70M to 140M by 2030.

European fiber push — Europe is targeting full coverage by 2030.

5G expansion — driving edge networking equipment upgrades globally.

Ubiquiti is uniquely positioned for this cycle because:

Its products dominate remote areas and SMB markets, where its value proposition beats premium brands (Cisco, HPE) and is superior to niche brands (MikroTik).

Its hardware + free software model offers dramatically lower total cost of ownership vs. peers with expensive licenses (Cisco ~$150/year; Aruba ~$75/year).

Vincent estimates UI’s TAM is ~$246B — ~60% higher than consensus — with enormous whitespace in Asia (currently only 5% of revenue)

UI has compounded revenue at ~26% CAGR since 2009, far outpacing peers like Cisco (~3%) or HPE (flat/declining). The company runs at industry-leading efficiency — generating ~$1.5M in revenue per employee — comparable to Google-level productivity. ROIC has averaged ~140% over 5 years, and the company has consistently bought back shares (down ~55% since IPO), while also paying a dividend.

Wall Street largely ignores UI due to:

Minimal investor communication (CEO Robert Pera avoids Wall Street — inspired by a Berkshire-like model).

High insider ownership (93% controlled by Pera).

No sell-side coverage after past short-seller episodes.

Risks include potential tariff exposure (now mitigated after shifting production to Vietnam), limited investor relations transparency, and reliance on continued community-driven growth. However, the analyst’s base case projects 17.5% CAGR through 2027 — nearly doubling Street consensus — with upside from Asia expansion and rising U.S./EU upgrade cycles.